Creating Invoices

Step-by-step guide to creating professional invoices in PineBill.

Quick Start

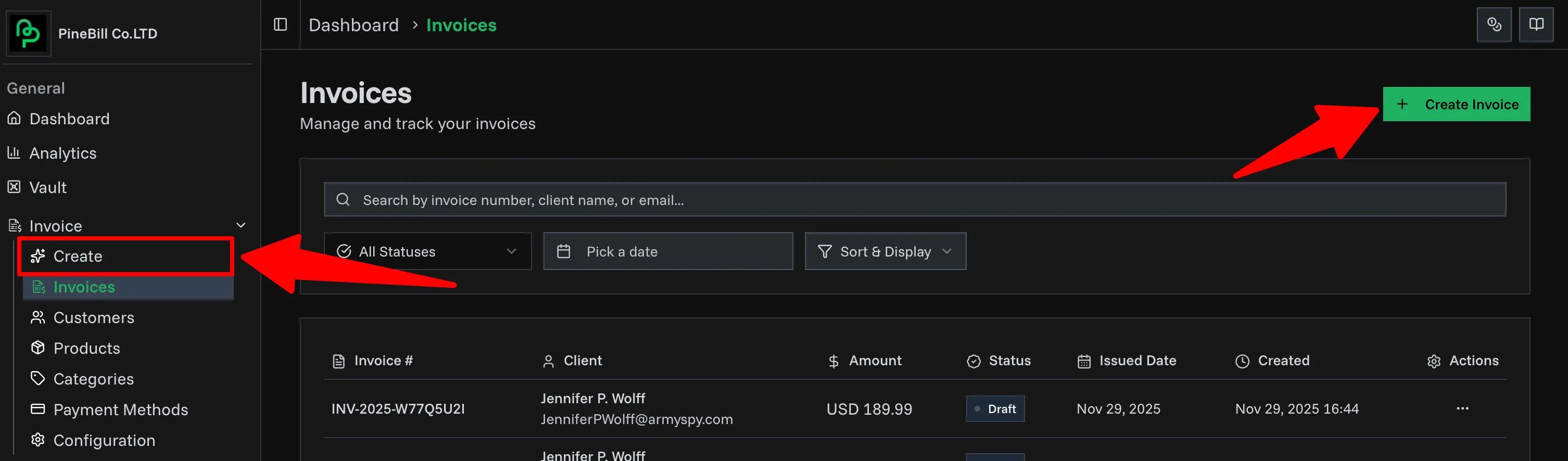

Access the invoice generator from your dashboard by clicking "Create Invoice" or navigating to the Generator page.

User Interface

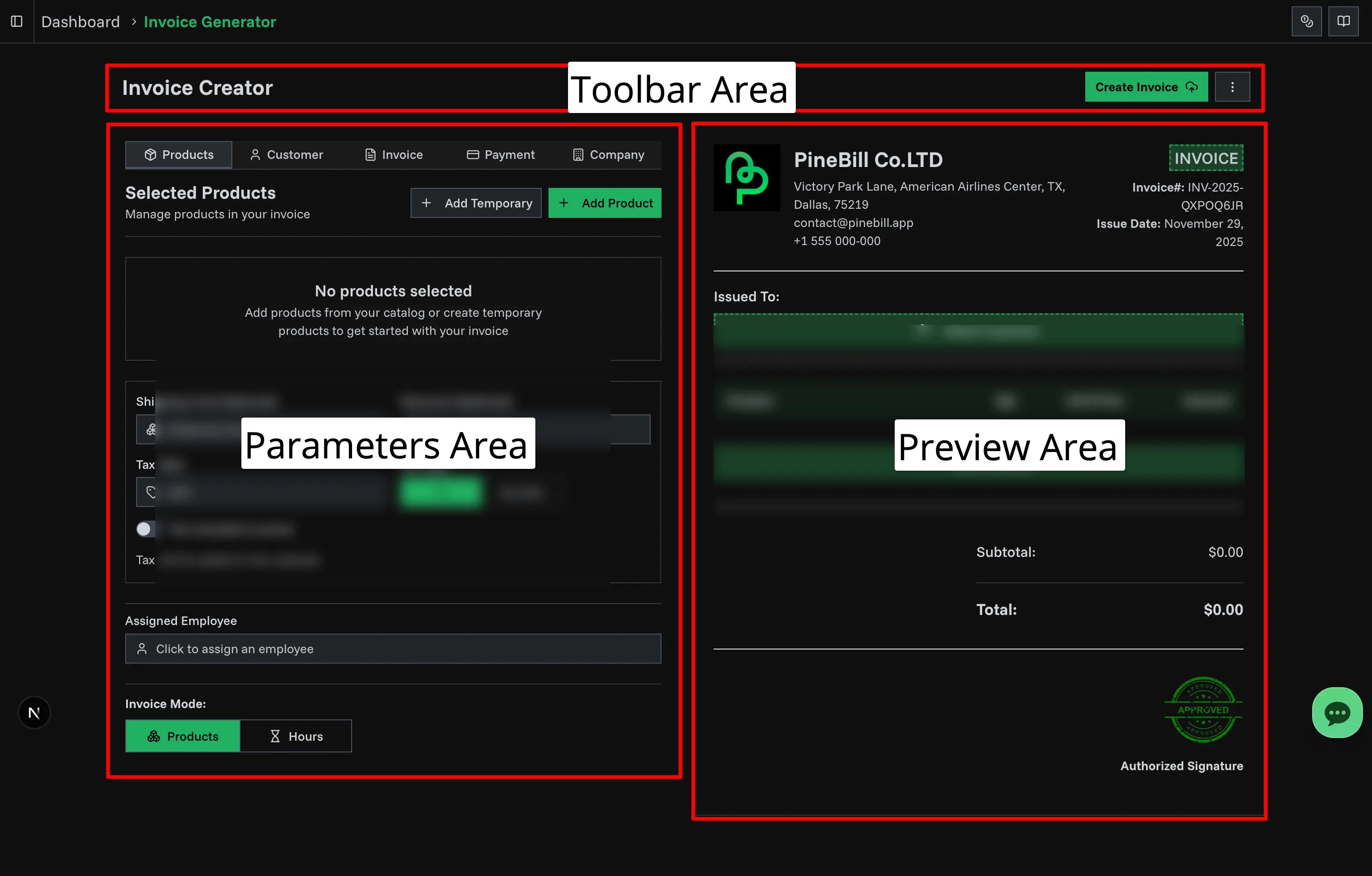

The invoice generator interface consists of 3 main regions:

- Parameters Area: Tabbed interface where you configure invoice details (Customer, Products, Invoice Details, Payment Methods, Company Info)

- Preview Area: Visual preview of your invoice (note: this is not real-time PDF generation, but an HTML preview)

- Toolbar Area: Top bar with Create Invoice button, options menu, and template/format settings

Toolbar Features

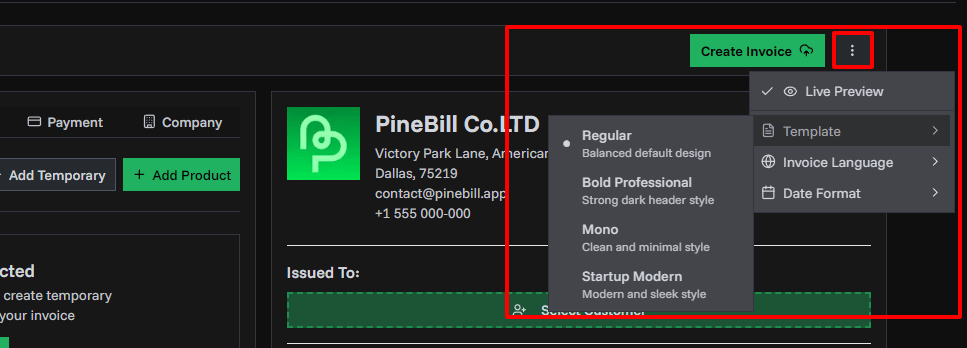

The toolbar at the top of the invoice generator provides quick access to display options and the create button.

Live Preview

Toggle live preview from the options menu to see your invoice in real-time as you make changes.

Templates

Select your invoice template from the options menu (top right):

- Classic: Clean, traditional design

- Bold Professional: Contemporary with bold accents

- Mono: Minimalist, monospace style

- Startup Modern: Sleek, modern look for startups

Each template includes all the same information with different visual styling. Learn more about templates.

Date Formats

Select date format from options menu. Available formats:

| Format 1 | Format 2 | Format 3 |

|---|---|---|

| MM/DD/YYYY | Month DD, YYYY | Mon DD, YYYY |

| DD/MM/YYYY | DD Month YYYY | DD Mon YYYY |

| YYYY-MM-DD |

Invoice Language

Select the language for your invoice PDF labels and text. This controls how section titles, column headers, and standard text appear on the generated PDF.

PineBill Supported Languages:

| Language | Language | Language |

|---|---|---|

| Arabic (العربية) | English | Italian (Italiano) |

| Azerbaijani (Azərbaycan dili) | French (Francais) | Japanese (日本語) |

| Chinese (中文) | German (Deutsch) | Korean (한국어) |

| Portuguese (Portugues) | Spanish (Espanol) | Turkish (Türkçe) |

The language setting only affects PDF labels (like "Bill To", "Invoice Date", "Total"). Your custom content such as product names, descriptions, and messages remains unchanged.

Set your default language in Invoice Settings to save time when creating invoices.

Step-by-Step Guide

Requirements

To create an invoice you must have:

| Requirement | Status | Details |

|---|---|---|

| Customer | Required | At least one customer |

| Product/Service Items | Required | At least one line item |

| Invoice Number | Auto-filled | Automatically generated |

| Issue Date | Auto-filled | Defaults to current date |

The invoice generator has 5 tabs. Fill them out to create your invoice.

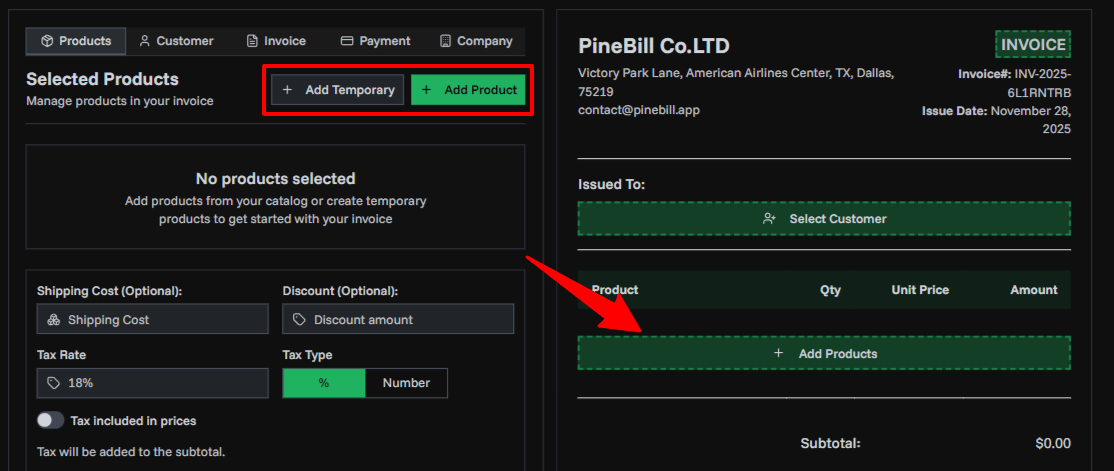

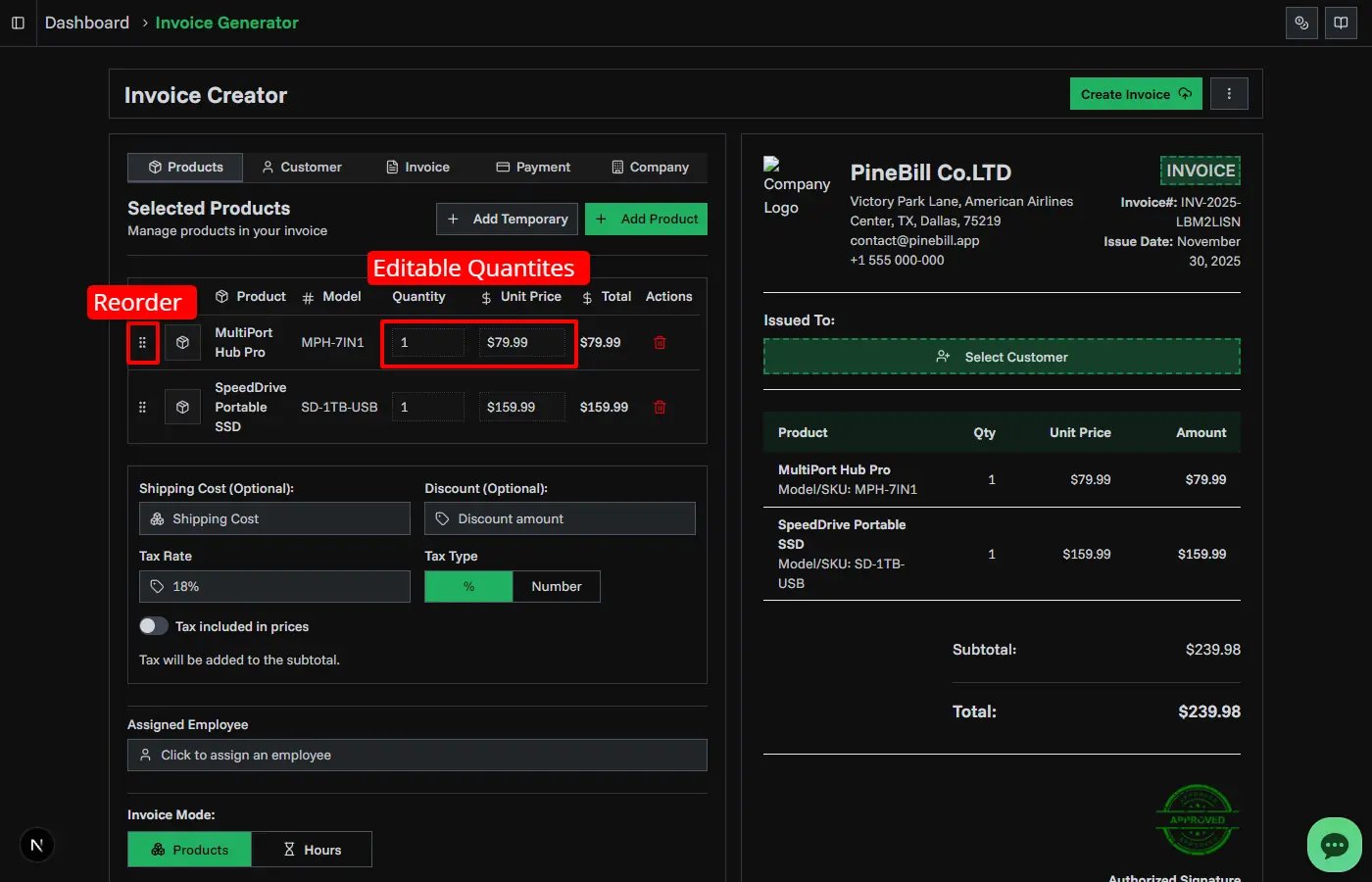

1. Products/Services (Required)

Add items to your invoice:

- Option A: From Product List: Select saved products or services

- Option B: Temporary Items: Create one-time items directly

Selected Product Features:

- Drag to Reorder: Click and drag items to change order

- Inline Editing: Click to edit quantity and unit price directly

Additional Costs:

- Shipping: Add delivery or shipping costs

- Discount: Apply a fixed discount amount

- Tax: Configure tax rate and type (see Calculations section)

Optional:

- Assign to Employee: Link invoice to a specific employee, later on you analyze employee performance based on invoiced amounts.

- Invoice Mode: Switch between PRODUCT and HOURLY modes using the toggle in the tab header.

Invoice Modes

Choose between two billing modes:

| Mode | Best For | Line Items Display |

|---|---|---|

| PRODUCT | Physical/digital products, fixed services | Quantity × Unit Price |

| HOURLY | Time-based work, consulting | Hours × Hourly Rate |

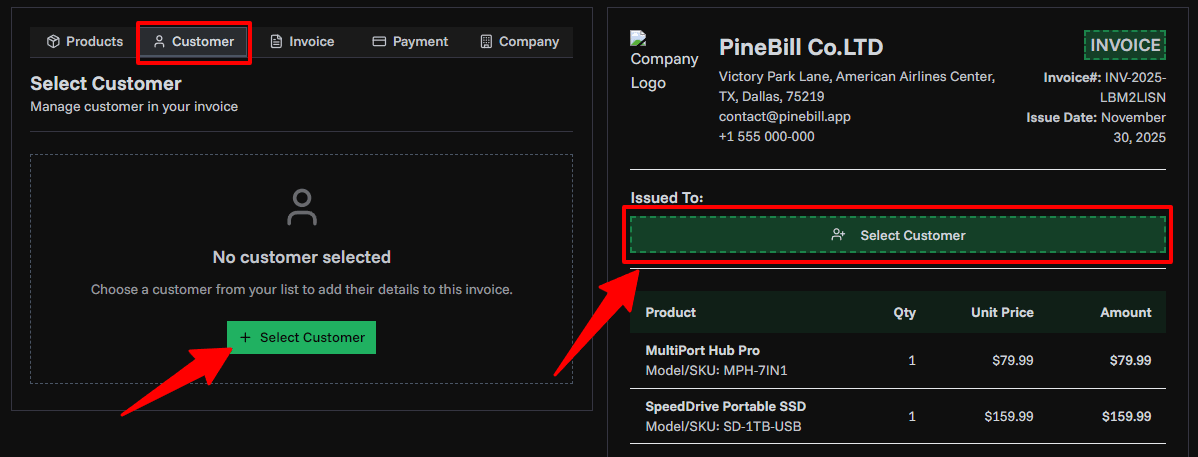

2. Customer (Required)

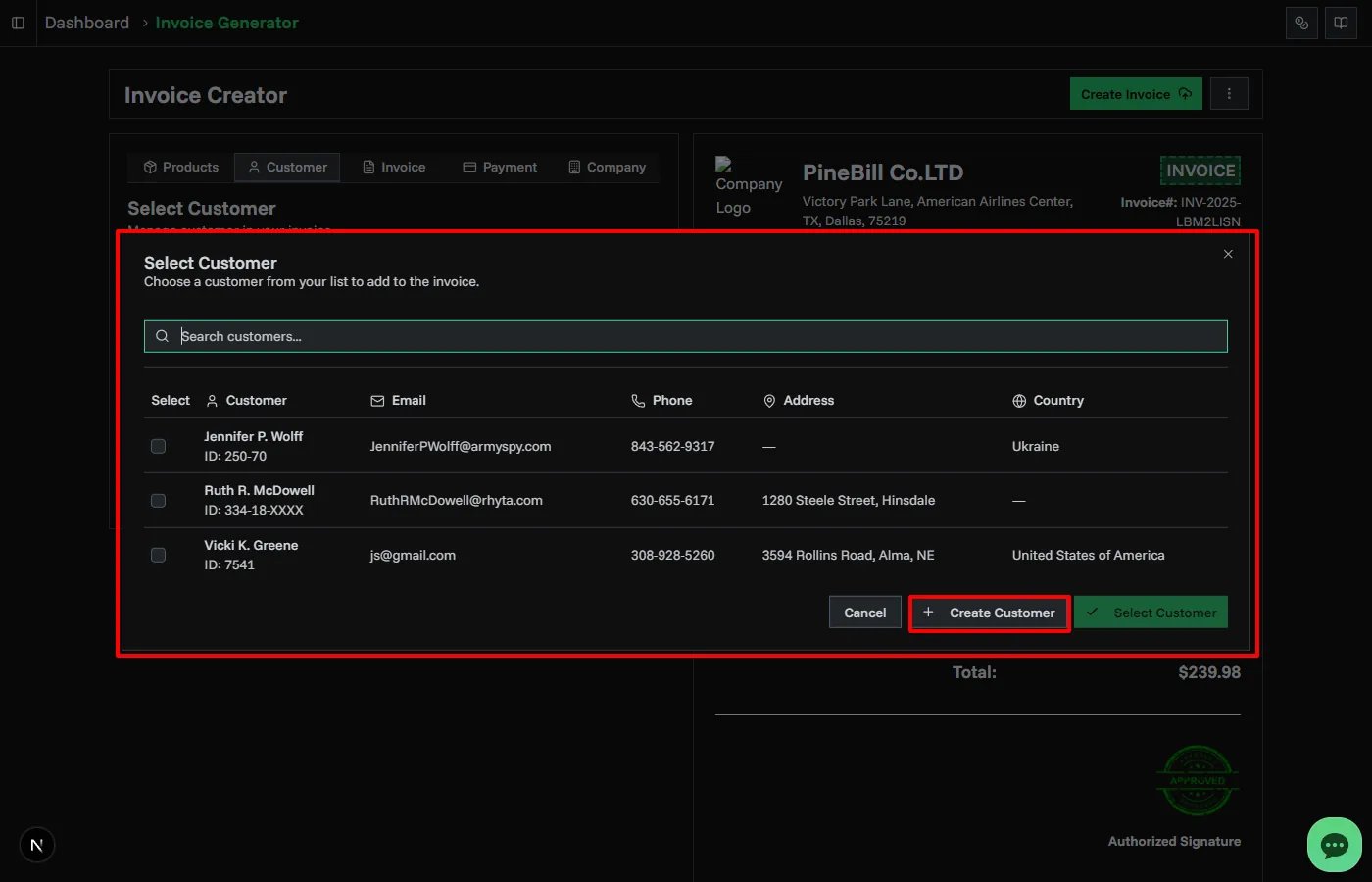

Select a customer from your saved customers list. You must have at least one customer to create an invoice.

- Option A: Select existing customer - Click "Select Customer" and search or browse your list.

- Option B: Add new customer - Click "Add New Customer", fill in name, email, phone, and address, then save.

Included Customer Information:

| Field | Value |

|---|---|

| Issued To (Full Name) | Vicki K. Greene |

| Identifier | 1234 |

| Address | 3594 Rollins Road, Alma, NE 68920 |

| Zip Code | 68920 |

| sample@pinebill.app | |

| Phone | +82 123-456-789 |

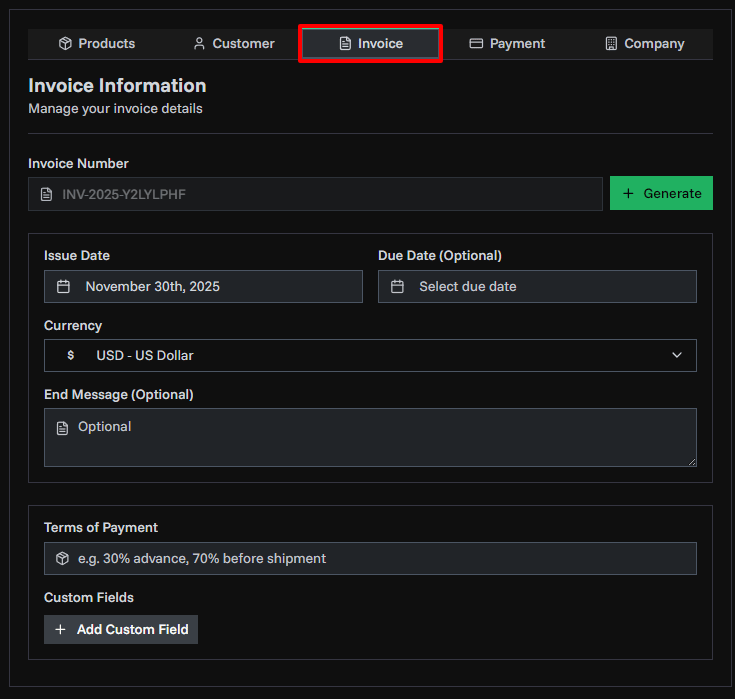

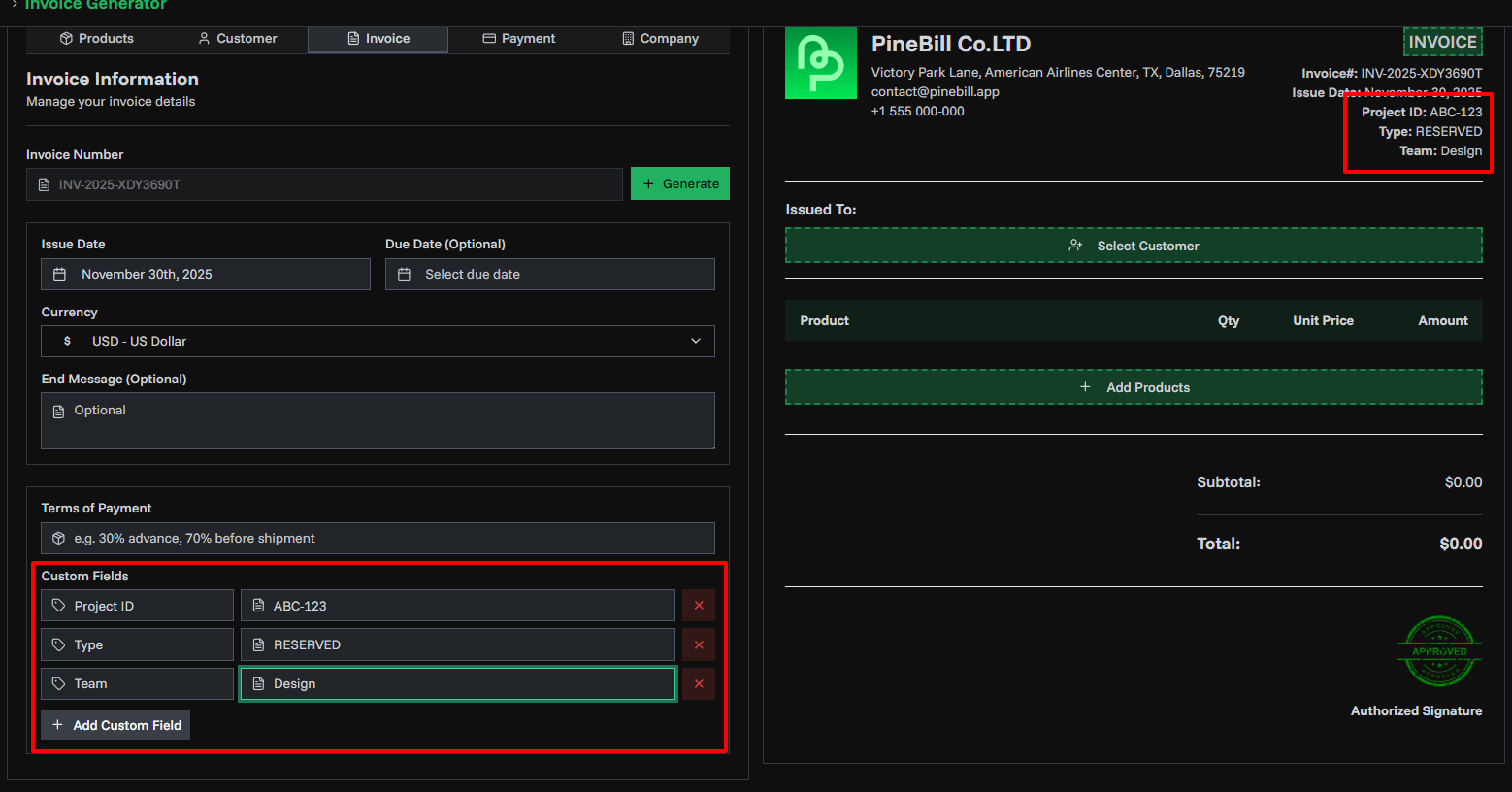

3. Invoice Details

Configure invoice metadata:

- Invoice Number: Click "Generate" to auto-create a unique number, the default behavior of Invoice number generation can be configured in Invoice Settings.

- Issue Date: When the invoice is created (Required)

- Due Date: Payment deadline (Optional)

- Currency: Select from available currencies, default is set in organization settings. Changing the currency will affect calculations and display of all invoice values. Default can be set in Invoice Settings.

- Terms of Payment: Payment conditions (e.g., "Net 30", "50% upfront"), default can be set in Organization Settings.

- End Message: Custom note at bottom of invoice, default can be set in Invoice Settings.

- Custom Data Fields: Add unlimited label-value pairs (e.g., PO Number, Project ID), default fields can be configured in Invoice Settings.

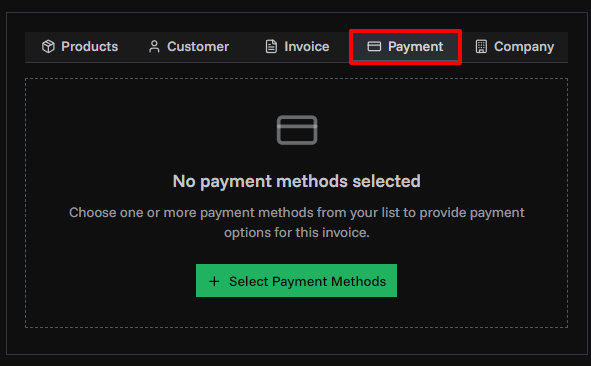

4. Payment Methods

Select one or more payment methods from your saved payment methods list. Payment methods are optional but recommended to provide customers with payment options. You can configure default payment methods in Payment Methods.

- Bank Transfer: Bank account details

- PayPal: PayPal email

- Cryptocurrency: Wallet address

- Custom: Any other payment method

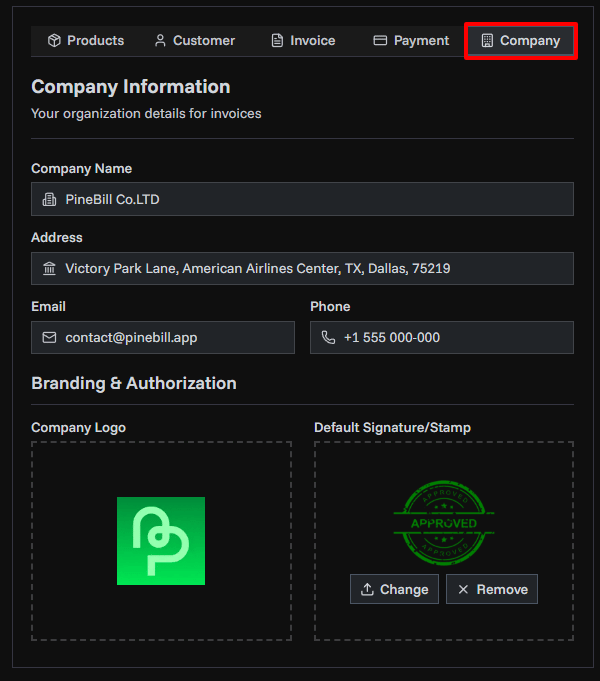

5. Company Information

Your company details are automatically filled from your organization settings:

- Company name, address, email, phone

- Logo: Only if uploaded in Organization Settings

- Signature/Stamp: Add a default signature for all invoices

All these details can be configured in Organization Settings.

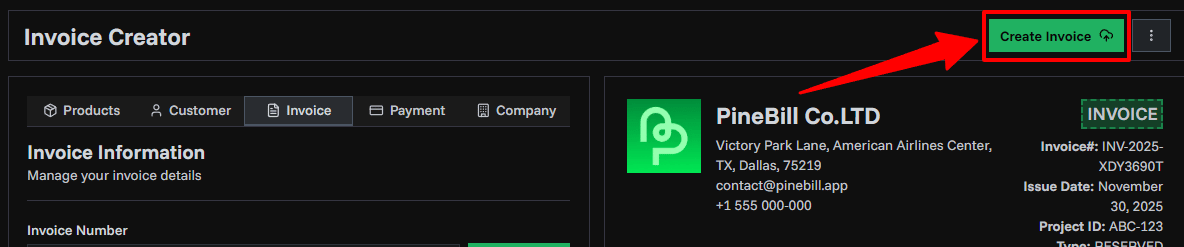

6. Creating the Invoice

Once all required fields are filled:

- Click "Create Invoice" button (top right)

- PDF is automatically generated

- Invoice is saved with DRAFT status

- You're redirected to the invoice detail page

From there you can:

- Download the PDF

- Share the invoice

- Update the status

- Edit if needed

Calculations

Tax Configuration

Two tax types available:

- Percentage (%): Tax calculated as percentage of subtotal

- Fixed Amount: Flat tax amount

Tax Included Toggle:

- ON: Prices already include tax (tax is extracted from total)

- OFF: Tax is added on top of prices (default)

Calculation Formula

Subtotal = Sum of (Quantity × Unit Price)

After Discount = Subtotal - Discount

Tax Amount = After Discount × (Tax Rate / 100) [or Fixed Amount]

Grand Total = After Discount + Tax + ShippingAdvanced Features

Custom Fields

Add any additional information to your invoices:

- Click "Add Custom Field" in Invoice Details tab

- Enter label (e.g., "PO Number")

- Enter value

- Repeat for multiple fields

Related Topics

- Invoice Components - Understand invoice structure

- Invoice Statuses - Manage invoice lifecycle

- Invoice Templates - Choose template styles

- Invoice Settings - Configure defaults and number generation