How to Create a Professional Invoice in 2025: Complete Guide

Small businesses in the United States are grappling with $825 billion in unpaid invoices, and unclear or incomplete invoices are a major culprit. If you're still creating invoices manually or sending documents that lack essential information, you're leaving money on the table.

In 2025, creating professional invoices isn't just about looking polished—it's about getting paid faster, maintaining clean financial records, and building trust with clients. Digital invoicing solutions have become essential for modern businesses, streamlining payment processes and reducing errors.

Whether you're a freelancer sending your first invoice or a growing business scaling your operations, this guide covers everything you need to create professional, compliant invoices that accelerate payment cycles using PineBill.

What Makes an Invoice "Professional" in 2025?

Invoices are more than requests for payment—they're legal documents, historical records of sales, and an important part of your financial workflow. A professional invoice in 2025 combines legal compliance, clear communication, and modern presentation.

Three characteristics define professional invoices:

Completeness: Contains all legally required information for your jurisdiction, eliminating questions or disputes.

Clarity: Each component should be simple and easy to understand, as ambiguity can lead to payment delays.

Consistency: Uses standardized formatting and sequential numbering that streamlines your accounting and builds brand recognition.

With digital invoicing platforms like PineBill, you can automate invoice creation, reduce processing times, and ensure consistent, professional invoices every time. These efficiency gains directly impact your cash flow and business sustainability.

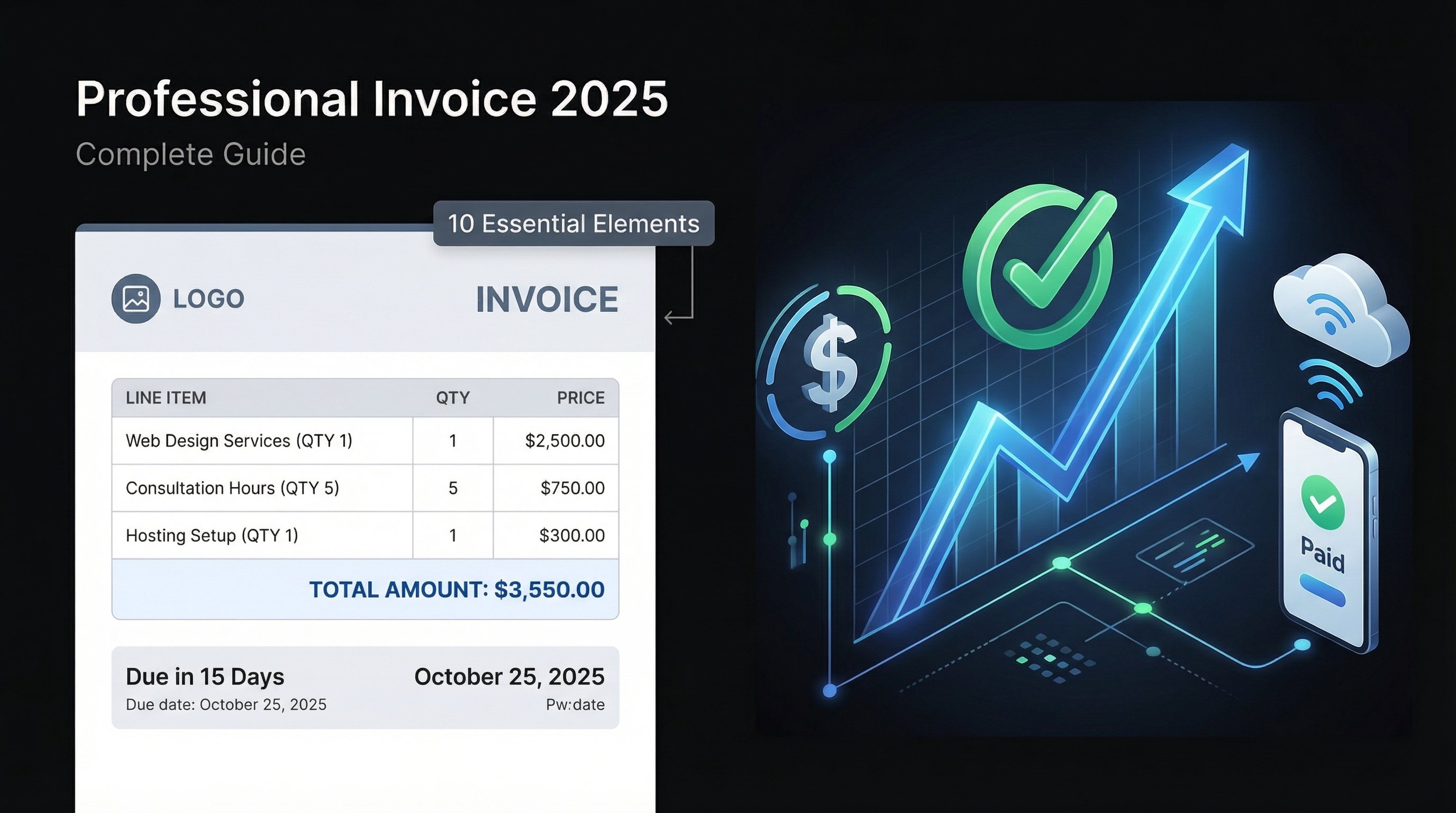

10 Essential Elements Every Invoice Must Include

Regardless of your business type or location, invoices generally include details such as the seller's and buyer's information, a unique invoice number, a clear description of goods or services provided, and applicable taxes.

Here's what every professional invoice needs:

1. The Word "Invoice" as a Clear Header

Make the word "invoice" clear and prominent at the top of the document to quickly identify it as such. This distinguishes your invoice from quotes, receipts, or purchase orders.

2. Your Business Information

Include your company name, business address, contact details (such as phone number or email), and any other relevant information. Depending on your jurisdiction, you may also need to include:

- Tax Identification Number (TIN) or Employer Identification Number (EIN)

- Business registration number

- VAT number (for EU businesses)

- Website or professional email address

Adding your company logo enhances professionalism and brand recognition.

3. Client Information

Include the name, address, and contact details of the client or business you're billing. It is best practice to address the invoice to the client or person and not the company, so double-check with your client for who to bill to invoice the right person.

For B2B transactions, include the client's company name, billing contact, and any purchase order numbers they provided.

4. Unique Invoice Number

In the US, there are no specific requirements for how you format your invoice numbers, however for accounting purposes, the numbers should be sequential and not include any gaps.

Common formats include:

- 2025-001: Year plus sequential number

- INV/2025/01/017: Document type, year, month, and number within that month

- CLIENT-2025-001: Client identifier plus year and number

Choose a system that works for your volume and stick with it consistently.

5. Invoice Date and Due Date

Include both the date you're issuing the invoice and when payment is due. Most small businesses ask for bills to be paid within 7 days, though 30 days (Net 30) is standard for B2B transactions.

Clear due dates set expectations and provide a reference point if you need to follow up on late payments.

6. Detailed Description of Products or Services

Providing detailed invoice descriptions is essential for preventing disputes and ensuring clarity by including a thorough breakdown of the products or services, specifying quantities, quality, and special arrangements.

For each line item, include:

- Clear description of the product or service

- Quantity or hours

- Unit price or hourly rate

- Line total

Avoid vague descriptions like "consulting services." Instead, use specific language like "Website redesign consultation - 8 hours @ $150/hour."

7. Subtotal, Taxes, and Total Amount Due

You may need to include sales tax on your invoices, as each state and county has different tax rates and rules. Break down your pricing clearly:

- Subtotal: Sum of all line items before taxes

- Tax: Applicable sales tax, VAT, or GST with rate shown

- Total Amount Due: Final amount in large, bold text

If you offer discounts or have deposits to deduct, show these as separate line items.

8. Payment Terms and Methods

You'll want to include when you should get paid in your payment terms. Specify:

- Accepted payment methods (bank transfer, credit card, PayPal, etc.)

- Bank details or payment portal links

- Currency (especially important for international clients)

- Early payment discounts if offered

- Late payment fees if applicable

The State you reside in must permit you to enforce late payment fees if it is agreed upon, with typical late fees for not paying an invoice on time being 1.5%-5% every month the bill is not paid.

9. Additional Notes or Terms

Use this section for:

- Thank you messages

- Project-specific references

- Warranty information

- Return policies

- Contract references

Keep it brief—one to three sentences maximum.

10. Contact Information for Questions

Make it easy for clients to reach you if they have questions. Include an email address or phone number specifically for billing inquiries.

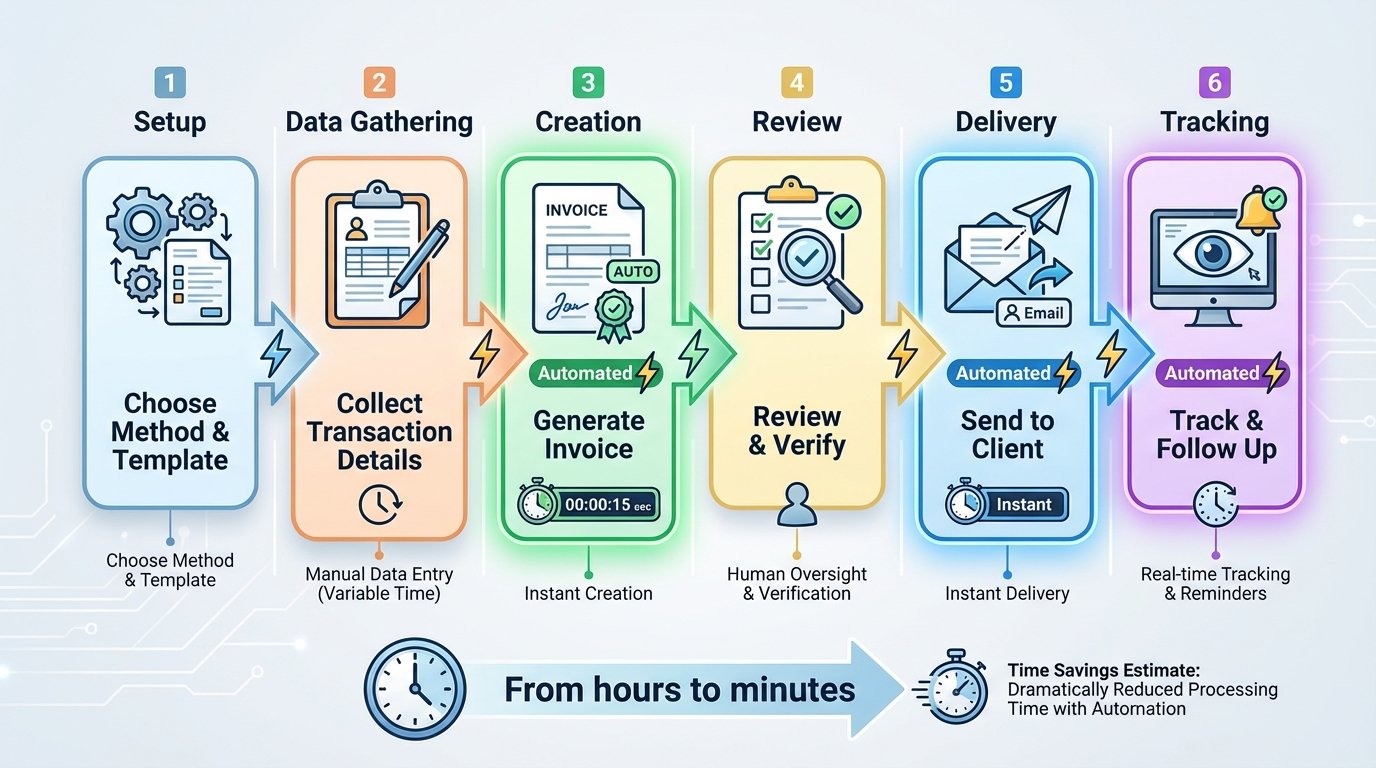

How to Create Professional Invoices: Step-by-Step Process

Creating professional invoices doesn't have to be complicated. Follow this systematic approach:

Choose Your Invoicing Method

The key to optimizing your invoicing process in 2025 lies in automation, as automating your invoicing system can effectively implement and sustain invoice best practices.

Modern invoicing platforms like PineBill provide:

- Automated invoice generation with professional templates

- Sequential invoice numbering

- Real-time payment tracking

- Automated reminders

- Multi-currency support

- Cloud storage and easy access

Get started with PineBill to create professional invoices in minutes, not hours.

Set Up Your Invoice Template

Small businesses should start by creating standardized invoice templates that include all essential details, as these templates streamline the process, ensuring consistency and professionalism in every transaction.

With PineBill, you can:

- Upload your logo and customize branding colors

- Set default payment terms and methods

- Configure tax rates for your location

- Choose from multiple professional templates (Classic or Bold Professional or more..)

- Save organization settings for consistent invoices

Learn how to set up your organization to configure your default invoice settings.

Gather Transaction Details

Before creating each invoice, collect:

- Client information and billing contact

- Complete description of work performed

- Dates of service

- Quantities and rates

- Any expenses or materials to bill

- Purchase order numbers (if applicable)

Having this information ready before you start prevents errors and speeds up the process.

Create and Review the Invoice

PineBill automatically handles calculations and validations for you:

- Tax calculations based on your configured rates

- Sequential invoice numbering

- Real-time preview of your invoice

- Automatic subtotals and grand totals

- Validation of required fields

Create your first invoice with our step-by-step tutorial.

Send the Invoice Promptly

By adopting a proactive invoicing strategy, businesses create a sense of urgency for clients while demonstrating professionalism and efficiency, as timely invoicing also helps maintain strong customer relationships by setting clear expectations.

With PineBill, you can:

- Generate shareable invoice links with password protection

- Set expiration dates and view limits on shared invoices

- Download professional PDF invoices

- Track when clients view your invoices

Learn about invoice sharing to understand all your distribution options.

Track and Follow Up

Payment delays decrease with consistent follow-ups and professional tracking systems.

PineBill helps you manage invoice statuses:

- Track invoices as Draft, Sent, Paid, Overdue, or Cancelled

- Monitor payment dates and outstanding balances

- View invoice analytics and revenue reports

- Access all invoices from a centralized dashboard

Explore invoice management to learn about tracking and organization.

Invoice Formatting Best Practices for 2025

Your invoice should not only be functional but also professional, as this speaks to the credibility of your business through consistent spacing, readable fonts, and a logical layout.

Visual Hierarchy

Top Section: Your logo and business information (establishes identity)

Upper Middle: Client information and invoice details (identifies the transaction)

Center Section: Itemized services/products table (the core content)

Bottom Section: Totals, payment terms, and notes (action items)

Typography and Spacing

- Use professional fonts like Arial, Helvetica, or Calibri

- Make the total amount due larger and bold

- Use sufficient white space to avoid crowding

- Align numbers to the right for easy scanning

- Use consistent text sizes throughout

Color and Branding

Incorporate your brand colors subtly:

- Header background in brand color

- Accent lines or borders

- Logo in full color

Avoid excessive colors that reduce readability or professional appearance.

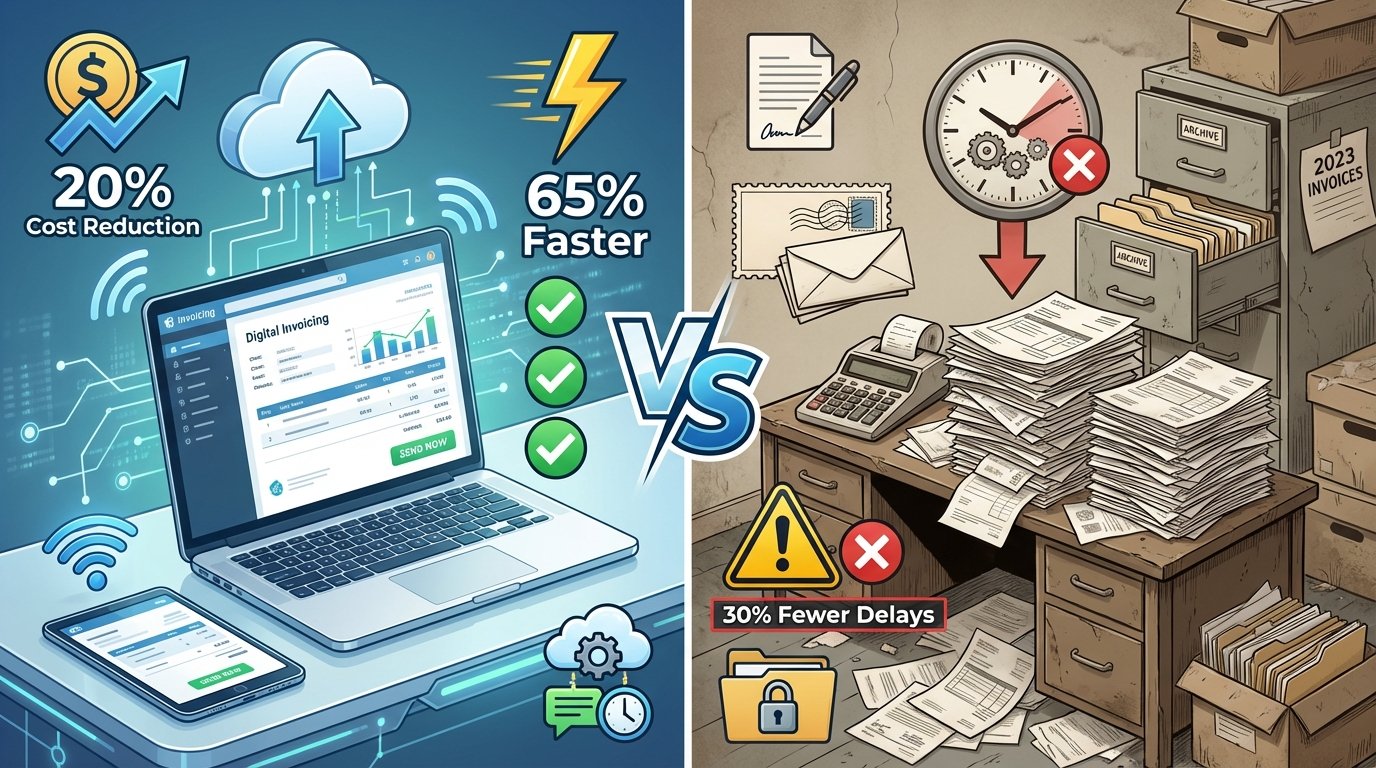

Digital Invoicing vs. Paper Invoices in 2025

Digital invoicing adoption is rising as businesses seek efficiency and cost savings. Here's why digital wins in 2025:

| Feature | Digital Invoicing (PineBill) | Paper Invoicing |

|---|---|---|

| Processing Time | Instant generation and delivery | Slow, manual entry required |

| Error Rate | Automated calculations reduce errors | High due to manual calculations |

| Cost | No printing or postage costs | Printing, postage, storage costs |

| Tracking | Real-time status updates and analytics | Uncertain delivery and receipt |

| Payment Speed | Faster with instant delivery and reminders | Slower processing cycle |

| Storage | Cloud-based, searchable, secure | Physical filing, limited access |

| Environmental Impact | Zero paper waste | Paper consumption |

| Scalability | Handles unlimited volume | Limited by manual capacity |

Digital storage offers significant advantages over paper files, as cloud-based systems let you access invoices from anywhere, search records instantly, and share documents with your accountant.

Legal Requirements and Invoice Retention

Understanding legal requirements protects your business from audits and disputes.

Retention Requirements

Federal rules vary—the IRS generally requires 3 years, FAR requires 3-4 years, and SOX requires 7 years for audit evidence. Many jurisdictions require businesses to keep invoice records for 3 to 7 years, so check local regulations and any industry-specific rules to stay compliant.

Best practice: Keep all invoices for 7 years to cover the longest potential requirement. PineBill automatically stores all your invoices securely in the cloud for easy access and compliance.

Data Security

Invoices contain sensitive business information. Protect your financial data with regular backups stored in multiple locations, such as your accounting software, cloud storage, and an external drive, and add password protection and encryption for sensitive client details.

PineBill provides enterprise-grade security with encrypted cloud storage and secure sharing options. Learn more about our security practices.

International Considerations

If you invoice international clients, make sure your documentation aligns with any currency formatting rules, VAT or GST requirements, and cross-border recordkeeping standards.

PineBill supports multiple currencies and international invoicing requirements. View supported currencies.

Common Invoicing Mistakes to Avoid

Even experienced business owners make these errors:

| Common Mistake | Impact & Solution |

|---|---|

| Missing or Incorrect Information | Omitting essential information can lead to confusion and payment delays. Always double-check that all necessary details are included before sending the invoice. |

| Inconsistent Numbering | Gaps in your invoice sequence raise red flags during audits and complicate your accounting. PineBill automatically generates sequential invoice numbers. |

| Vague Descriptions | Generic line items like "services rendered" invite questions and disputes. Be specific about what was provided. |

| Unclear Payment Terms | Setting impractical payment terms can strain client relationships and result in late payments. Clearly state when payment is due. |

| Late Invoice Submission | Sending invoices late or with errors can disrupt your cash flow and damage client trust. PineBill streamlines invoice creation so you can send invoices immediately after completing work. |

| Manual Error Prone Processes | Manual data entry accounts for the majority of invoice errors. Digital platforms eliminate calculation errors and ensure accuracy. |

| No Follow-Up System | Assuming clients will pay without reminders leads to unnecessary delays. Use invoice tracking to monitor payment status. |

How PineBill Simplifies Professional Invoicing

Creating professional invoices shouldn't consume hours of your time or require accounting expertise. PineBill consolidates everything you need into one intuitive platform:

Professional Templates: Choose from Classic or Bold Professional templates that include all required elements automatically. Explore invoice templates.

Smart Invoice Generation: Create invoices in minutes with saved customer and product data. Learn how to create your first invoice.

Secure Sharing: Generate shareable links with password protection, expiration dates, and view limits. Understand invoice sharing.

Status Tracking: Monitor invoices through their lifecycle—Draft, Sent, Paid, Overdue, or Cancelled. Manage invoice statuses.

Customer Management: Build a customer database with contact information and invoice history. Add and manage customers.

Product Catalog: Organize your products and services with categories, SKUs, and pricing. Set up your product catalog.

Professional Branding: Upload your logo and customize invoice settings to match your brand. Configure organization settings.

Multi-Currency Support: Invoice international clients in their preferred currency. View supported currencies.

Analytics Dashboard: Track revenue, invoice counts, and payment trends. Explore analytics.

With PineBill, you'll spend less time on administrative tasks and more time growing your business. Get started for free.

Key Takeaways: Creating Professional Invoices in 2025

-

Include all 10 essential elements: Business info, client info, unique numbers, dates, detailed descriptions, accurate totals, payment terms, and contact information.

-

Go digital: Automation reduces processing time, cuts operational costs, and decreases payment delays significantly.

-

Use PineBill for streamlined invoicing: Create professional invoices in minutes with automated calculations, sequential numbering, and professional templates. Start creating invoices.

-

Send invoices promptly: Issue invoices immediately upon project completion to maintain positive cash flow.

-

Track invoice status: Monitor your invoices through their lifecycle and stay on top of payments. Learn about invoice management.

-

Prioritize clarity: Each component of your invoice should be simple and easy to understand, as ambiguity can lead to payment delays.

-

Maintain proper records: Keep invoices for at least 7 years with secure cloud storage and automatic backups.

-

Leverage professional tools: The key to optimizing your invoicing process in 2025 lies in automation—automated invoicing software eliminates manual data entry, effectively reduces errors, and ensures faster payments.

Professional invoicing directly impacts your bottom line. Businesses with streamlined invoice processes report better cash flow, fewer disputes, and stronger client relationships.

Ready to Transform Your Invoicing?

Professional invoicing doesn't have to be complex or time-consuming. With the right approach and tools, you can create polished invoices in minutes, get paid faster, and maintain pristine financial records.

PineBill provides everything you need to create professional invoices:

- Quick Setup: Create your account and set up your organization in minutes

- Easy Invoice Creation: Follow our step-by-step guide to create your first invoice

- Professional Templates: Choose from multiple templates and customize with your branding

- Complete Documentation: Access our comprehensive documentation for all features