What Is a Billing Address? Essential Guide for Invoicing

You've just sent an invoice to a client, but the payment bounces back with a vague error about a mismatched billing address. Frustrating, right? This common issue delays cash flow and erodes trust.

A billing address isn't just another form field—it's critical for fraud prevention, tax compliance, and professional invoicing. In this guide, we'll break down exactly what a billing address is, why it matters for your business, and how to handle it correctly.

What Is a Billing Address?

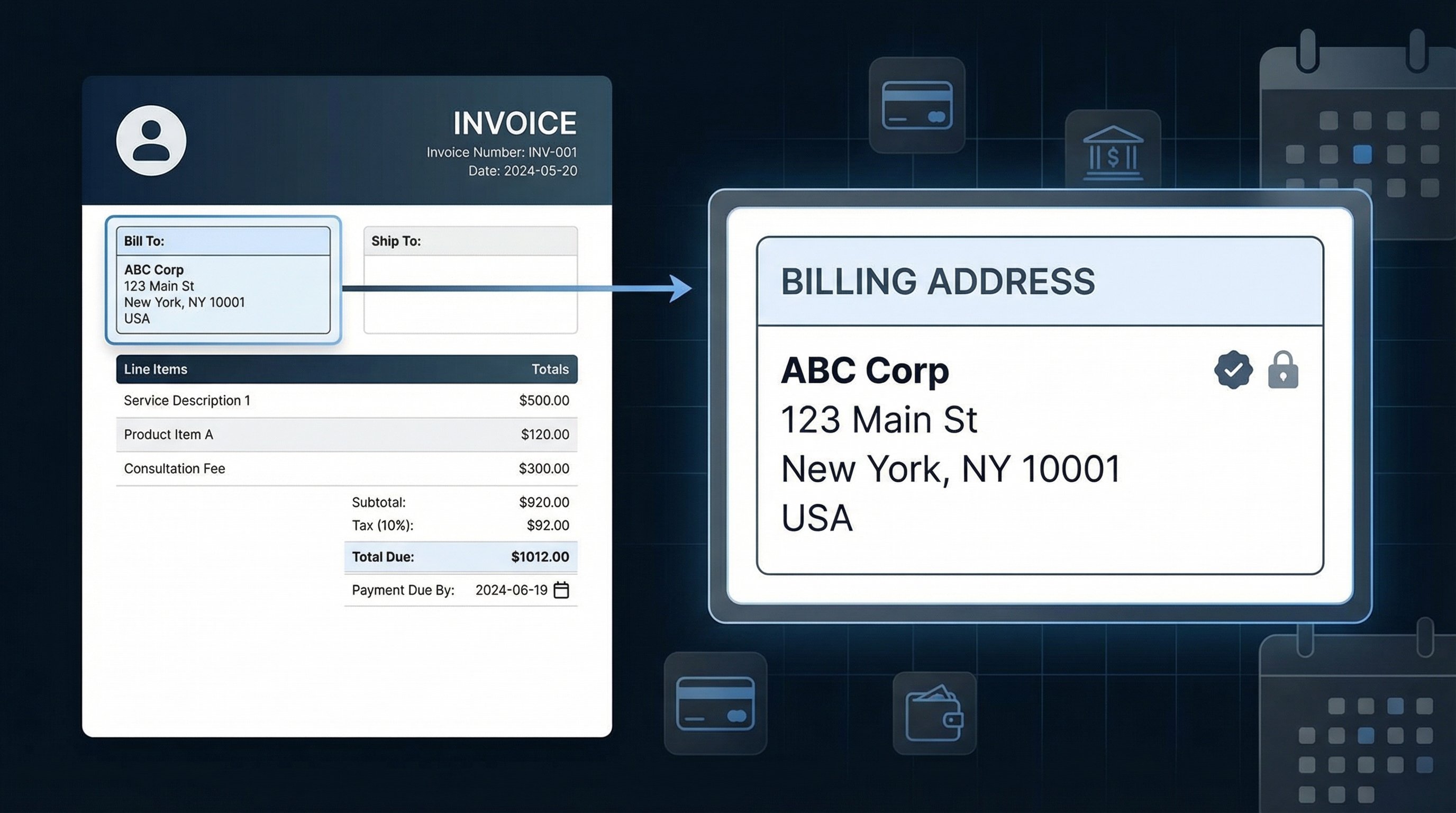

A billing address is the full address associated with a customer's payment method, such as a credit card, debit card, or bank account. It's the location where bills, invoices, and statements are sent for payment processing.

When you create an invoice, the billing address identifies who you're billing and where to direct payment-related correspondence. For businesses and freelancers, this is typically the client's company headquarters, home office, or registered business address.

Key components include:

- Full name or company name

- Street address (including apartment/unit if applicable)

- City, state/province

- ZIP/postal code

- Country

This address is verified during transactions via systems like Address Verification Service (AVS), which matches it against the card issuer's records to prevent fraud.

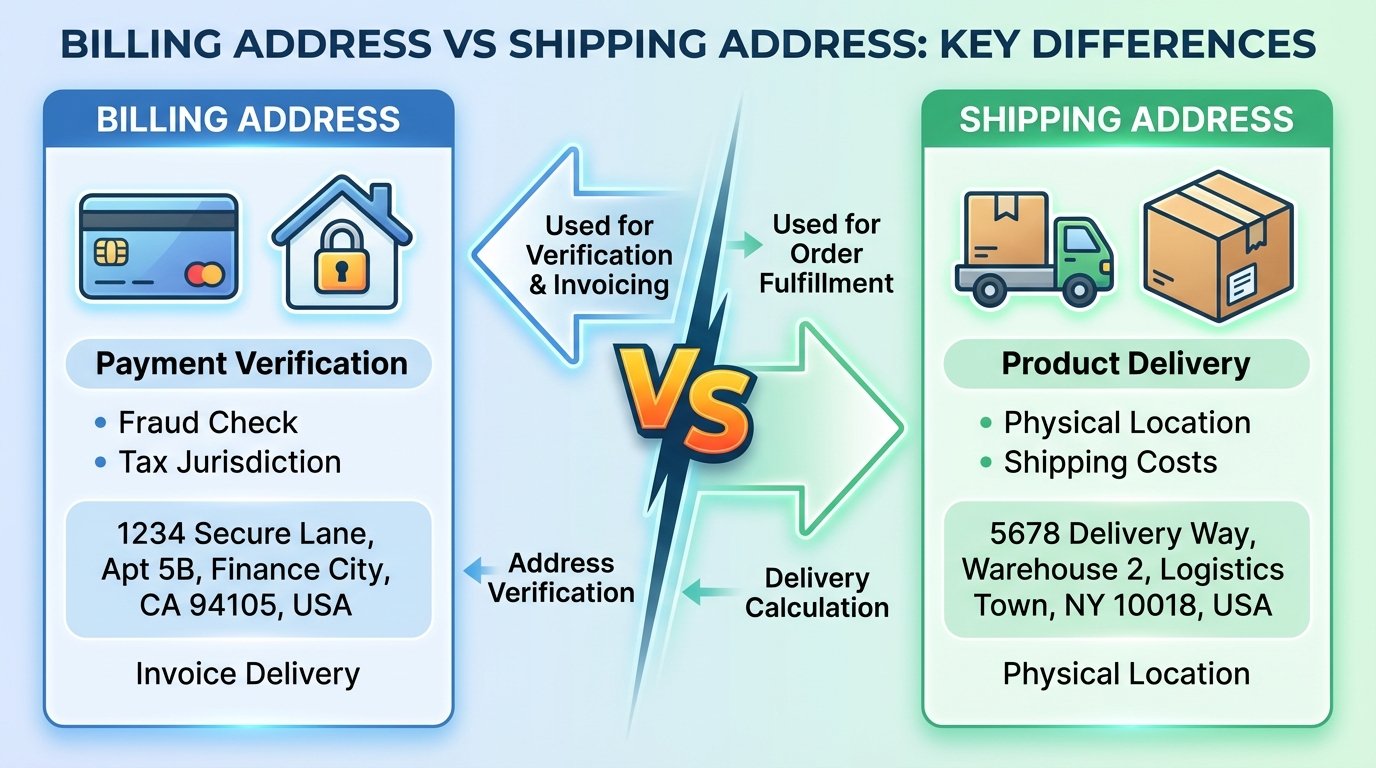

Billing Address vs. Shipping Address: Key Differences

Many confuse billing and shipping addresses, but they serve distinct purposes.

| Aspect | Billing Address | Shipping Address |

|---|---|---|

| Purpose | Payment verification and invoice delivery | Physical product delivery |

| Linked To | Payment method (card/bank) | Delivery location |

| Verification | AVS for fraud prevention | Postal services for accuracy |

| On Invoices | Required for billing section | Optional, for goods/services |

| Can Be Same? | Often yes, but not always | N/A |

For service-based businesses like consulting or freelancing, shipping addresses rarely apply. Focus on billing for digital delivery.

Why Is the Billing Address Important on Invoices?

Including an accurate billing address on every invoice protects your business in multiple ways:

-

Fraud Prevention: Payment processors check the billing address against card records. Mismatches trigger declines, reducing chargebacks by up to 60% according to industry standards.

-

Legal Compliance: Determines applicable sales tax jurisdiction. Incorrect addresses lead to audit risks or penalties.

-

Payment Speed: Ensures invoices reach the right accounts payable department. Studies show accurate details cut payment times by 20-30%.

-

Professionalism: Builds trust. Clients expect precise, complete information.

-

Record-Keeping: Essential for GAAP/IFRS compliance and easy reconciliation.

Without it, you risk lost payments, delayed receivables, and damaged relationships.

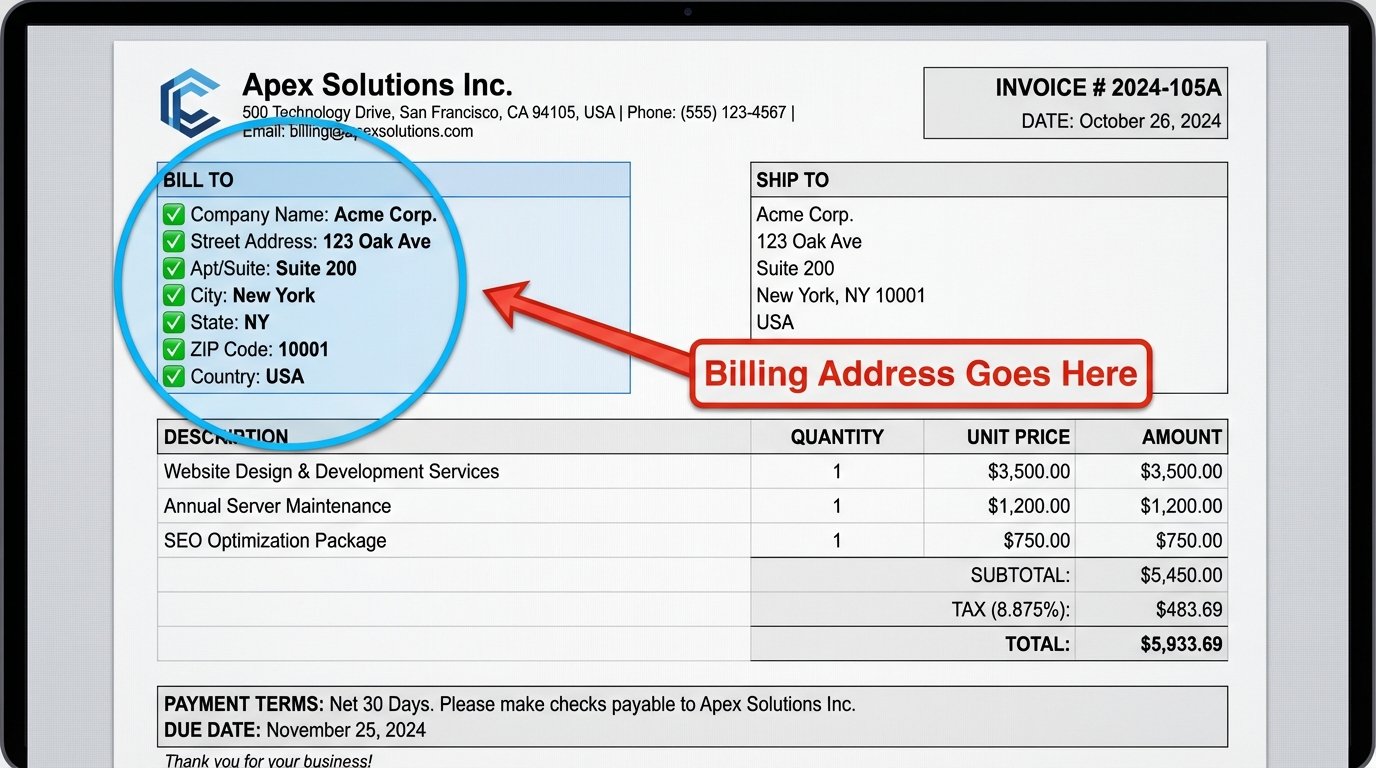

What Should You Include in a Billing Address?

Craft a complete billing address to avoid issues:

- Recipient: Client name or company legal name (use the one on their payment method).

- Street: Full address, e.g., "123 Main St, Apt 4B".

- City/State/ZIP: Exact format per country (e.g., US: City, ST 12345).

- Country: Always include for international clients.

- Contact: Optional phone/email for the billing contact.

Example:

ABC Corp Attn: Accounts Payable 456 Oak Avenue Suite 200 New York, NY 10001 USA Phone: (555) 123-4567 billing@abccorp.com

How to Find Your Client's Billing Address

- Ask during onboarding—include in contracts or client intake forms.

- Check payment method details if paying by card.

- Use client portals in tools like PineBill to store and auto-populate.

- Verify via email before first invoice.

Verify During Onboarding

Collect billing details upfront via forms. PineBill's client management lets you save this permanently.

Cross-Check Payment Info

For card payments, request the address on file with their bank.

Confirm Annually

Addresses change—send a quick update request yearly.

Best Practices for Billing Addresses in Invoicing

Follow these to streamline operations:

- Always Verify: Double-check before sending. Use autocomplete tools.

- Separate Fields: Label clearly as "Bill To" on invoices.

- International Format: Use ISO standards for global clients.

- Automate: Platforms like PineBill pull from client profiles automatically.

- Update Records: Log changes in your CRM.

Pro Tip: Enable client self-edits via secure portals to keep data current without manual chasing.

Common Billing Address Mistakes and How to Avoid Them

Avoid these pitfalls that cause 15-20% of payment delays:

- Typos: Misspelled streets or ZIPs trigger AVS fails. Fix: Proofread and use validation tools.

- Outdated Info: Clients move. Fix: Annual confirmations.

- Shipping Confusion: Using delivery address for billing. Fix: Ask explicitly.

- Missing Details: No country or suite number. Fix: Use templates with required fields.

- Wrong Recipient: Personal vs. company. Fix: Match payment holder.

Key Takeaways

- A billing address links to payment methods for verification and invoice delivery.

- Distinct from shipping—focus on payment, not delivery.

- Essential for fraud prevention, compliance, and faster payments.

- Include full details: name, street, city, state, ZIP, country.

- Automate with PineBill to eliminate errors and save time.

Ready to perfect your invoicing? PineBill's customizable templates and client portals ensure billing addresses are always spot-on, getting you paid faster.