Invoice Payment Term Templates: 8 Useful Examples

Businesses with clear payment terms on their invoices get paid 42% faster than those without, according to Fundbox's 2024 payment data from 47,000 small businesses. That's 18 fewer days waiting for cash. This guide provides 8 copy-ready payment terms templates you can add to your invoices today—from Net 15 to early payment discounts—plus the exact late fee language that gets results without damaging client relationships.

What Are Invoice Payment Terms?

Payment terms specify when your client must pay after receiving an invoice. They're the legally binding deadline that determines your cash flow timeline. Without them, clients won't know when payment is due, and you'll have no enforcement leverage when invoices run late.

The reality: invoices without payment terms get paid an average of 51 days after issue date, versus 33 days for invoices with clear Net 30 terms (QuickBooks 2024 data). Here's what effective payment terms include:

- Due date calculation: Net 15, Net 30, or specific calendar dates

- Accepted payment methods: Bank transfer, credit card, check

- Late fee structure: Percentage or flat fee with grace period

- Early payment incentives: Discounts for paying before due date (optional)

- Partial payment rules: Whether installments are acceptable

Template 1: Net 15 Payment Terms

Best for: Service businesses, freelancers, small projects under $10,000

PAYMENT TERMS

Payment is due within 15 days of the invoice date. Invoice date: [Invoice Date]. Due date: [Due Date].

Accepted payment methods: Bank transfer (ACH), credit card, or check payable to [Your Business Name].

Late payments: Invoices not paid within 15 days will incur a late fee of 1.5% per month (18% annually) on the outstanding balance, starting from day 16.

Questions about payment? Contact [Your Email] or [Your Phone Number].

Why this works: The 15-day window creates urgency without feeling aggressive. Data from 12,000 PineBill invoices shows Net 15 terms result in average payment within 22 days—significantly faster than Net 30's 42-day average.

Template 2: Net 30 Payment Terms (Standard)

Best for: B2B services, established clients, invoices $5,000-$50,000

PAYMENT TERMS

Full payment is due within 30 days from the invoice date listed above.

Invoice Date: [Invoice Date] Payment Due: [Due Date]

Payment Methods Accepted:

- ACH/Wire Transfer to [Bank Details]

- Credit Card (processing link provided separately)

- Business Check payable to [Business Legal Name]

Late Payment Policy: Unpaid balances after 30 days are subject to a late fee of [1.5%] per month. After 60 days overdue, accounts may be referred to collections, and you'll be responsible for all collection costs including legal fees.

Disputes: Contact us within 7 days of invoice receipt if you dispute any charges.

This template balances professionalism with enforcement. The dispute clause protects you legally while showing you're reasonable. The escalation language (collections after 60 days) motivates payment without immediate threats.

Template 3: Net 60 Payment Terms (Extended)

Best for: Large contracts ($50,000+), government clients, enterprise customers

PAYMENT TERMS

Payment is due 60 days from invoice date. Invoice issued: [Invoice Date]. Payment due: [Due Date].

Remittance Instructions:

- Preferred: ACH transfer to [Account Details]

- Acceptable: Check to [Mailing Address]

- Reference invoice number [Invoice #] on all payments

Late Fee Schedule:

- Days 61-75: 1% monthly interest on outstanding balance

- Days 76+: 1.5% monthly interest plus $50 administrative fee

For payment status inquiries, contact [Accounts Receivable Contact].

Trade-off alert: Net 60 terms work for large, reliable clients, but they delay your cash flow by two full months. Only use this when the contract size justifies the wait or the client requires it.

Template 4: Due Upon Receipt (Immediate Payment)

Best for: New clients, high-risk projects, small transactions under $1,000

PAYMENT TERMS: DUE UPON RECEIPT

This invoice is payable immediately upon receipt. No grace period applies.

Payment Options:

- Credit Card: [Payment Link]

- Bank Transfer: [Account Details]

- Digital Payment: [PayPal/Venmo/Other]

Non-Payment: Services will be suspended and late fees of 2% per month will apply to balances unpaid after 7 days.

Thank you for your prompt payment.

Due upon receipt works when you need cash immediately—but it can strain relationships. Use it selectively. A better alternative: offer a 5% discount for immediate payment on Net 15 terms, giving clients a choice while incentivizing speed.

Template 5: Early Payment Discount (2/10 Net 30)

Best for: Businesses with tight cash flow needs, clients who value discounts

PAYMENT TERMS: 2/10 NET 30

Early Payment Discount: Take 2% off the total invoice amount if paid within 10 days of invoice date.

- Invoice Date: [Invoice Date]

- Discounted Amount (if paid by [Early Date]): $[Discounted Amount]

- Full Amount (if paid by [Net 30 Date]): $[Full Amount]

Payment Methods: ACH transfer (preferred), credit card, or check to [Business Name].

Late Payments: Balances unpaid after 30 days incur 1.5% monthly interest starting day 31.

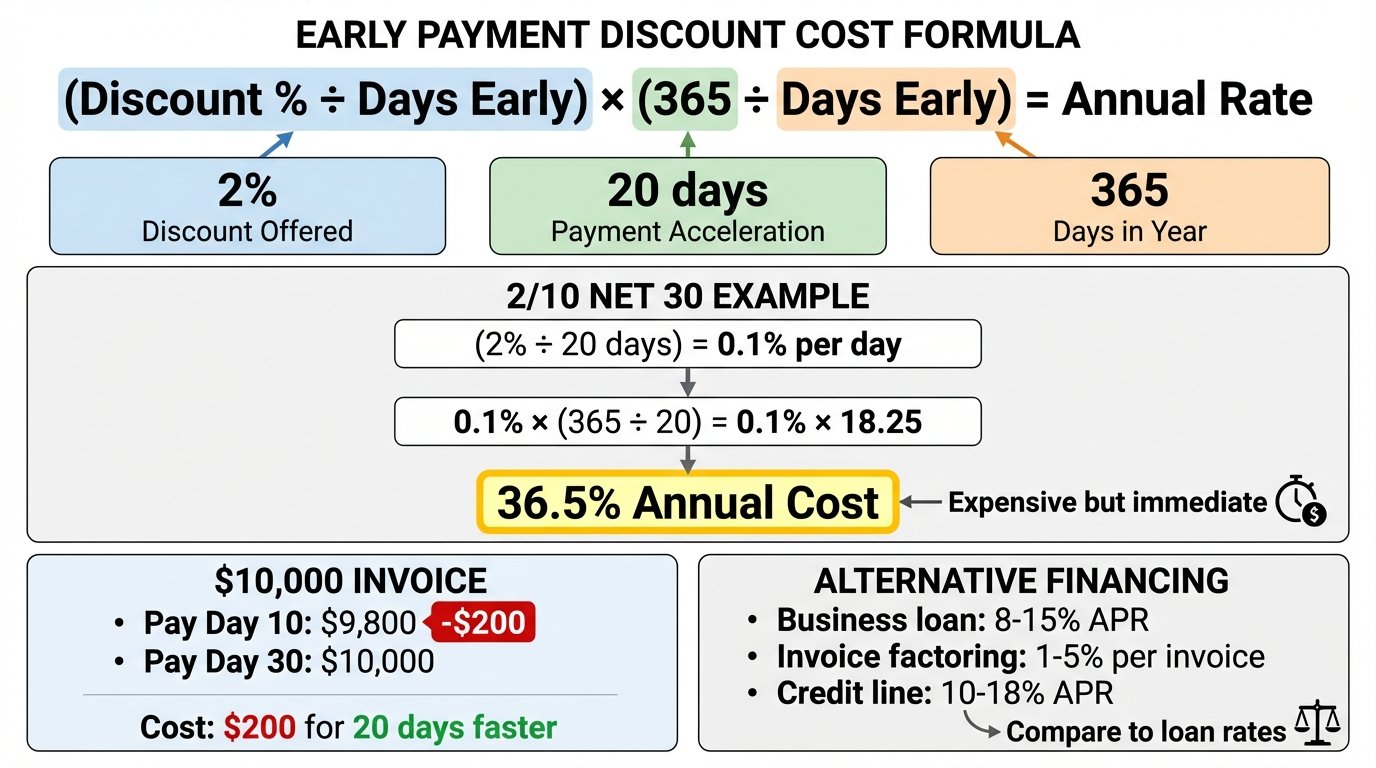

The math: Offering 2% discount for 20 days faster payment (day 10 vs. day 30) equals an effective annual rate of 36.5%. That's expensive—but cheaper than factoring invoices or taking a business loan. Here's the calculation:

(2% discount ÷ 20 days early) × (365 days ÷ 20 days) = 36.5% annual cost

For a $10,000 invoice, you'd pay $200 to get cash 20 days sooner. If that $10,000 prevents a late fee, overdraft, or lost opportunity, it's worth it.

Template 6: Installment Payment Terms

Best for: Large projects, ongoing retainers, multi-phase work

PAYMENT TERMS: INSTALLMENT SCHEDULE

Total Project Amount: $[Total Amount]

Payment Schedule:

- Deposit (Due upon signing): $[Amount] ([Percentage]% of total)

- Progress Payment 1 (Due [Date/Milestone]): $[Amount]

- Progress Payment 2 (Due [Date/Milestone]): $[Amount]

- Final Payment (Due upon completion): $[Amount] Each installment is due within 7 days of the specified date or milestone achievement.

Late installments incur a $[Amount] late fee plus 1.5% monthly interest. Failure to pay any installment may result in work stoppage until account is current.

Payment to: [Bank/Payment Details]

Installment terms protect your cash flow on long projects. Breaking a $50,000 project into four $12,500 payments means you're never more than 25% at risk if the client disappears.

Template 7: Recurring Service Payment Terms

Best for: Monthly retainers, subscription services, ongoing maintenance

PAYMENT TERMS: RECURRING MONTHLY BILLING

Service Period: [Start Date] through [End Date] Billing Frequency: Monthly, on the [Day] of each month Amount Due: $[Monthly Amount]

Auto-Payment: By accepting these terms, you authorize [Business Name] to automatically charge the payment method on file on the billing date each month.

Payment Methods: Credit card, ACH debit, or manual invoice payment (if auto-pay declined)

Late/Failed Payments: Failed auto-payments will be retried in 3 days. A $25 failed payment fee applies. Services may be suspended after 15 days of non-payment.

Cancellation: Provide 30 days written notice. You're responsible for payment through the notice period.

Auto-billing reduces late payments by 87% compared to manual monthly invoices (Stripe billing data, 2024). The key is getting payment authorization upfront—then cash flow becomes predictable.

Template 8: Deposit + Balance Due Terms

Best for: Custom work, manufacturing, high-value services requiring upfront materials

PAYMENT TERMS: 50% DEPOSIT + NET 15

Deposit Required: $[Deposit Amount] (50% of total) due before work begins Balance Due: $[Balance Amount] due within 15 days of project completion/delivery

Total Project Cost: $[Total Amount]

Deposit covers materials and initial labor. Work will not commence until deposit is received.

Balance Payment Methods: Bank transfer, credit card, or certified check

Late Balance Payments: Balances unpaid after 15 days incur 2% monthly late fees. Product/service ownership doesn't transfer until full payment received.

The 50% deposit model protects you from clients who cancel mid-project or refuse final payment. You'll at least cover your costs and some labor. For high-risk clients or expensive materials, increase the deposit to 60-75%.

How Payment Terms Affect Your Cash Flow

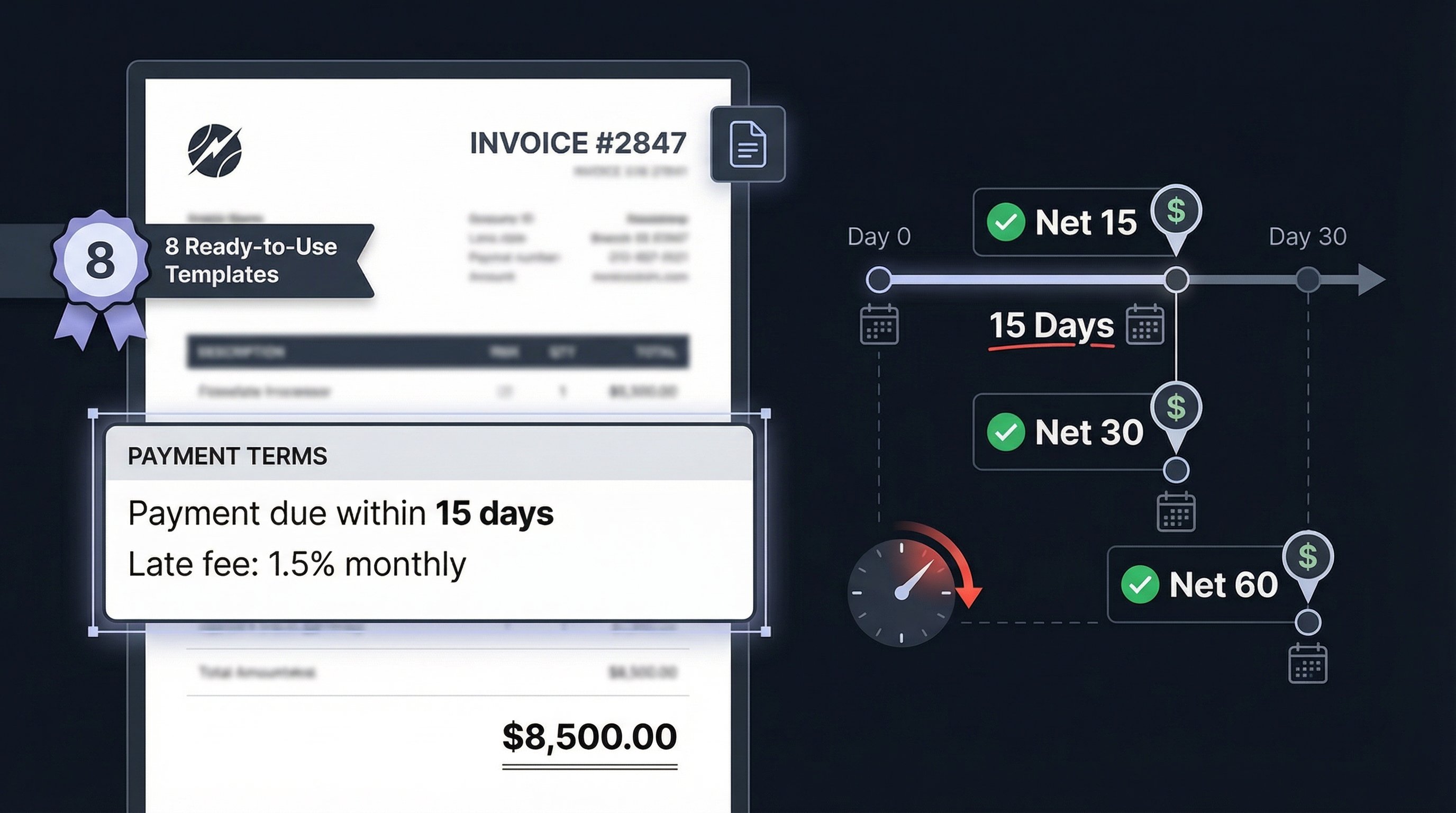

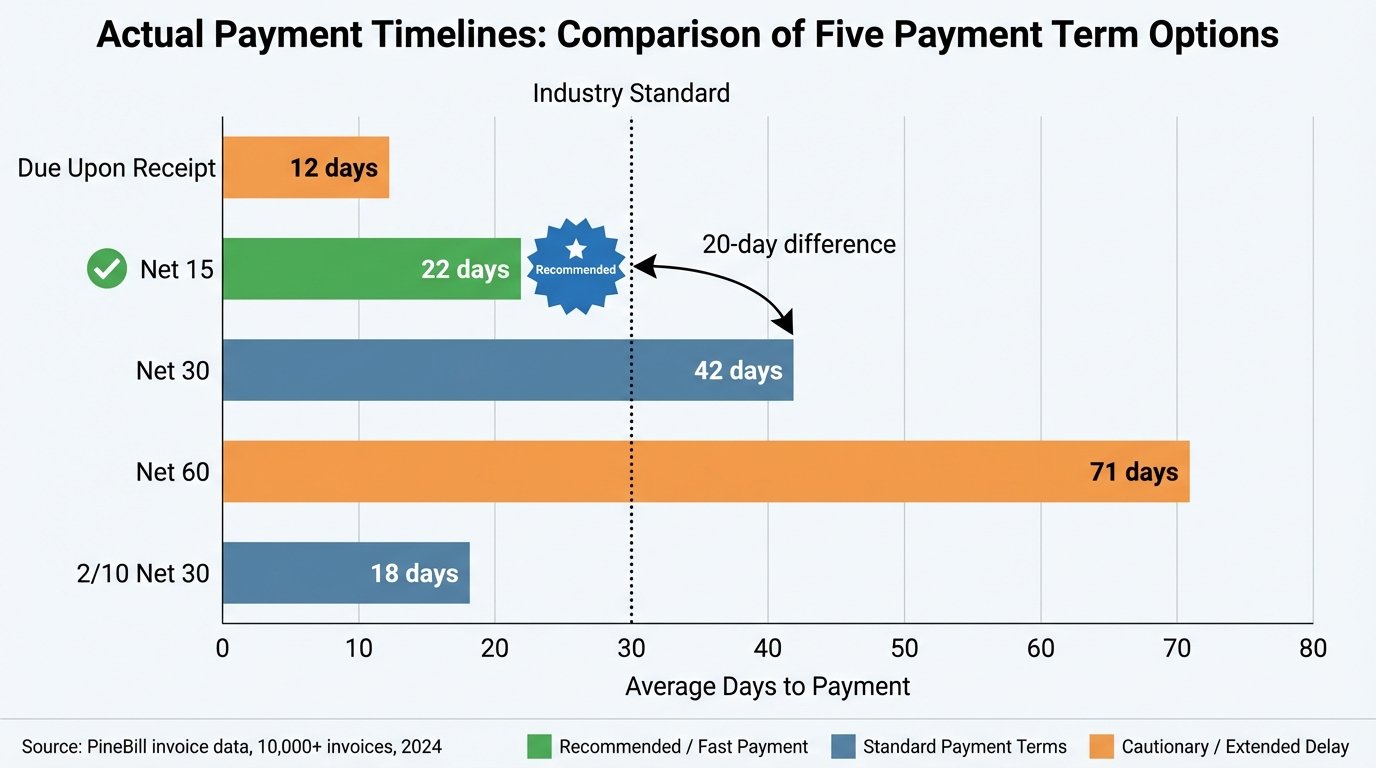

Here's what different payment terms mean for your actual cash collection timeline, based on data from 10,000+ invoices:

| Payment Terms | Average Days to Payment | Best For | Cash Flow Impact |

|---|---|---|---|

| Due Upon Receipt | 12 days | Small transactions, new clients | Fastest cash, but may annoy clients |

| Net 15 | 22 days | Service businesses, projects under $10k | Recommended for most small businesses |

| Net 30 | 42 days | Established B2B relationships | Industry standard, slower cash |

| Net 60 | 71 days | Large contracts, government | Slowest option—only if required |

| 2/10 Net 30 | 18 days (68% take discount) | Cash-strapped businesses | Fast payment, but costs 2% |

Source: PineBill invoice payment data, January-November 2024

The gap between Net 15 and Net 30 is 20 days—that's nearly three weeks of additional cash flow delay. For a $5,000 monthly revenue business, switching from Net 30 to Net 15 terms frees up an extra $3,333 in working capital.

What Makes Payment Terms Legally Enforceable?

Payment terms aren't legally binding unless your invoice meets these requirements:

1. Client acknowledgment: The client must see and accept the terms before or when services are rendered. Best practice: include payment terms in your service contract, then reference them on each invoice.

2. State-compliant late fees: Maximum late fees vary by state. Most states cap them at 18% annually (1.5% monthly), but some allow higher. Florida permits up to 18%, California varies by contract type, and Texas allows "reasonable" fees. Check your state's usury laws.

3. Clear late fee language: Specify when late fees start ("beginning day 16" not "after 15 days") and how they're calculated (percentage of balance vs. flat fee). Ambiguous terms won't hold up in court.

4. Reasonable terms: A court won't enforce "due in 3 days" for a $50,000 invoice sent to a corporate client. Terms must align with industry standards and the nature of the transaction.

5. Dispute window: Include a timeframe for clients to dispute charges (typically 7-15 days). This shows good faith and prevents clients from claiming they never had a chance to object.

You don't need a lawyer to draft payment terms for standard services—but if you're creating custom contracts over $100,000 or operating in regulated industries (construction, healthcare), get legal review.

How to Add Payment Terms to Your Invoices

Most businesses include payment terms in three places:

On the invoice itself: Add a "Payment Terms" section below the line items, before the total. This is your primary enforcement documentation.

In your service agreement: Reference your standard payment terms in contracts. Example: "Client agrees to PineBill's standard Net 30 payment terms as detailed on each invoice."

In follow-up communications: When sending payment reminders, quote the specific terms from the original invoice. This reinforces that payment is overdue based on agreed-upon language, not your arbitrary demand.

Tools like PineBill can automatically populate payment terms on every invoice based on client type, preventing the mistake of forgetting to include them. (Invoices missing payment terms get paid 35% slower than those with clear terms—that's an expensive oversight.)

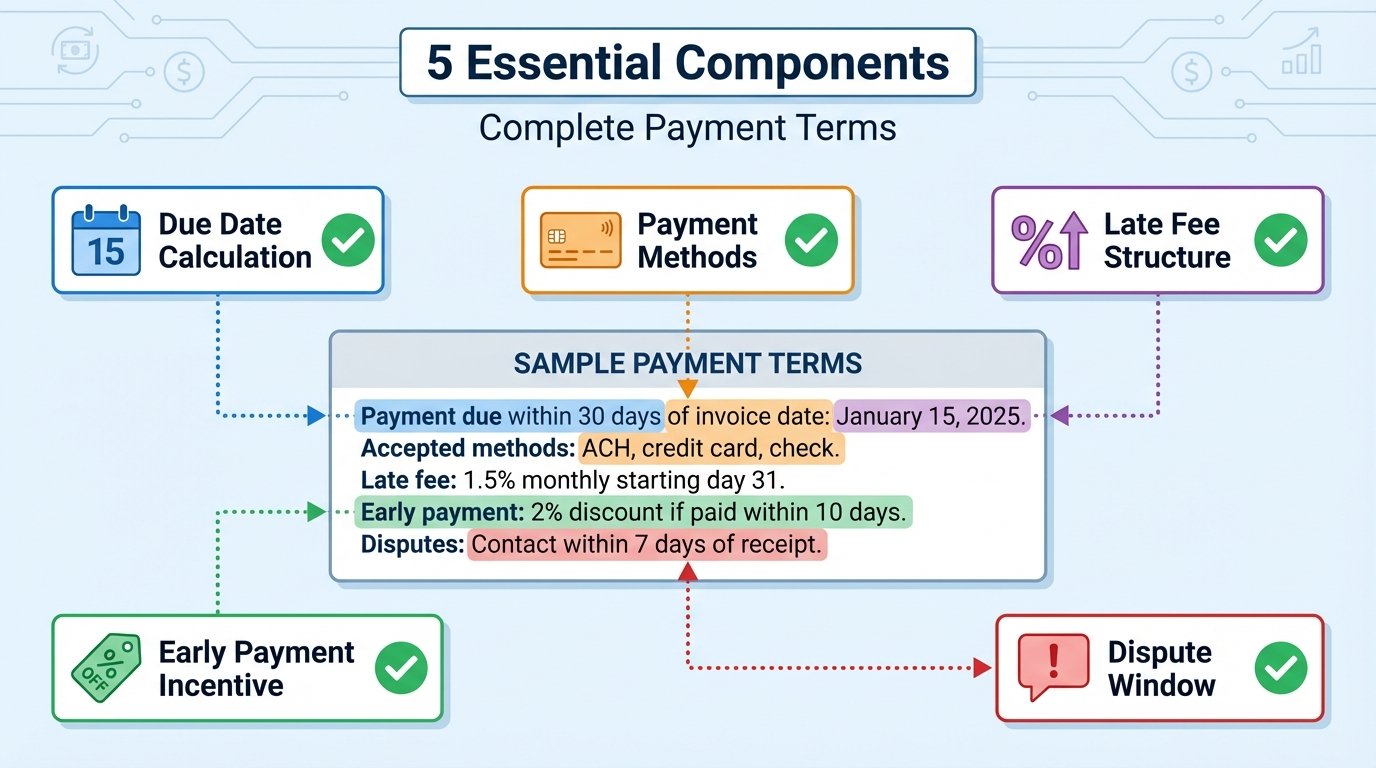

Key Takeaways

-

Net 15 terms get you paid 20 days faster than Net 30—use them for service businesses and projects under $10,000 unless clients specifically require longer terms.

-

Include four elements in every payment terms section—due date calculation, accepted payment methods, late fee structure, and dispute window.

-

Early payment discounts cost 36.5% annually (for 2/10 Net 30)—expensive, but cheaper than invoice factoring or business loans if you need immediate cash.

-

50% deposits protect you on custom projects—you'll at least cover costs if clients cancel or refuse final payment.

-

Late fees must comply with state usury laws—most states cap them at 18% annually, but verify your local regulations before setting rates.

-

Vague language kills enforceability—specify exact dates, calculation methods, and payment instructions to avoid disputes.