Open Invoice Management: Definitions and Cash Flow Strategy

87% of businesses are paid past their original due date (Chaser, 2022). Every unpaid document becomes an open invoice, representing revenue that's earned but legally unavailable for use. This guide details the lifecycle of an open invoice and provides metrics to convert these receivables into liquid capital.

The Lifecycle of an Open Invoice

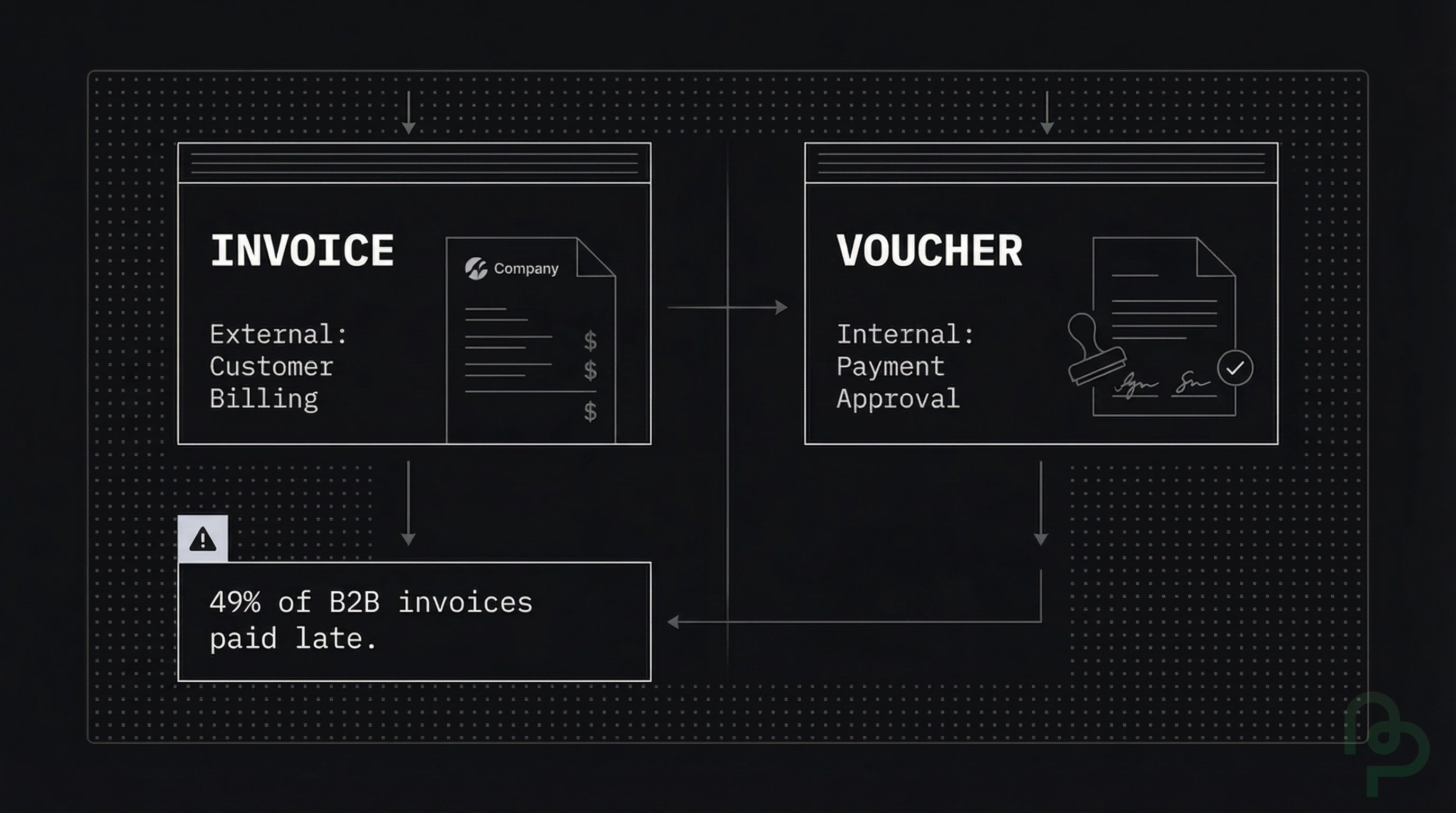

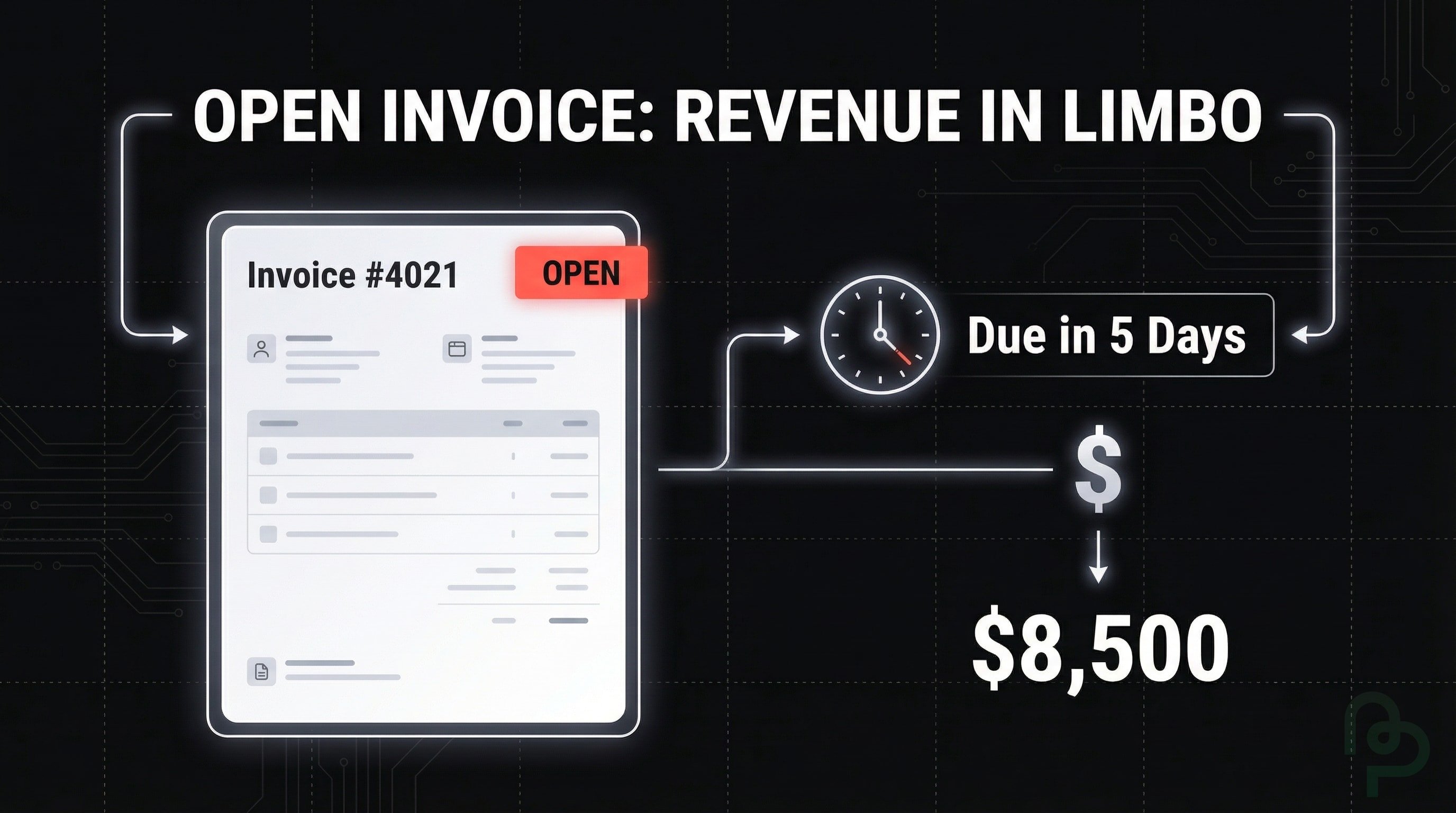

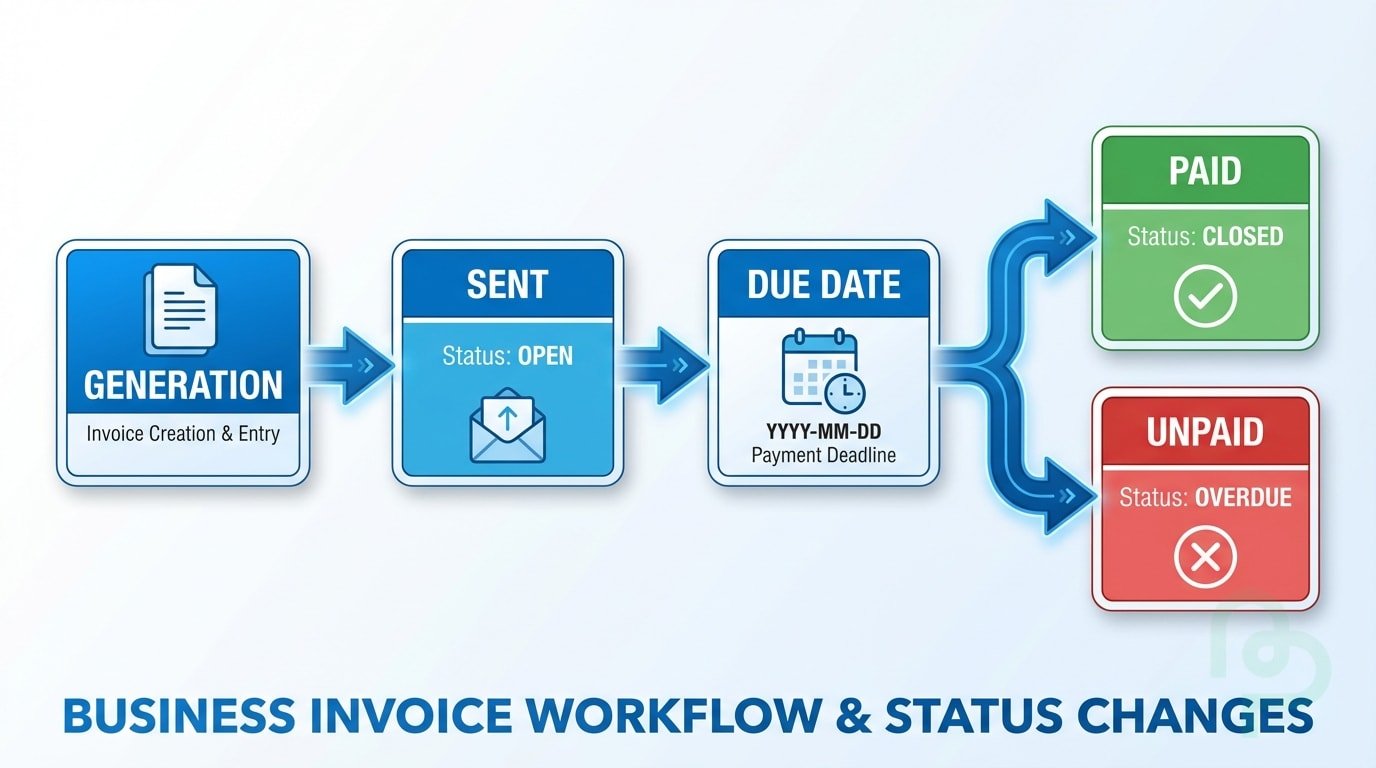

An open invoice is any bill issued to a client that hasn't been paid in full yet. It's an asset on your balance sheet under Accounts Receivable, even if the funds aren't in your bank account. Technically, all invoices start as "open" the moment you send them to a customer.

The document stays open until the customer finishes the transaction or you write it off as bad debt. If a client owes you $5,000 but only pays $2,500, that invoice remains open for the remaining balance. Tools like PineBill track these partial payments automatically to ensure your ledger stays accurate.

| Invoice Status | Payment Deadline | Internal Impact |

|---|---|---|

| Open | Before or on Due Date | Projected Cash Flow |

| Overdue | Past Due Date | Liquid Crisis Risk |

| Closed | Transaction Complete | Realized Revenue |

| Written Off | Non-collectible | Asset Loss |

Source: Tipalti, 2024

Financial Risks of Unpaid Documents

More than half of business owners spend over four hours every week specifically chasing late payments (Chaser, 2022). That's time you won't get back for business development or project execution. When open invoices pile up, your business faces significant liquidity risks.

Manual invoice processing costs an estimated $12 to $15 per document due to data entry and human error (Tipalti, 2024). If you're managing 50 open invoices, you're potentially losing over $600 in administrative overhead alone. Platforms like PineBill reduce this cost by automating the tracking and reconciliation process.

Strategies to Close Invoices Faster

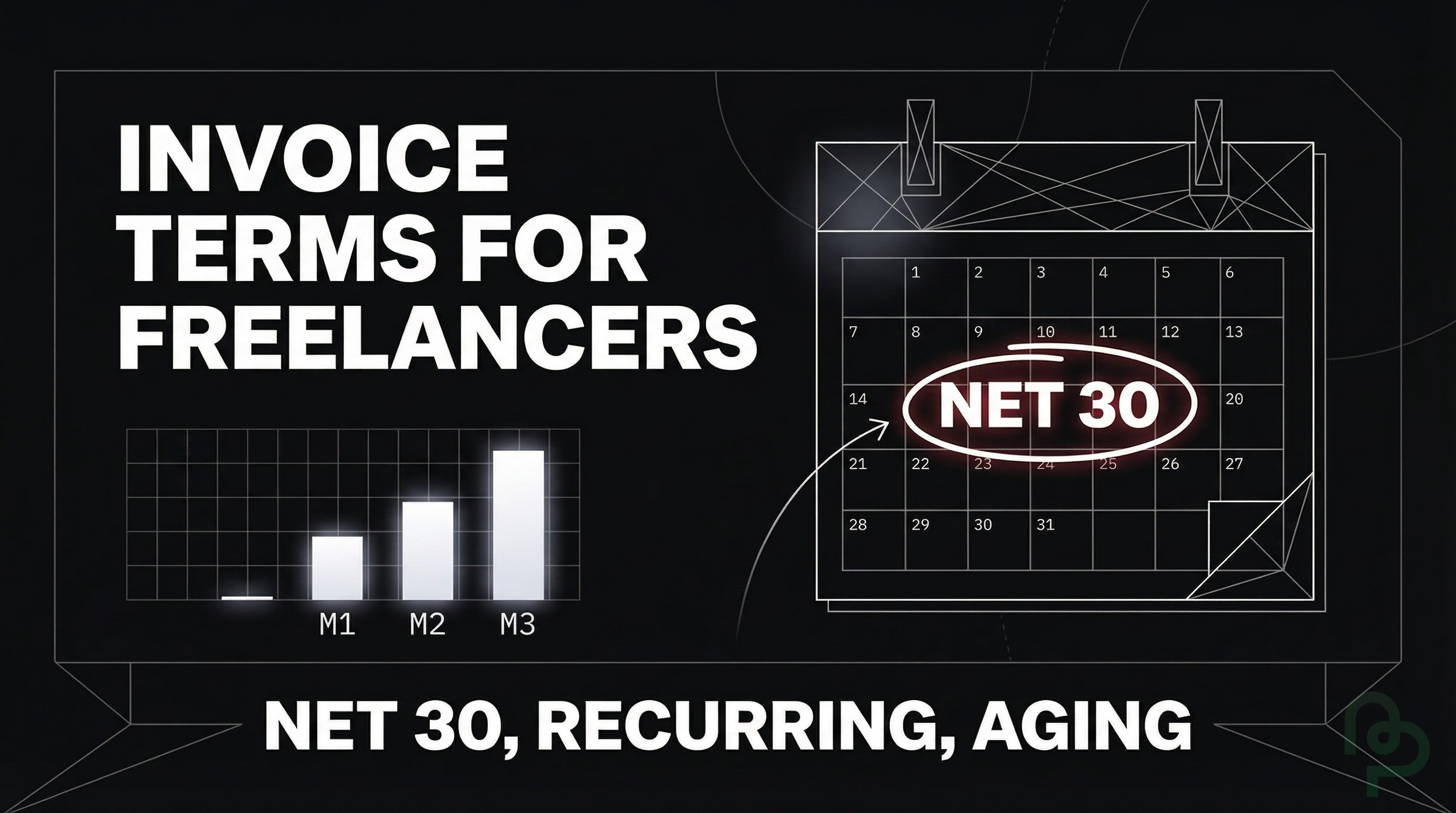

Closing an invoice requires moving it from your aging report to your cleared bank feed. You don't have to wait for the client to remember—proactive systems change behavior. Using clear terms like "Net 15" or "Due on Receipt" helps set expectations early.

Consider offering a 2% discount if a $8,500 invoice is paid within ten days. While it's a small hit to your margin, it's often cheaper than the cost of a business line of credit. Integrating PineBill with your bank feeds identifies matching transactions instantly, so you'll know exactly when an open status becomes closed.

Key Takeaways

- Open Status Defintion—An invoice stays open until the balance reaches zero or is officially written off.

- Tracking Cost—Chasing unpaid bills costs businesses up to 4+ hours of administrative time weekly.

- Partial Payments—Partial payments keep an invoice open even if some cash has been received.

- Status Verification—Automated reconciliation reduces the $15-per-invoice cost of manual processing.

- Aging Reports—Categorizing open invoices by age helps prioritize collection efforts.