Accounts Payable vs Accounts Receivable: Tracking Cash Flow

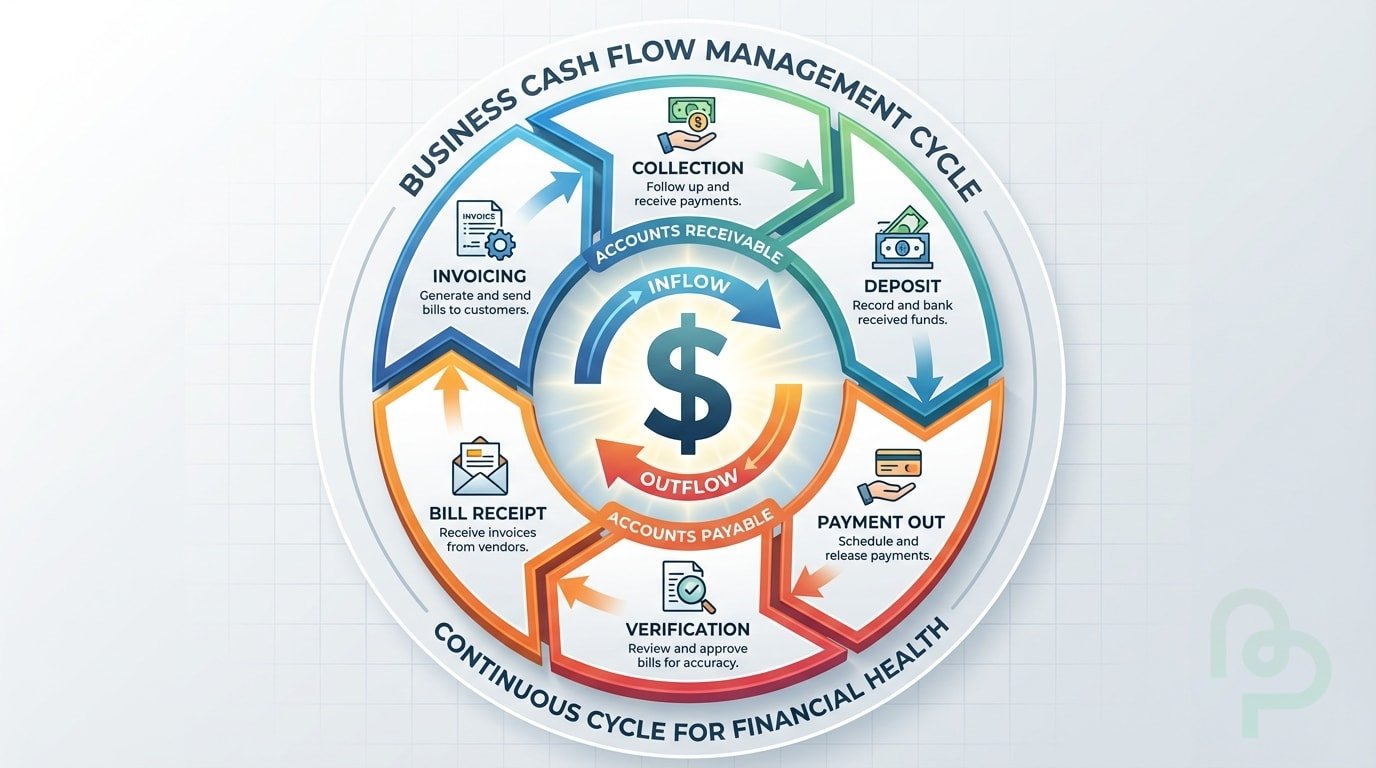

Accounts receivable (AR) represents money your customers owe you, while accounts payable (AP) is money you owe to vendors and suppliers (PayPal, 2025). AR is a current asset; AP is a current liability. Managing this balance prevents the cash flow gaps that cause 82% of small business failures (U.S. Bank, 2023). This guide shows you exactly how to track both categories to maintain solvency.

Assets vs. Liabilities

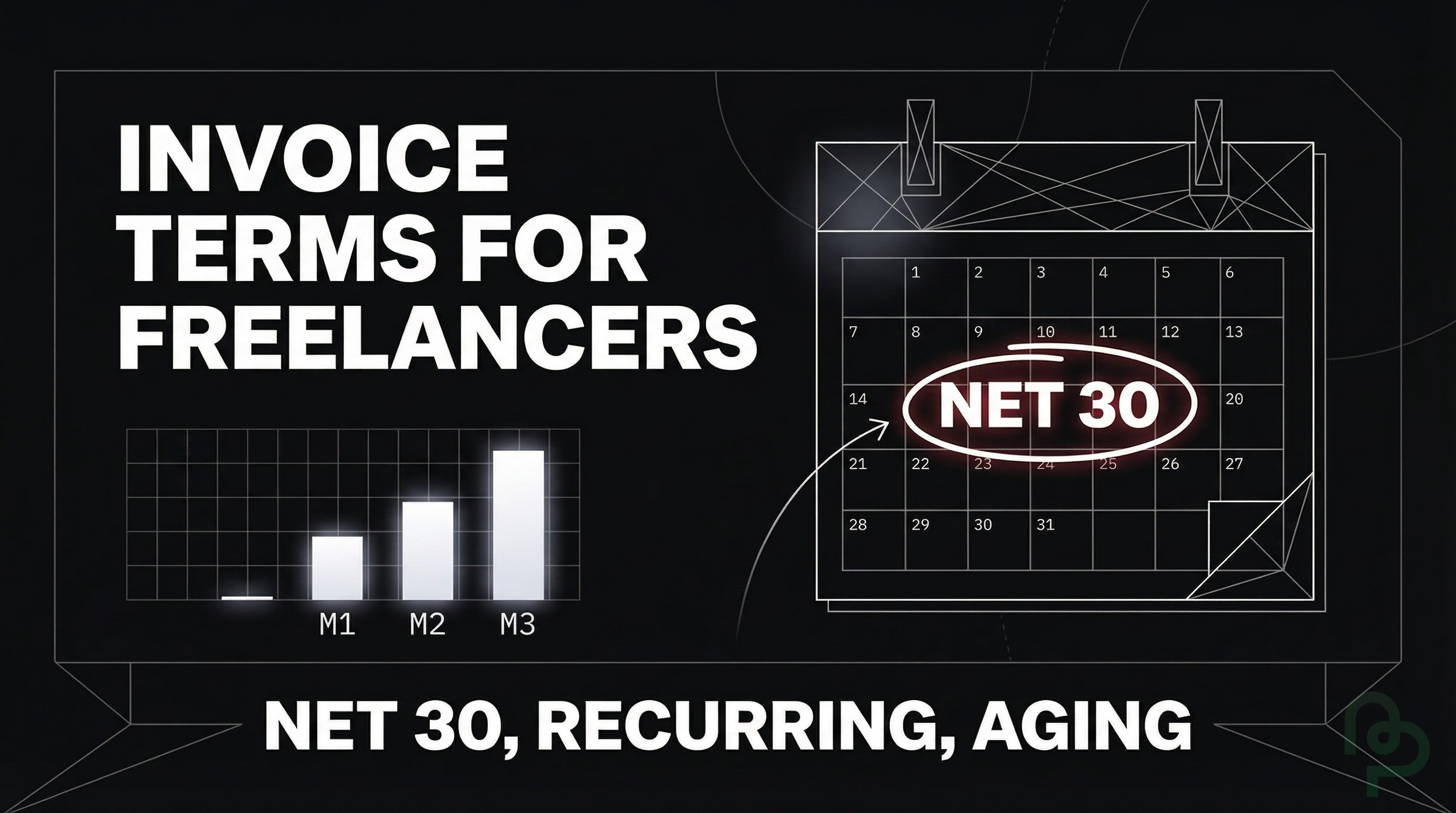

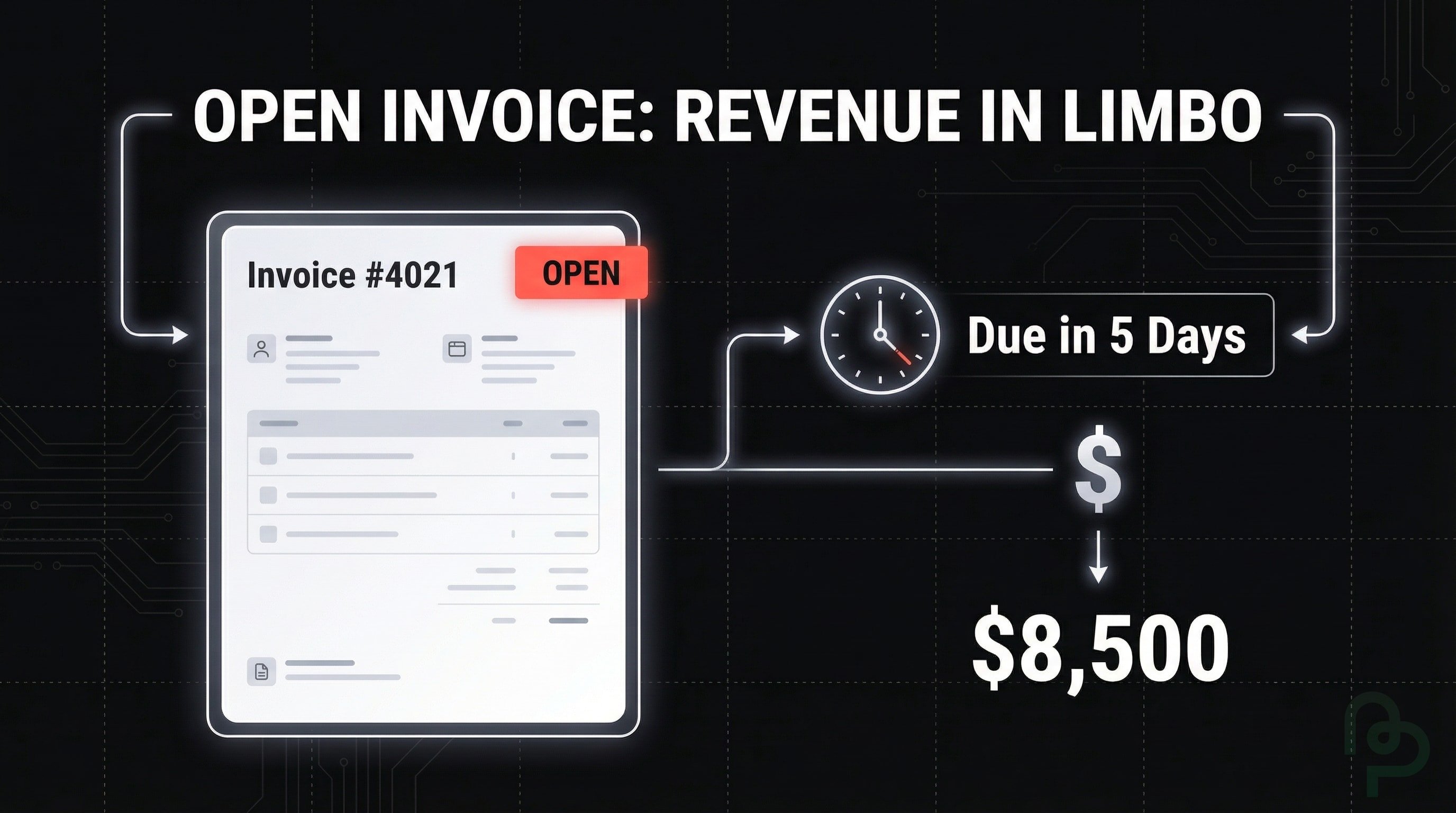

Your accounts receivable balance includes all issued invoices awaiting customer payment. For example, if you finish a $5,000 project and send an invoice with net-30 terms, that amount is an asset on your books. Accurate AR tracking ensures you don't leave cash on the table through forgotten follow-ups.

Accounts payable tracks your outstanding bills for goods or services received on credit. When you order $150,000 in inventory but haven't paid the supplier, you've incurred a liability. Timing these payments strategically allows you to keep cash in your account longer without incurring late fees.

Systems like PineBill organize your AR aging reports so you can see exactly who owes you money at a glance. Without automation, you'll likely spend hours manually reconciling bank deposits against open invoices. Using software ensures your ledger reflects real-time totals instead of month-old data.

| Feature | Accounts Payable (AP) | Accounts Receivable (AR) |

|---|---|---|

| Classification | Current Liability | Current Asset |

| Flow Direction | Cash Outflow | Cash Inflow |

| Involved Parties | Vendors and Suppliers | Customers and Clients |

| Ledger Impact | Credit Balance (Normal) | Debit Balance (Normal) |

Source: PayPal, 2025

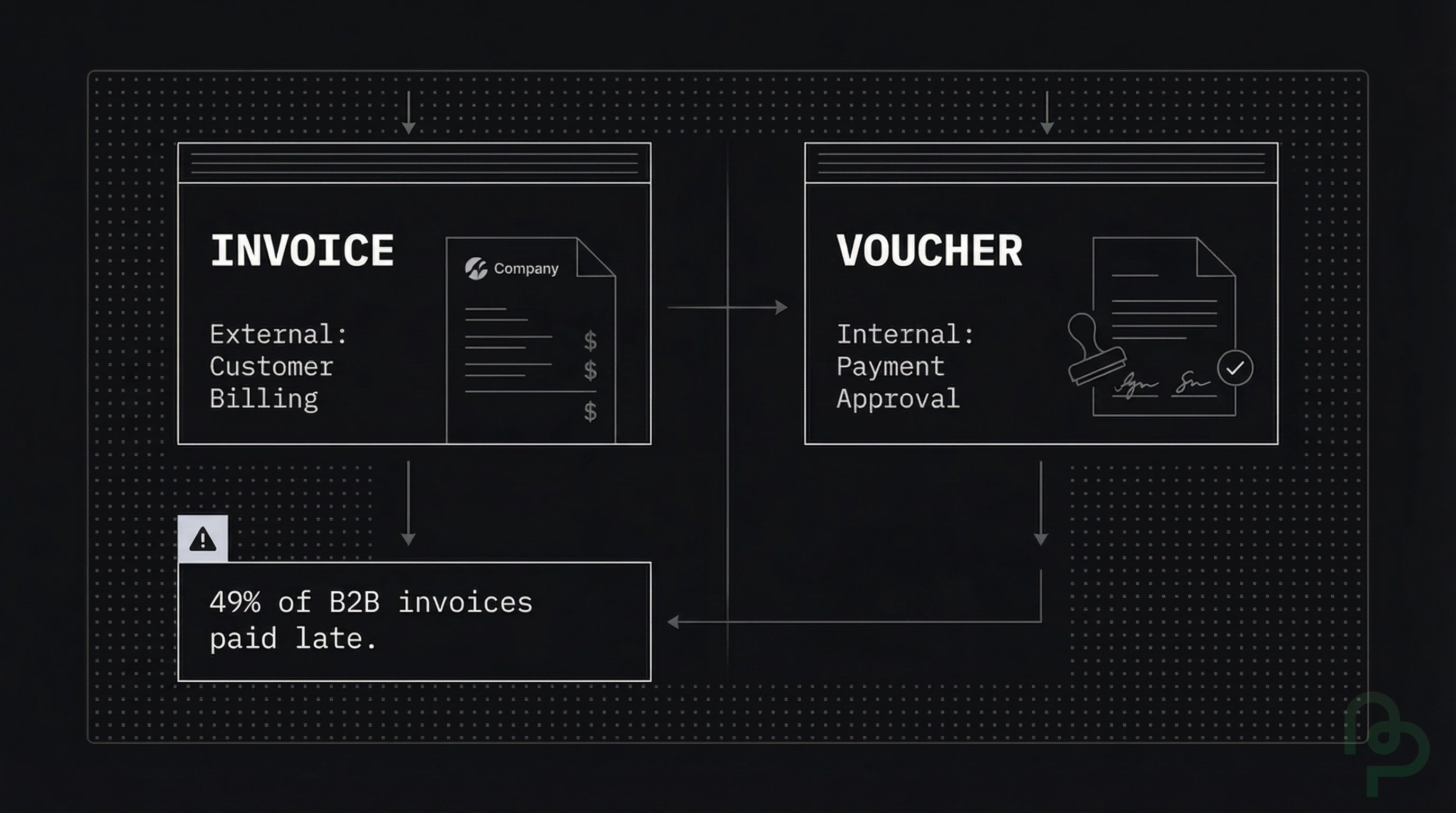

Internal Controls and Fraud Prevention

Separating the duties of AP and AR is a fundamental accounting principle to prevent errors and theft. Approximately 20% of examined business fraud cases originate from billing improprieties (ACFE, 2022). If one person handles both invoicing and bill payments, it's easier to hide unauthorized transactions.

Large organizations typically have separate departments for each function. Small operations can use software like PineBill to create audit trails that track who created an invoice and who marked it as paid. This transparency reduces the risk of duplicate payments that drain your capital.

Optimizing Your Cash Conversion Cycle

Accelerating your AR process is the fastest way to increase your available liquidity. You can offer a 2% discount for payments made within 10 days to incentivize early settlement. Digital tools like PineBill send automated reminders for $5,000 invoices, reducing the need for manual "chasing" phone calls.

Strategic AP management involves taking advantage of the full payment term provided by vendors. Don't pay a net-30 invoice on day one if you have high-interest debt to service first. You'll want to balance early-payment discounts from suppliers against your need for cash reserves during slow months.

Key Takeaways

- Manage AR as an asset—unpaid invoices are legally obligated funds you can use as collateral.

- Treat AP as a liability—it represents short-term debt that must be settled to maintain vendor trust.

- Segregate duties—ensure the person issuing checks isn't the same person recording incoming payments.

- Automate follow-ups—systems reduce the time spent on collection by up to 50%.