Year to Date (YTD): Meaning, Formula & Calculation Guide

Year-to-date (YTD) measures progress from the first day of the current calendar or fiscal year to the present day. This guide shows you the exact formulas needed to track revenue, payroll, and investment returns accurately.

Calendar vs. Fiscal YTD

You'll likely use a calendar year, which runs from January 1 to December 31. Many retailers or government entities use a fiscal year instead, such as July 1 to June 30, to match natural business cycles (Bill.com, 2025).

Tools like PineBill generate YTD reports automatically based on your preferred reporting period. If you don't specify a fiscal year, most banks and tax authorities assume you're using the standard calendar year starting January 1st. Confusing these dates can lead to overdraft errors, which cost businesses $35 per incident (CFPB, 2024).

The Standard YTD Formula

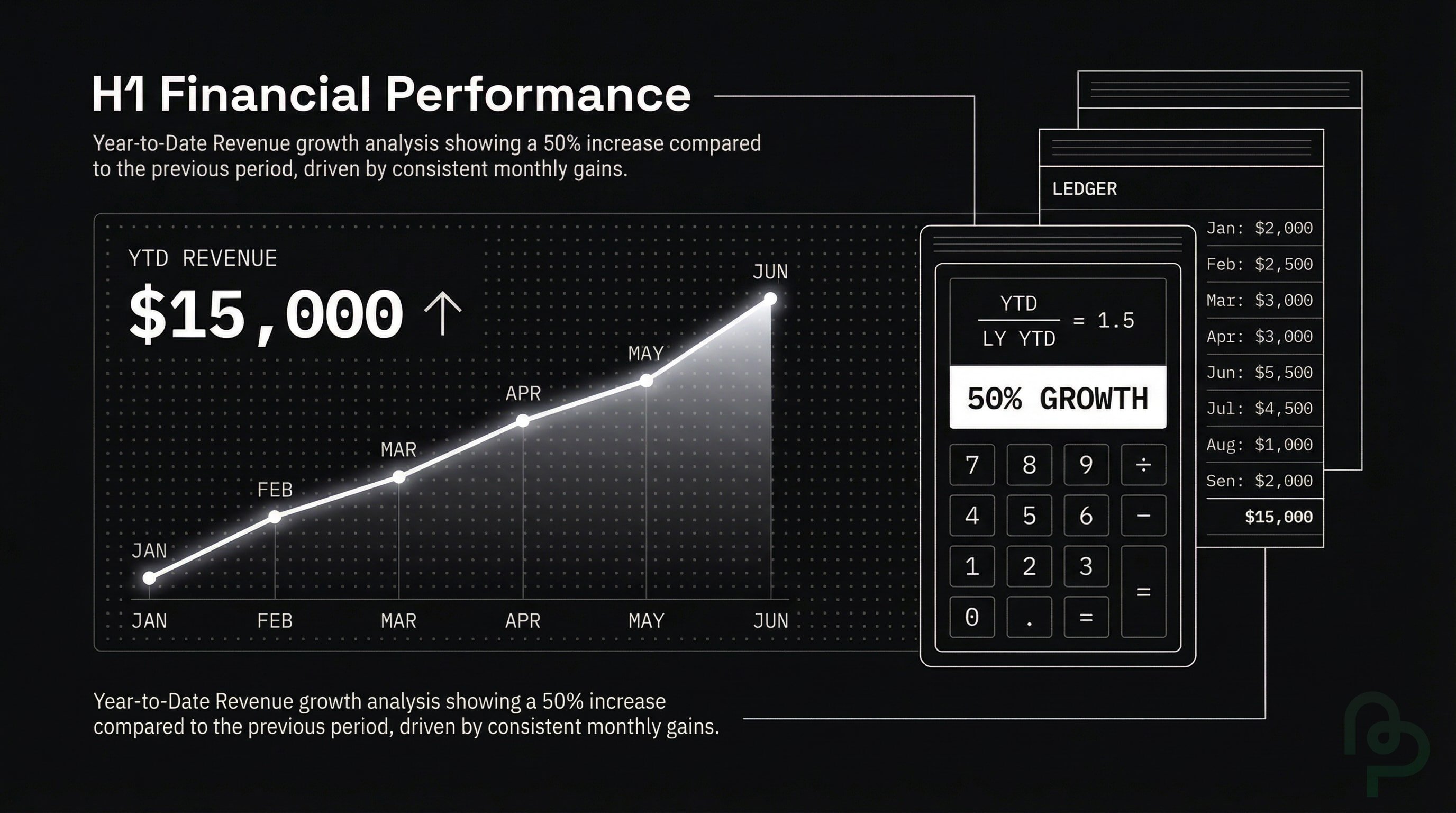

Calculating your business growth requires a simple percentage formula. It's the most effective way to see if you're hitting your annual revenue targets.

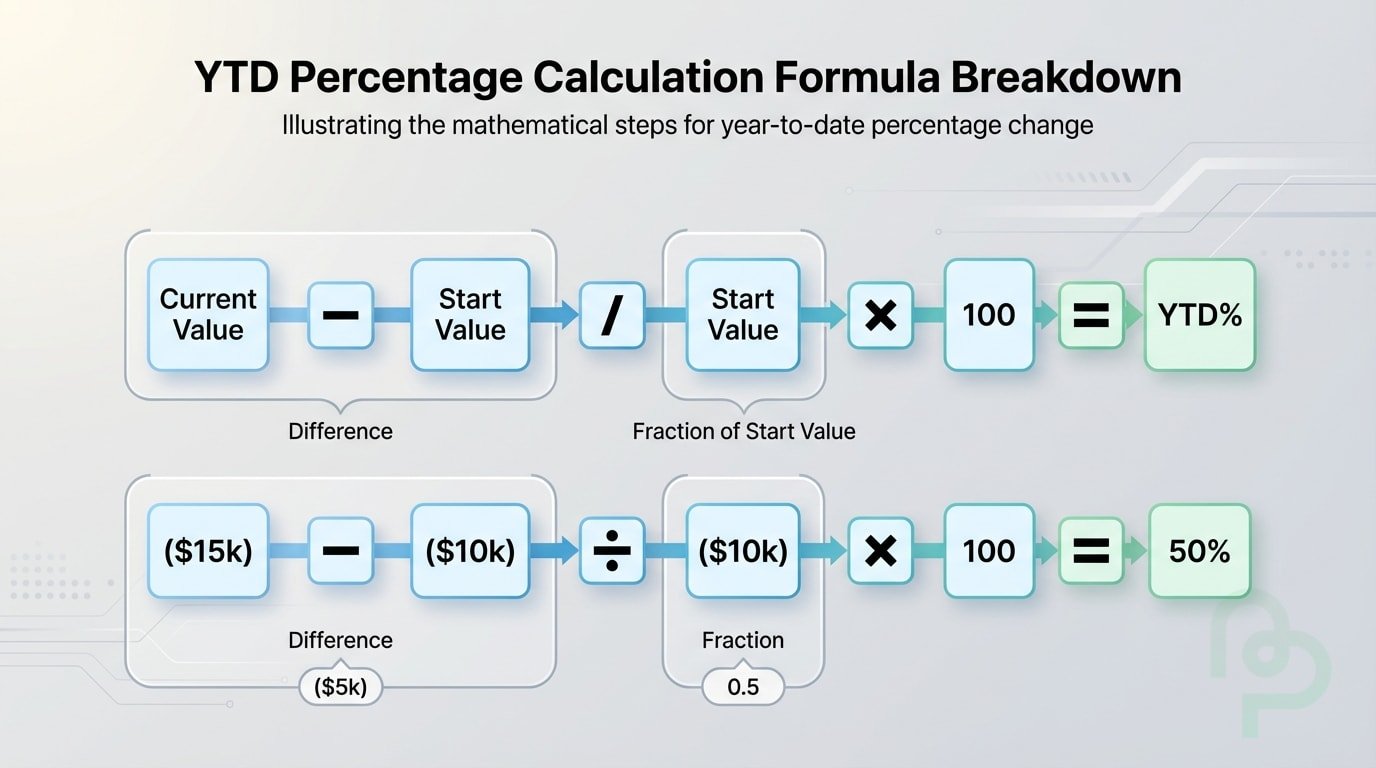

Percentage YTD Formula:

[(Current Value – Beginning Value) / Beginning Value] x 100

For example, if your business revenue was $10,000 on January 1st and grew to $15,000 by June 30th, the calculation would be:

($15,000 - $10,000) / $10,000 = 0.5.

Multiplying by 100 gives you a 50% YTD growth rate.

Comparing Tracking Metrics

| Metric | Start Date | Best Use Cases |

|---|---|---|

| MTD (Month to Date) | 1st day of current month | Tracking short-term marketing campaigns. |

| YTD (Year to Date) | 1st day of fiscal/calendar year | Measuring progress toward an annual budget. |

| YoY (Year over Year) | Same date in the prior year | Comparing growth against past seasonal trends. |

Source: Investopedia, 2025

YTD in Payroll and Investments

Employees track YTD earnings on pay stubs to calculate their tax bracket placement. These figures represent gross pay before any 401(k) deductions or income tax payments are withheld (LegalClarity, 2025).

For individual retirement accounts, a typical 401(k) portfolio yields an average annual return of 5% to 8% (FreshBooks, 2022). If your YTD return is currently sitting at 2% by March, you're on track to meet those historical benchmarks. PineBill syncs bank feeds automatically, allowing you to monitor these cash flows without manual data entry.

Key Takeaways

- Use the start date—always verify if your YTD starts on January 1st or a specific fiscal date.

- Isolate your growth—apply the percentage formula to compare revenue across different years.

- Watch deductions—YTD net pay on a pay stub tells you exactly what you've kept after taxes.

- Monitor seasonal shifts—use MTD data to ensure seasonal slumps don't skew your annual forecast.

- Audit regularly—automated reports prevent overdraft fees, which average $35 per incident (CFPB, 2024).