Calculate Retained Earnings: Formula and Business Guide

Retained earnings refer to the cumulative portion of a business's net income that you keep for reinvestment rather than paying out as dividends to shareholders. Tracking this figure is vital because it represents your internal funding capacity for $8,000 project expansions or $5,000 equipment upgrades without relying on outside debt. This guide provides the exact formulas, a manual calculation example, and how automated tools help you monitor equity trends.

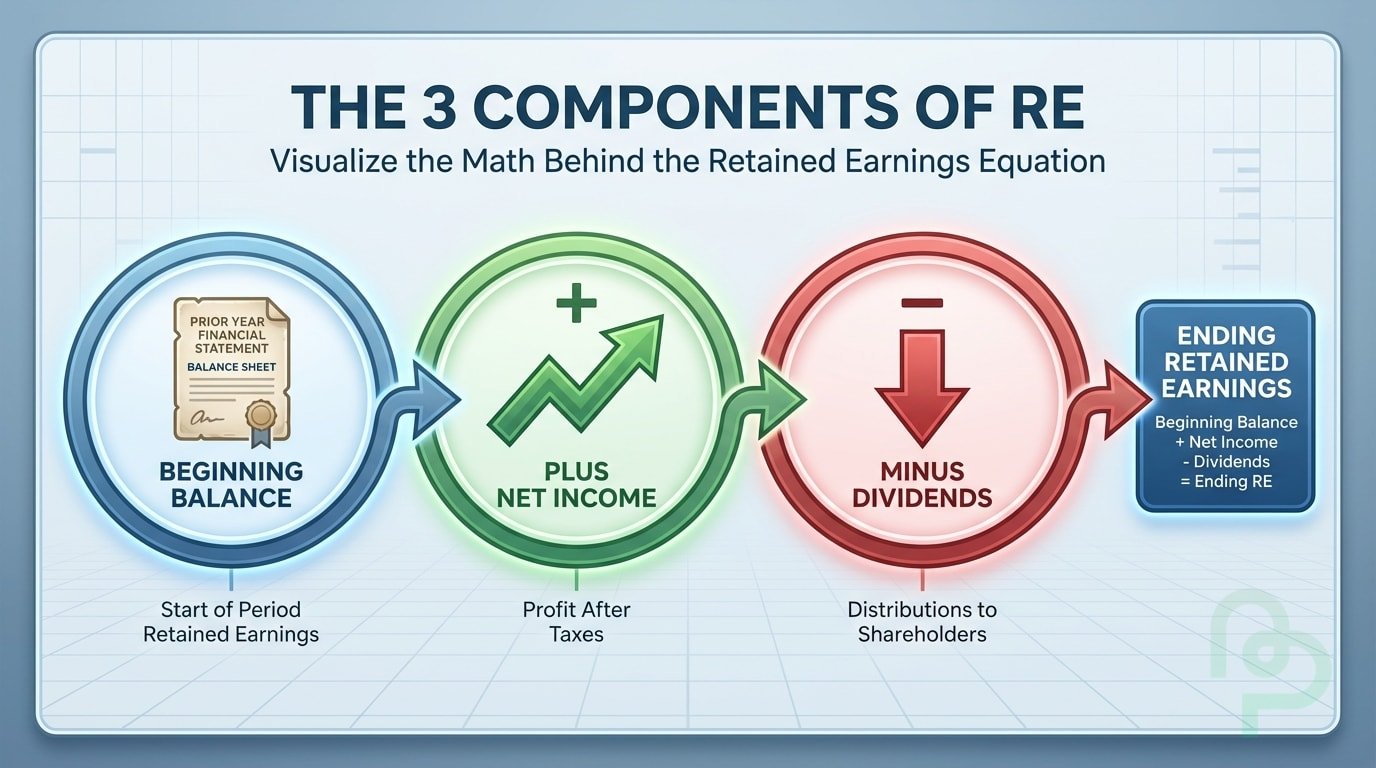

The Standard Retained Earnings Formula

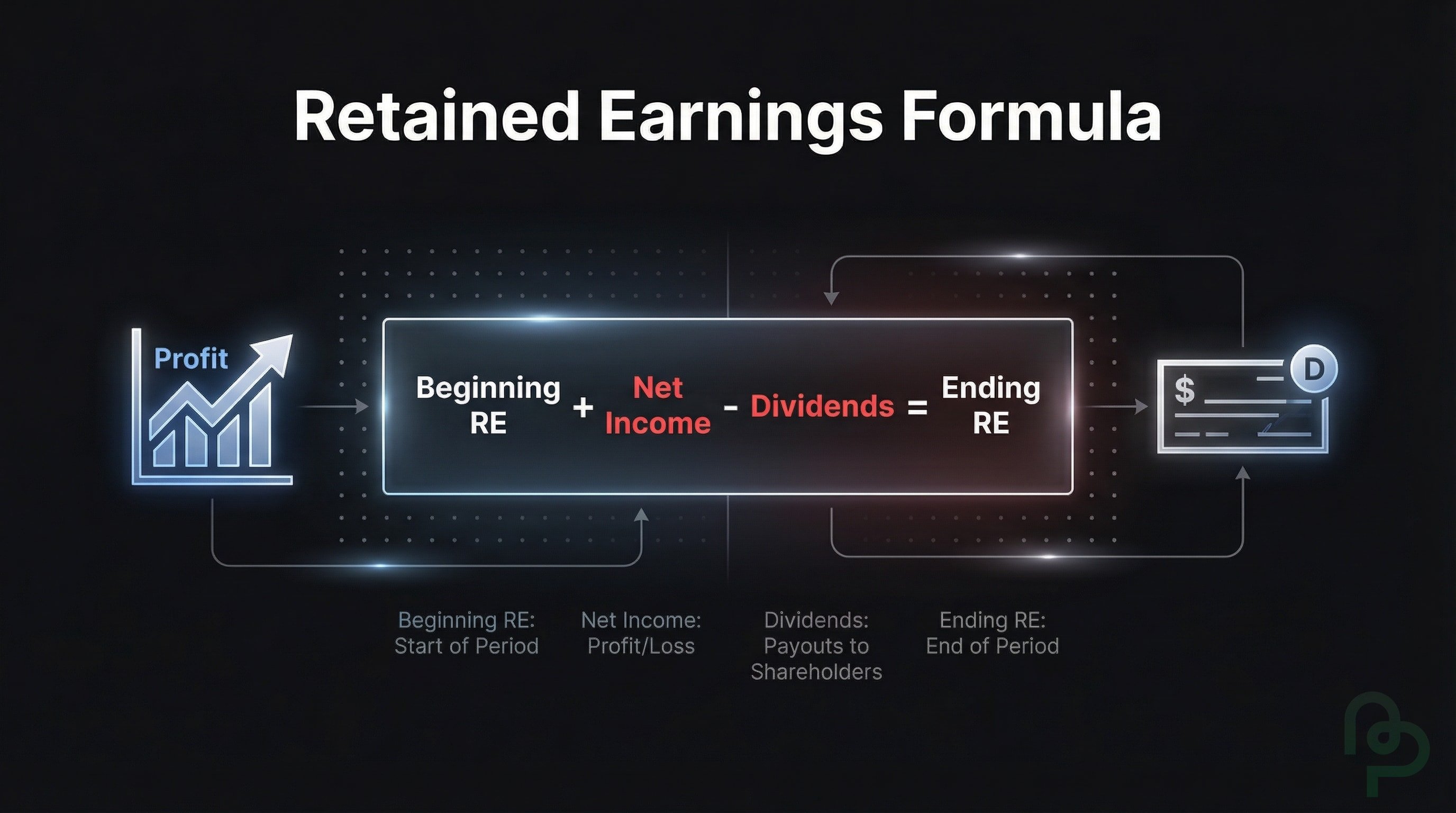

To find your balance for the current period, you'll need three specific numbers from your financial reports. Early-stage startups rarely pay dividends because every dollar is typically funneled back into operations (Stripe, 2025). If you're in your first year of business, your beginning balance is $0.

Use this equation at the end of your fiscal quarter or year:

Ending Retained Earnings = Beginning Retained Earnings + Net Income (or Loss) – Dividends

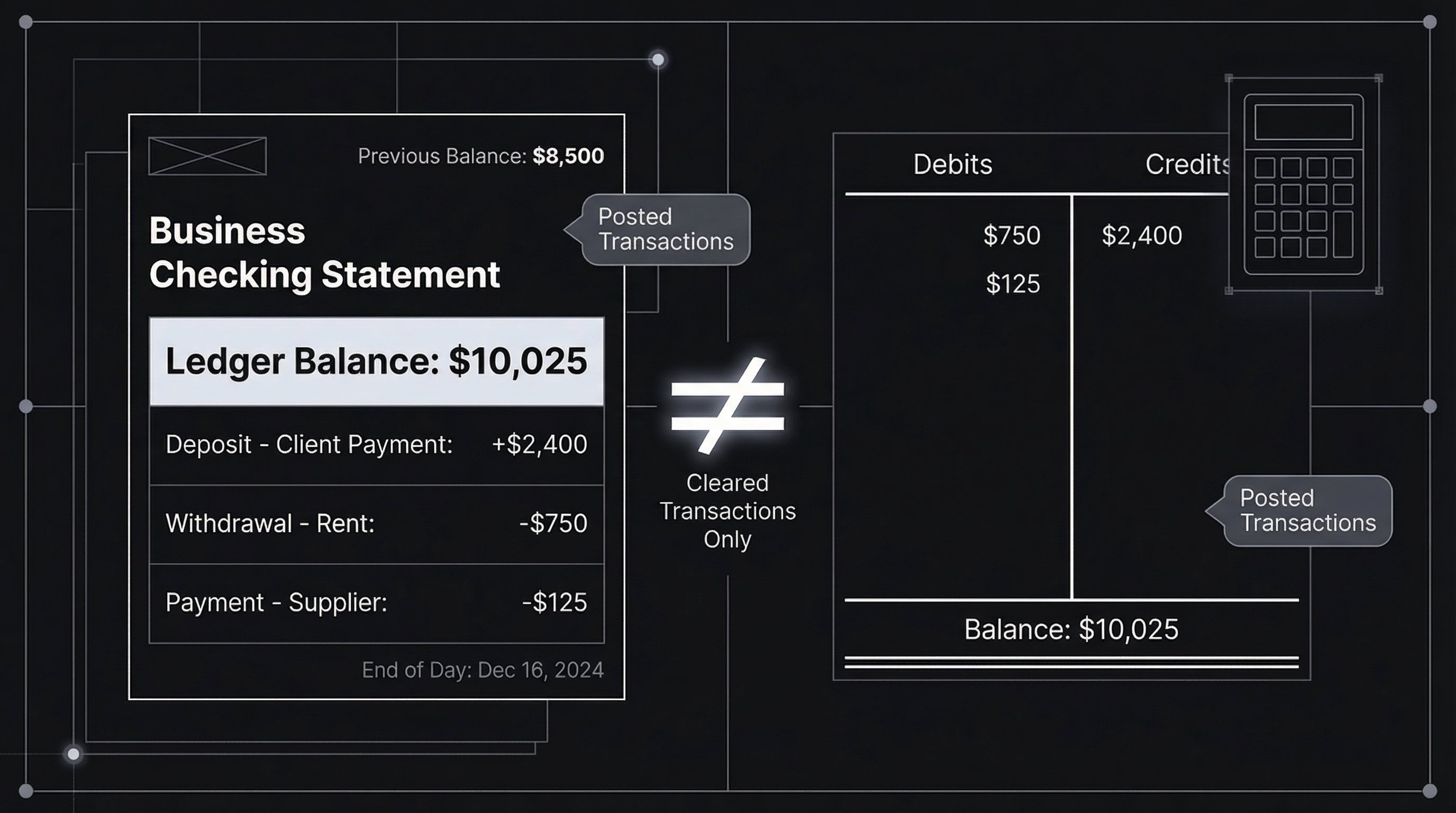

Net income flows directly from your income statement. If your firm records a net loss, you'll subtract that number instead of adding it. Tools like PineBill sync bank feeds automatically to help ensure your net income calculations remain accurate throughout the month.

How Retained Earnings Impact Growth

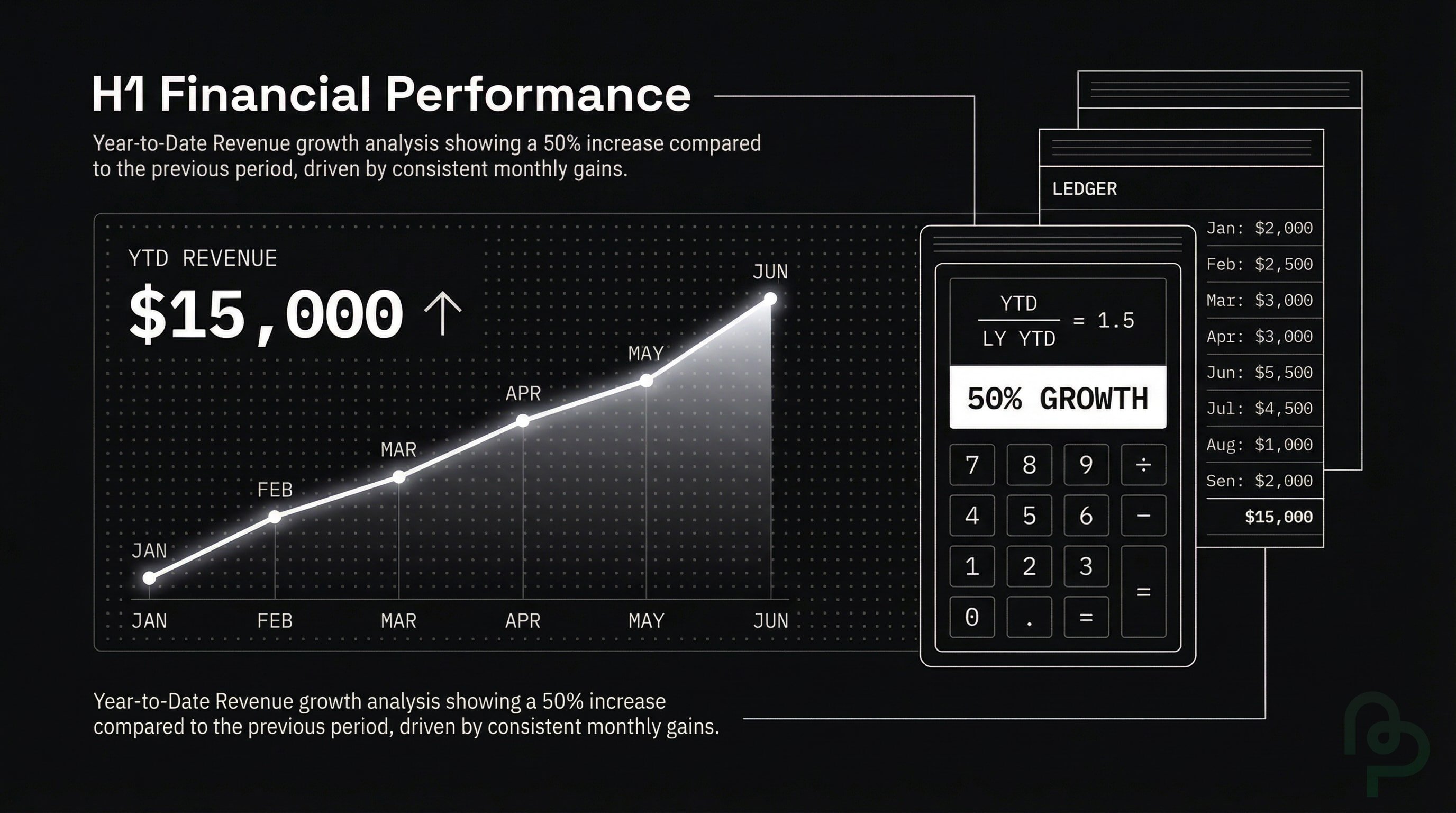

Retained earnings function as a financial cushion. Small businesses carry a median cash buffer of only 27 days (JPMorgan Chase, 2024). Keeping profits within the company improves your creditworthiness and lowers interest costs because you don't need to borrow for $10,000 inventory orders.

High-growth companies often show a rapidly increasing retained earnings balance. This signals to potential investors that the business is sustainable and capable of funding its own path forward (Workday, 2025).

| Feature | Manual Spreadsheet Tracking | Automated Invoicing Software |

|---|---|---|

| Update Frequency | Monthly or Quarterly | Real-time through bank sync |

| Risk of Error | High (Human data entry) | Low (Automated categorization) |

| Dividend Tracking | Requires manual ledger entries | Integrated equity reporting |

| Data Availability | Retrospective only | Forward-looking projections |

Source: Stripe, 2025

Step-by-Step Calculation Example

Imagine a software company scaling its platform. At the start of the year, its balance sheet shows $250,000 in retained earnings carried over from the previous year. During the fiscal year, they record a net income of $80,000 after all expenses.

Identify Beginning Balance: Locating the $250,000 from the prior year's equity section.

Add Net Profit: Add the current year's $80,000 net income to the starting balance ($330,000 total).

Subtract Dividends: If the company pays out $20,000 to early investors, subtract this amount.

Finalize Ending Balance: The new retained earnings figure is $310,000 (Workday, 2025).

Key Takeaways

- Internal Funding—Retained earnings allow you to buy $5,000 in equipment without taking a high-interest loan.

- Sustainability Metric—A growing balance shows investors your business generates more than it spends.

- Startup Baseline—New businesses start with a $0 balance until the first profitable period ends.

- Dividend Impact—Every dollar paid to shareholders reduces the pool of money available for reinvestment.

- Balance Sheet Location—You'll find this figure in the Shareholders' Equity section, bridging the income statement and the balance sheet.