What Is Ledger Balance? Definition & Calculation

A ledger balance is your bank account's official end-of-day balance that includes only cleared transactions—meaning that $3,000 check you deposited this morning won't appear until tomorrow. Mixing it up with your available balance causes 1 in 4 business overdrafts (CFPB 2024), costing $35 each time. Here's exactly what ledger balance means, how to calculate it in under 5 minutes, and why the difference from available balance matters for managing your business cash flow.

What Is Ledger Balance? The Core Definition

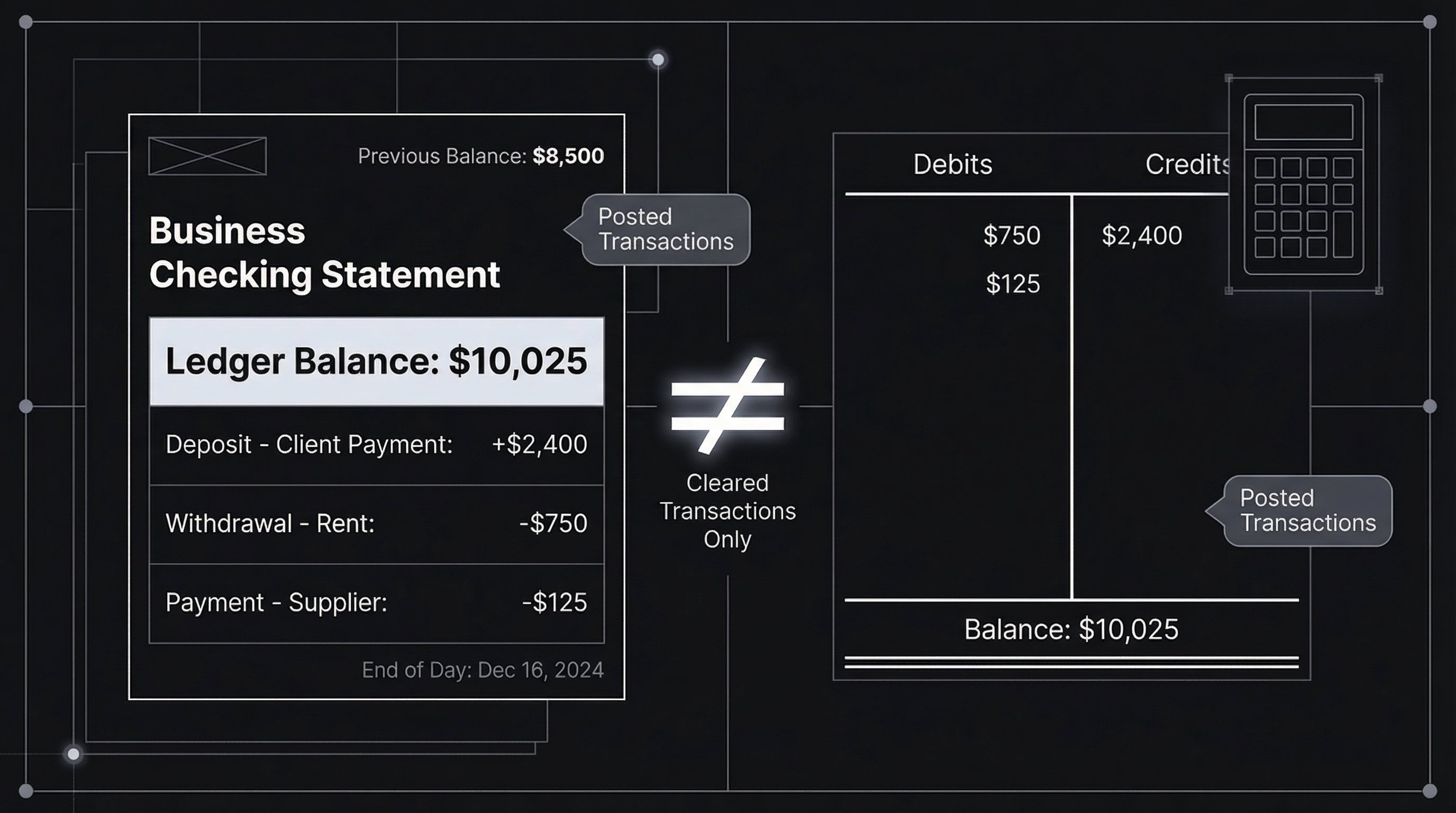

Your ledger balance represents the total funds in your bank account at the close of each business day after all transactions have been fully processed and posted. Banks calculate this balance during their nightly batch processing—typically between midnight and 2 AM—and it becomes your opening balance the next morning.

Here's the thing: your ledger balance doesn't update throughout the day. That $500 invoice payment you received at 2 PM? It's pending. The $1,200 supplier payment you authorized at 10 AM? Also pending. Neither affects your ledger balance until the bank processes them during tonight's batch cycle.

This balance appears on your official bank statements and serves as the foundation for reconciling your books. Financial institutions use it to determine whether you've met minimum balance requirements and to calculate monthly service fees.

What Gets Included:

- Cleared deposits (funds that have fully processed)

- Posted withdrawals (completed ATM withdrawals, cleared checks)

- Processed debit card transactions (not just authorized)

- Bank fees and charges already applied

- Wire transfers that have settled

What Gets Excluded:

- Pending deposits waiting to clear

- Authorized but unposted debit card purchases

- Checks you've written that haven't been cashed

- Holds placed on recent deposits

- Preauthorized transactions not yet processed

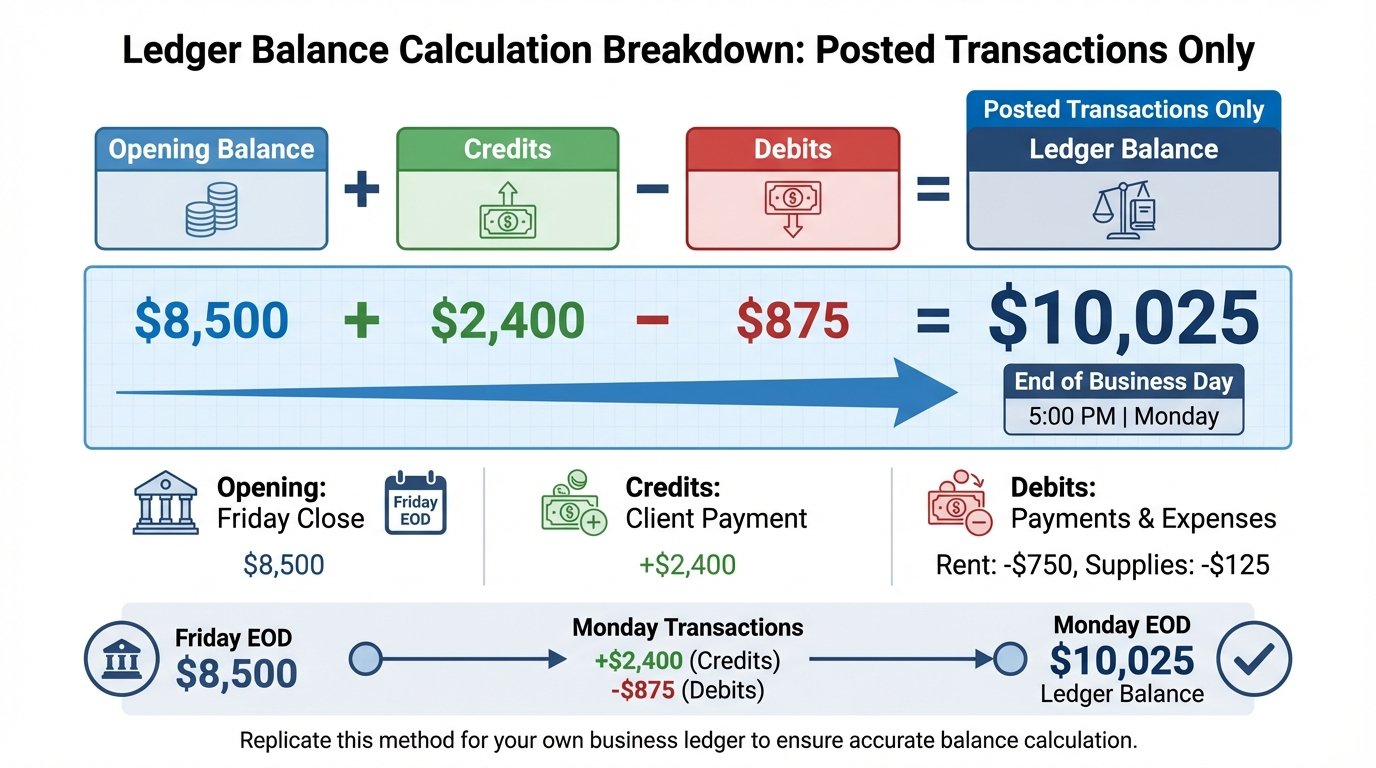

How to Calculate Your Ledger Balance in 3 Steps

You don't need to wait for tomorrow's bank statement to know your ledger balance. Calculate it yourself using this formula:

Ledger Balance = Opening Balance + Posted Credits - Posted Debits

Identify Your Opening Balance

Start with your ledger balance from the previous business day's close. This appears as your starting balance when you check your account first thing in the morning. For Monday, you'd use Friday's closing balance (banks don't process on weekends).

Example: Your Friday closing balance was $8,500.

Add All Posted Credits

Include only deposits and incoming payments that have fully cleared and posted to your account. Check your transaction history for items marked "posted" or "completed"—not "pending."

Example: A $2,400 client payment posted Monday morning.

Subtract All Posted Debits

Deduct withdrawals, payments, and fees that have been processed and posted. Again, only count completed transactions.

Example: A $750 rent payment and $125 in supplier payments posted Monday.

Calculation:

$8,500 (opening) + $2,400 (credits) - $875 (debits) = $10,025 ledger balance

This $10,025 becomes your official ledger balance for Monday and won't change until Tuesday's batch processing completes.

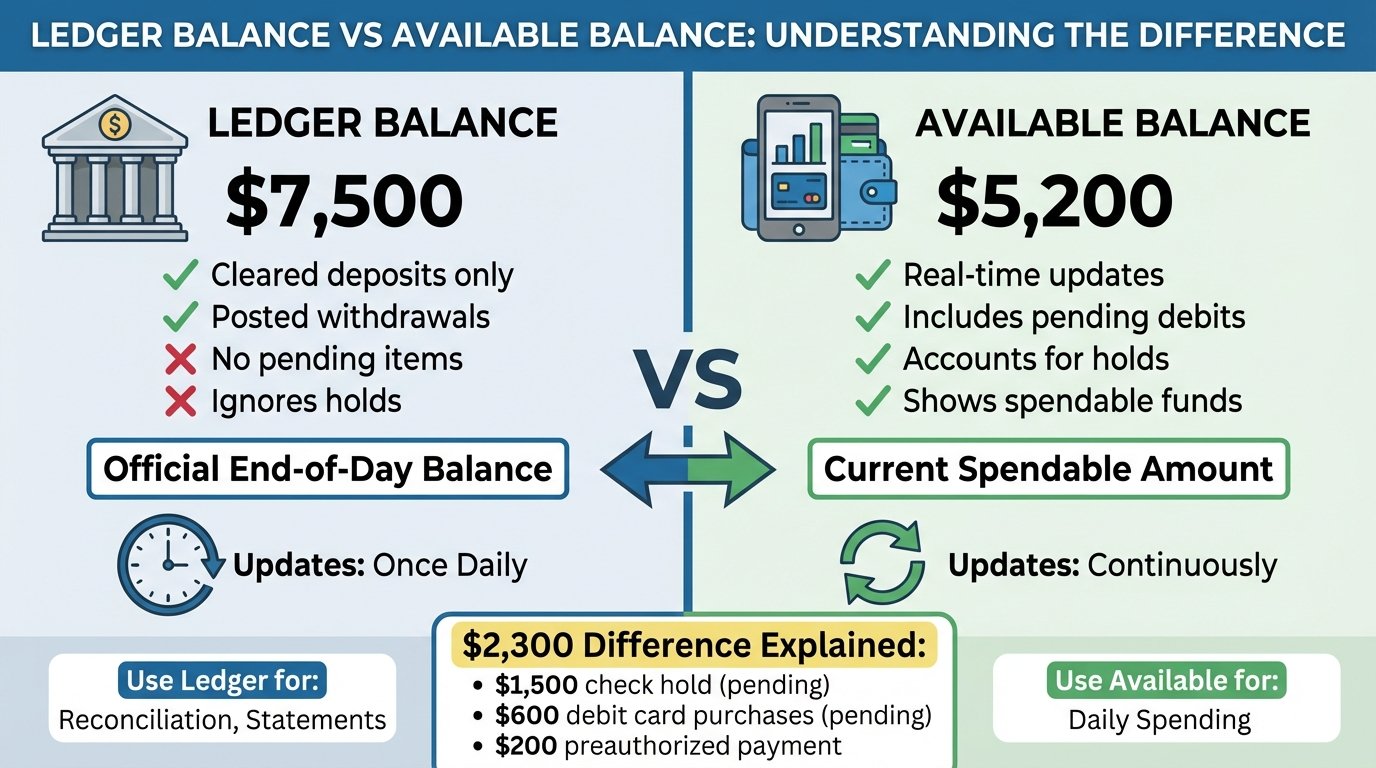

Ledger Balance vs. Available Balance: What's the Difference?

The confusion between these two balances costs businesses an average of $420 annually in overdraft fees (Bankrate 2024). They serve different purposes and update on completely different schedules.

| Feature | Ledger Balance | Available Balance |

|---|---|---|

| Updates | Once daily (end of business day) | Continuously in real-time |

| Includes Pending Items | No—cleared transactions only | Yes—factors in pending debits |

| Reflects Holds | No | Yes—subtracts held amounts |

| Used For | Official statements, reconciliation | Determining spendable funds |

| Changes During Day | Remains static | Fluctuates with each transaction |

| Best For Decisions | Long-term planning, bookkeeping | Immediate spending choices |

Real Scenario:

Your Monday morning ledger balance: $7,500

Your Monday morning available balance: $5,200

Why the $2,300 difference?

- $1,500 hold on Friday's deposited check (waiting to clear)

- $600 in pending debit card transactions from weekend

- $200 preauthorized payment not yet posted

You can't spend that $2,300 until those items clear, even though it appears in your ledger balance. The available balance protects you from overdrafting by showing what's truly accessible.

The reality: your ledger balance tells you what you had at yesterday's close. Your available balance tells you what you can spend right now.

Why Ledger Balance Matters for Your Business

Understanding your ledger balance isn't just bookkeeping housekeeping—it directly impacts your bottom line in three critical ways.

1. Accurate Financial Reconciliation

Your monthly bank statement shows ledger balances, not available balances. When reconciling your books, you're matching your accounting records against these end-of-day totals. A mismatch here means errors in your financial statements, which can trigger issues during audits or when applying for business loans.

Businesses that reconcile weekly catch 70% more errors than those reconciling monthly (Journal of Accountancy 2023). Those errors average $847 per occurrence in miscalculated cash flow.

2. Meeting Minimum Balance Requirements

Banks assess minimum balance requirements using your ledger balance—not available balance. If your business checking account requires a $5,000 minimum to avoid the $25 monthly fee, the bank checks your ledger balance at the end of each day.

Failing this requirement just 3 times per year costs you $75 in avoidable fees.

3. Preventing Cash Flow Miscalculations

Relying solely on available balance creates a false sense of funds. That $4,500 client payment showing in your available balance? If it hasn't posted to your ledger balance yet, it could be reversed if the check bounces or the ACH fails.

Smart cash flow planning uses ledger balance as the baseline and treats anything above it as tentative until confirmed (which typically takes 1-3 business days for most deposits).

When to Use Ledger Balance vs. Available Balance

Different financial decisions require different balances. Using the wrong one leads to bounced payments or missed opportunities.

Use Ledger Balance For:

-

Reconciling Bank Statements — Your accounting software should match the ledger balance shown on your monthly statement, not the available balance.

-

Financial Reporting — Profit and loss statements, balance sheets, and cash flow reports should reflect ledger balances for accuracy.

-

Tax Preparation — The IRS expects your records to match your official bank statements, which show ledger balances.

-

Year-End Accounting — Your December 31st ledger balance determines your ending cash position for annual reports.

Use Available Balance For:

-

Daily Spending Decisions — Before authorizing a $3,200 equipment purchase, check available balance to ensure funds are truly accessible.

-

Payroll Processing — Verify your available balance can cover the $12,500 payroll run scheduled for Friday, accounting for pending transactions.

-

Emergency Expenses — When your supplier needs immediate payment, available balance shows what you can actually wire today.

-

Avoiding Overdrafts — Your available balance accounts for pending debits that haven't hit your ledger balance yet.

Quick Decision Framework:

- Need to spend money today? Check available balance.

- Reconciling your books? Use ledger balance.

- Planning next week's expenses? Use ledger balance plus known pending items.

- Making an immediate payment? Available balance is your limit.

How to Reconcile Your Ledger Balance (Avoid Costly Errors)

Reconciliation catches discrepancies before they compound into major problems. This process takes 15-20 minutes weekly and prevents the $847 average error that unreconciled accounts experience.

Weekly Reconciliation Process:

-

Pull Your Current Ledger Balance — Log into your business banking and note your current ledger balance.

-

Match Against Your Accounting Records — Compare this to the cash account balance in your accounting software (QuickBooks, Xero, etc.).

-

Identify Discrepancies — If they don't match, you've got unrecorded transactions, duplicate entries, or errors.

-

Account for Timing Differences — Outstanding checks you've issued but recipients haven't cashed won't appear in your bank's ledger balance yet.

-

Adjust Your Books — Record any bank fees, interest earned, or transactions you missed.

Red Flags That Require Immediate Investigation:

- Your ledger balance decreased but you recorded no withdrawals

- Duplicate transactions appearing in your ledger

- Bank fees you didn't anticipate or recognize

- Deposits taking longer than 3 business days to post

- Your ledger balance is negative (immediate overdraft risk)

Common Ledger Balance Mistakes (And How to Fix Them)

Mistake #1: Confusing Ledger and Available Balance

You see $6,000 in your ledger balance and authorize a $5,500 payment, not realizing $2,000 in pending transactions will hit tomorrow. Result: $35 overdraft fee.

Fix: Always check both balances before making large payments. If available balance is significantly lower, investigate pending items first.

Mistake #2: Forgetting About Outstanding Checks

You wrote three checks totaling $1,850 last week. They haven't been cashed yet, so they're not in your ledger balance—but they will be.

Fix: Maintain a separate register of outstanding checks. Subtract this amount from your ledger balance mentally when planning expenses.

Mistake #3: Ignoring Deposit Hold Periods

That $8,000 client check you deposited Friday shows in your available balance Monday, so you assume it's cleared. The bank reverses it Wednesday when the check bounces.

Fix: Know your bank's hold policies. Checks over $5,000 typically hold for 2-5 business days. Don't count deposits in your ledger balance until they've actually posted.

Mistake #4: Relying on Yesterday's Ledger Balance

You checked your ledger balance Sunday night ($4,200) and made decisions Monday based on that number—not realizing Monday's batch processing dropped it to $2,800.

Fix: Check your ledger balance at the start of each business day, not the night before. Banks process overnight.

Mistake #5: Missing Bank Fees

Your ledger balance dropped by $25, but you don't see a corresponding transaction in your records. Turns out it's a monthly maintenance fee you forgot about.

Fix: Review your bank's fee schedule quarterly. Set calendar reminders for recurring fees so you can budget for them and record them in your books immediately.

Key Takeaways

-

Ledger balance is your official end-of-day total—it includes only cleared, posted transactions and updates once daily during batch processing.

-

Available balance shows real-time spendable funds—it factors in pending transactions and holds, changing continuously throughout the day.

-

The $2,300 difference between balances isn't unusual—pending deposits, uncleared checks, and holds create gaps that can last 1-5 business days.

-

Use ledger balance for reconciliation and reporting—your bank statements, tax documents, and financial reports all rely on ledger balances, not available balances.

-

Check both balances before large payments—a $6,000 ledger balance might only represent $3,800 available if you've got pending debits waiting to post.

-

Reconcile weekly to catch the $847 average error—businesses reconciling monthly miss discrepancies that compound into significant cash flow problems.