What Is an Itemized Receipt? Accurate Expense Tracking Guide

An itemized receipt is a detailed document listing every individual product or service from a transaction, including quantities and unit prices. It's different from a generic credit card slip that only shows a total amount. Automated policy checks using these details saved businesses over $4.6 million in 2024 alone (Fyle, 2025). This guide breaks down the tax requirements for itemized receipts and how to automate their collection.

Mandatory Elements for Business Compliance

A simple receipt might show a vendor name and a $5,200 charge, but auditors specifically look for the "essential character" of the expense. Itemized receipts provide a granular breakdown that justifies your spending as a business necessity. You'll need these records to meet the IRS burden of proof for the legitimacy of your deductions.

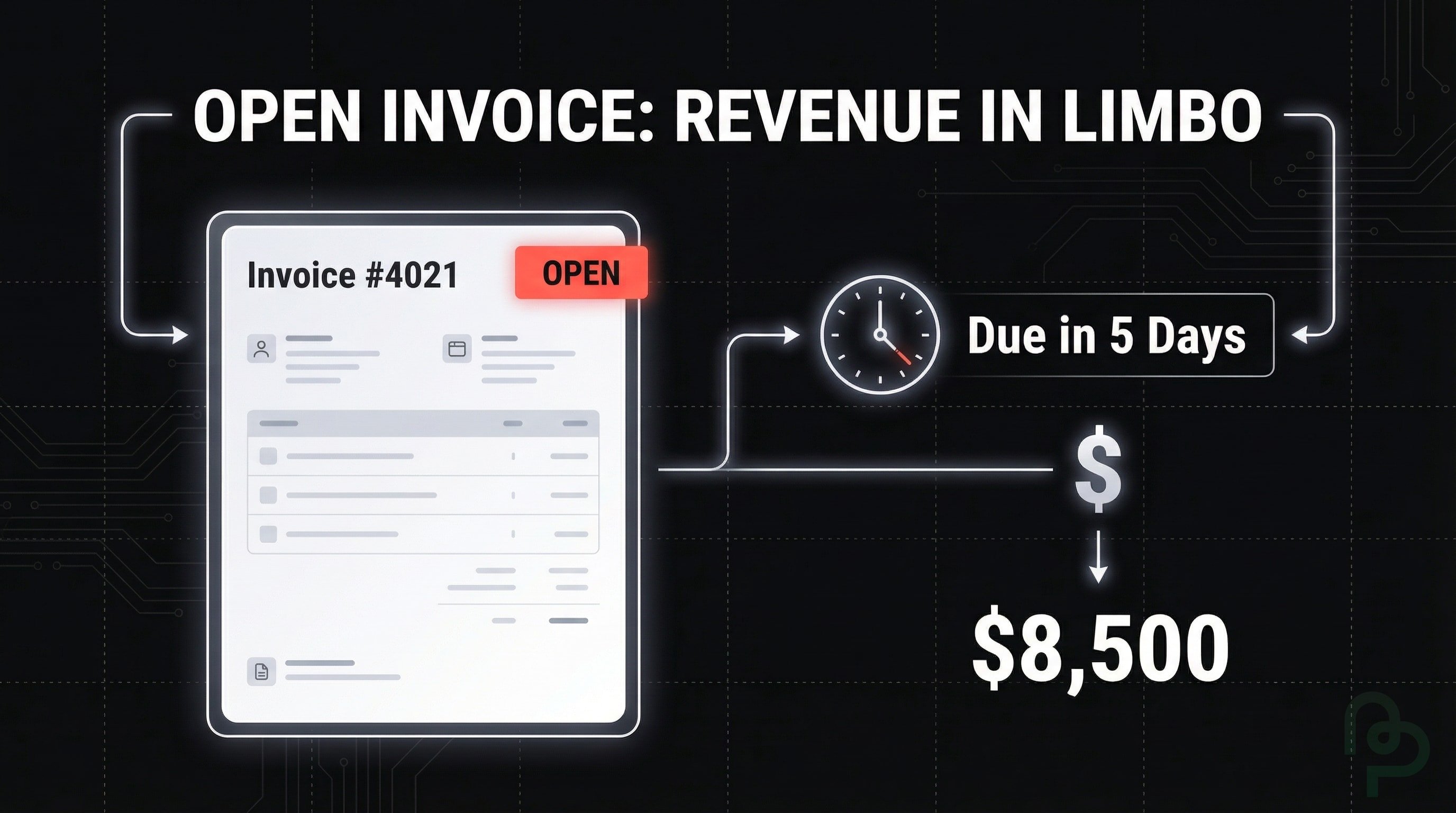

Every itemized receipt should include the vendor's legal name, address, and the specific date of the service. Detailed descriptions must split the total into unit costs and quantities. For example, a $8,500 project expense should separate $7,000 in labor from $1,500 in materials. Tools like PineBill sync bank feeds automatically, making it easier to match these line-item details to your ledger throughout the year.

| Feature | Standard Receipt | Itemized Receipt |

|---|---|---|

| Merchant Name & Date | Included | Included |

| Final Total Amount | Included | Included |

| Line-Item Descriptions | Not Included | Included |

| Unit Quantity/Price | Not Included | Included |

| Detailed Taxes/Fees | Often Missing | Always Included |

Source: Coast, 2025

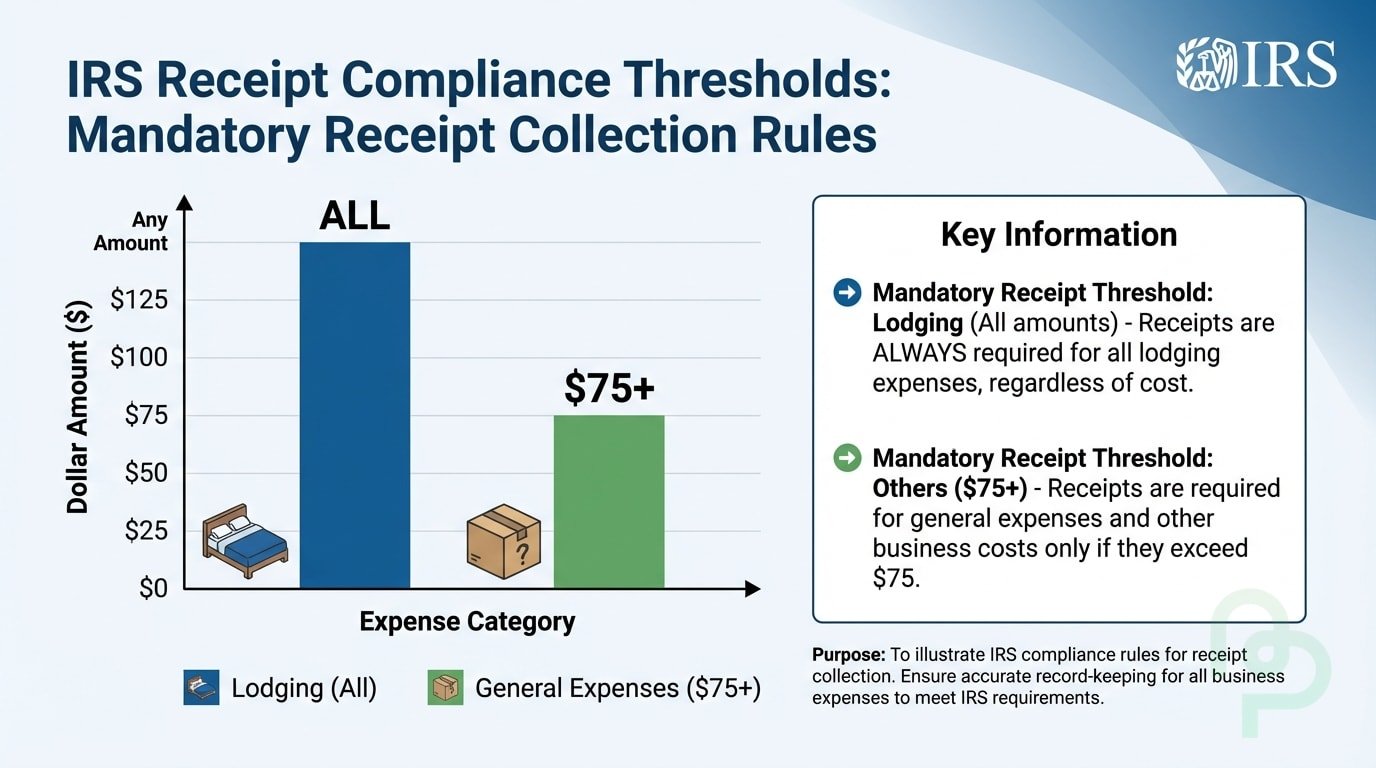

IRS Requirements and $75 Thresholds

The IRS requires documentary evidence for all travel, gift, and car expenses associated with your business. You must have receipts for any lodging expense regardless of the dollar amount (IRS, 2024). For other business expenses, receipts are mandatory if the total reaches $75 or more.

Businesses that implement real-time receipt capture see employee submission times drop from 30 days to less than 24 hours (Fyle, 2025). This speed ensures you don't lose the chance to record deductible items that fall below the $75 threshold but still impact your net income. PineBill enables teams to store digital copies of these receipts safely for the required three-year retention period.

Preventing Internal Fraud and Spend Bloat

Itemized receipts are your strongest defense against internal embezzlement and redundant spending. They help finance teams identify non-deductible items, like alcohol on a client meal receipt, which can then be excluded from reimbursement. Clear itemization also spots duplicate purchases, such as a subscription billed twice within the same billing cycle.

Ease of use encourages employees to stay within policy. Adoption and card spend behavior increase by 54.2% when companies switch to effortless, itemized digital processing systems (Fyle, 2025). Modern tools like PineBill help businesses categorize these line items for clearer tax reporting without the need for manual data entry.

Key Takeaways

- IRS Lodging Rule—Documentary evidence is required for every lodging expense regardless of the total amount.

- The $75 Threshold—Receipts are mandatory for all other business expenses totaling $75 or higher.

- Financial Transparency—Detailed line items prevent auditors from disallowing legitimate business deductions.

- Real-time Capture—Automating receipt collection reduces submission delays from 30 days to 1 day (Fyle, 2025).

- Fraud Prevention—Line-item detail stops non-compliant personal expenses from being hidden in business totals.