Voucher vs. Invoice: Key Differences for Business Accounting

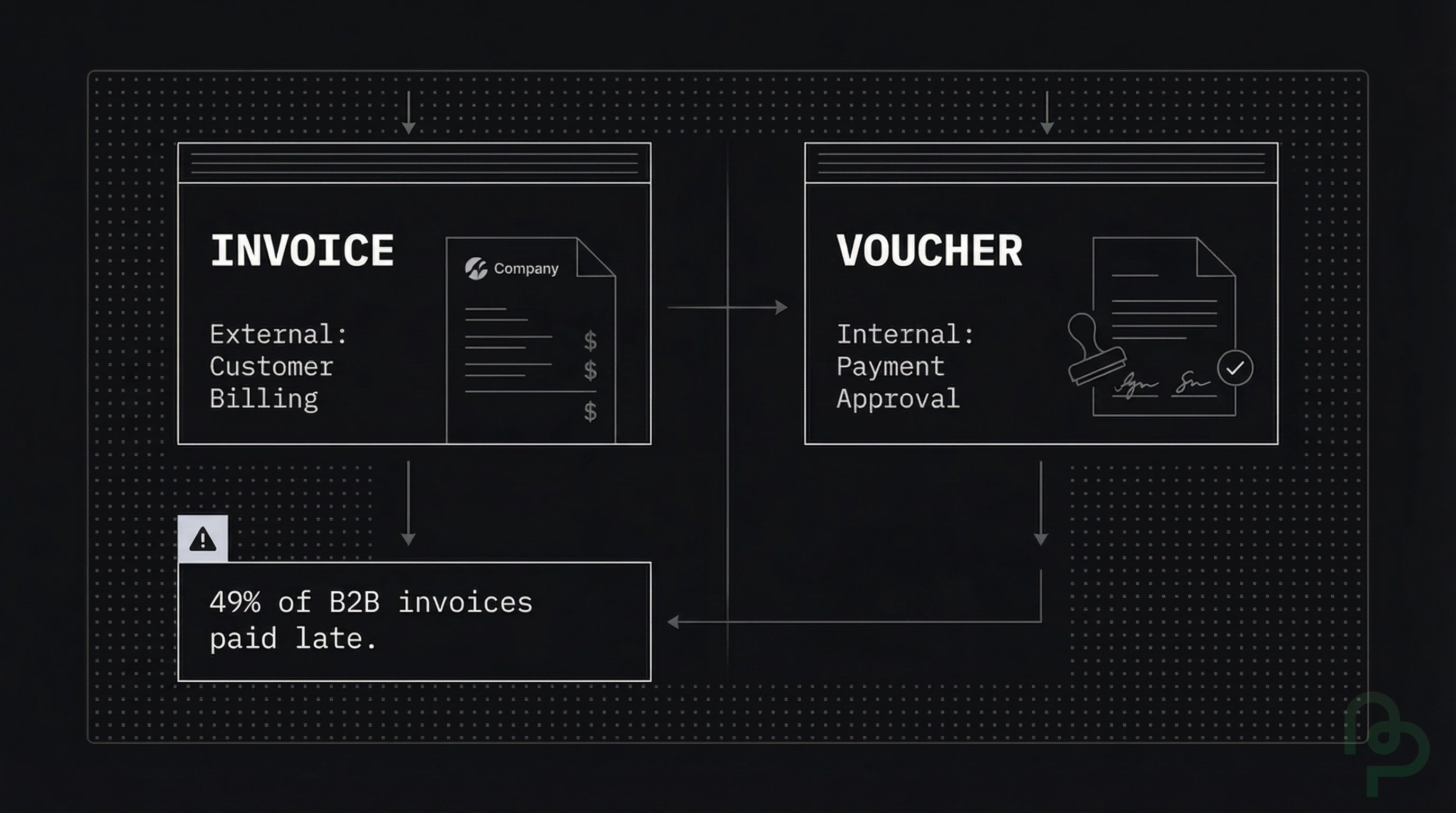

Late payments impact 49% of all B2B invoices (PYMNTS, 2024). This inefficiency often stems from confusing internal approvals with external requests. This guide clarifies the voucher vs. invoice distinction so you won't lose track of your $15,000 receivables.

External Requests vs. Internal Approval

An invoice is an external document you send to a customer to demand payment for goods or services. It's the primary record of a sale and triggers the recipient's accounts payable process. If a client owes you $5,000, your invoice serves as the legal evidence for that debt.

A voucher is an internal document your accounting department creates to authorize a payment. It acts as a cover sheet for a folder containing the vendor's invoice, the purchase order, and the receiving report. Since 14% of asset misappropriation stems from accounts payable fraud (ACFE, 2024), vouchers provide a critical security layer.

| Feature | Invoice | Voucher |

|---|---|---|

| Scope | External (Buyer and Seller) | Internal (Accounting/Finance) |

| Purpose | Request for payment | Authorization to pay |

| Preparation | Created at the time of sale | Created after receiving a bill |

| Legal Status | Legally binding demand | Internal control record |

Source: PiceApp, 2025

The Workflow of Accounts Payable

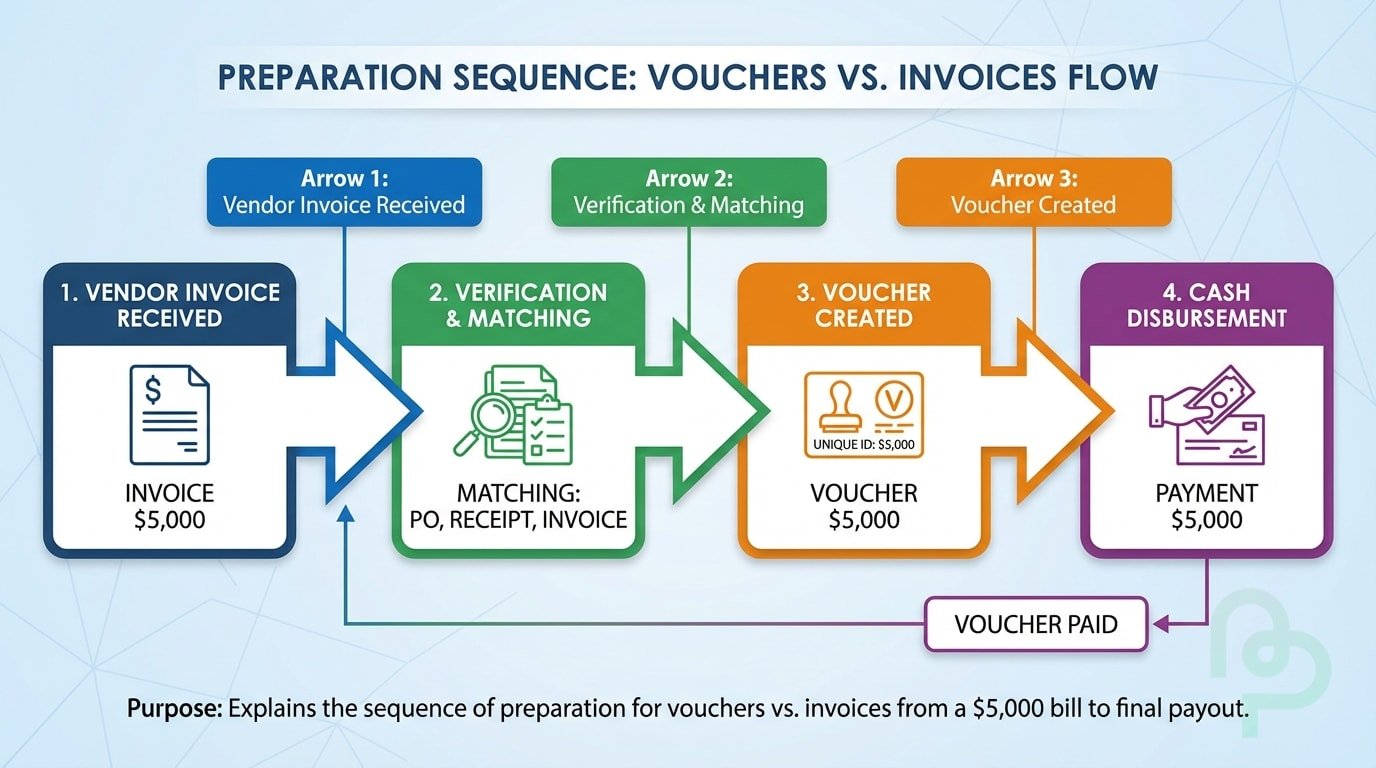

You'll typically see an invoice come first in the transaction cycle. A vendor delivers office furniture and sends a $5,000 invoice to your business. Your team doesn't just cut a check immediately; they verify the shipment first.

Once verified, an accountant prepares a payment voucher to document the internal approval path. Tools like PineBill help you manage these outgoing requests by centralizing your electronic records. This ensures every $15,000 expense is matched to a specific authorization before funds leave your bank account.

Why Your Small Business Needs Both

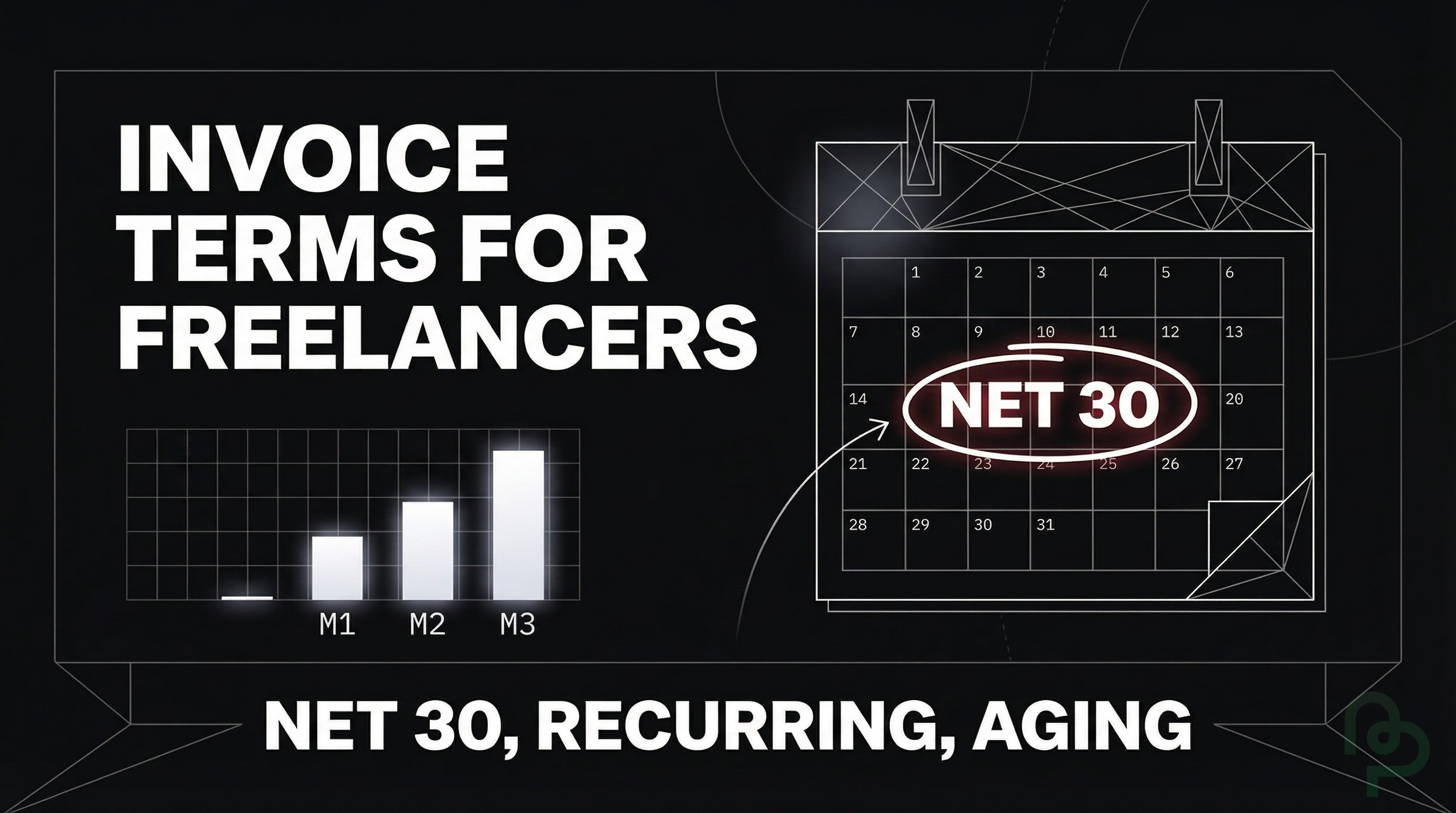

Invoices are non-negotiable for tax compliance and revenue tracking. Without professional invoices, you won't have the paper trail necessary for standard audits or tax filings. Invoices ensure your customers understand exactly what they're paying for and when the $5,000 is due.

Vouchers prevent unauthorized spending and duplicated payments. Organizations lose approximately 5% of their annual revenue to fraud (ACFE, 2024). A voucher system forces a "three-way match" between the bill, the order, and the goods received, which catches errors before they become losses.

Using PineBill manages the invoicing side by automating professional document generation and tracking. While you'll use vouchers for your internal checks, your customers will appreciate the clarity of your digital invoices. This professional approach can reduce your Days Sales Outstanding (DSO) by providing clear payment terms.

Key Takeaways

- Invoice Direction—Invoices travel from the seller to the buyer as a demand for payment.

- Voucher Purpose—Vouchers authorize internal payments and approve the release of funds.

- Fraud Prevention—A voucher system helps block the 14% of fraud that occurs in accounts payable (ACFE, 2024).

- Order of Operations—The invoice serves as the source document used to initiate the internal voucher process.

- Automation—Digitizing your records with systems like PineBill ensures high-value invoices aren't lost in the mail.