Quote vs. Invoice: What’s the Difference and When to Use Each

Running a small business means juggling multiple documents, and few are as crucial as quotes and invoices. But many owners mix them up, leading to confusion, delayed payments, and even legal issues. If you've ever wondered why a client disputes a bill despite agreeing to your estimate, the difference between a quote and an invoice is likely at the root.

In this guide, we'll break down what each document is, highlight their key differences, and explain when to use them. By the end, you'll know how to implement them effectively to improve cash flow and client relationships. Whether you're freelancing or managing a growing team, mastering these basics saves time and money.

Want to streamline your quoting and invoicing process? PineBill helps you create professional quotes, convert them to invoices instantly, and get paid faster—all in one platform.

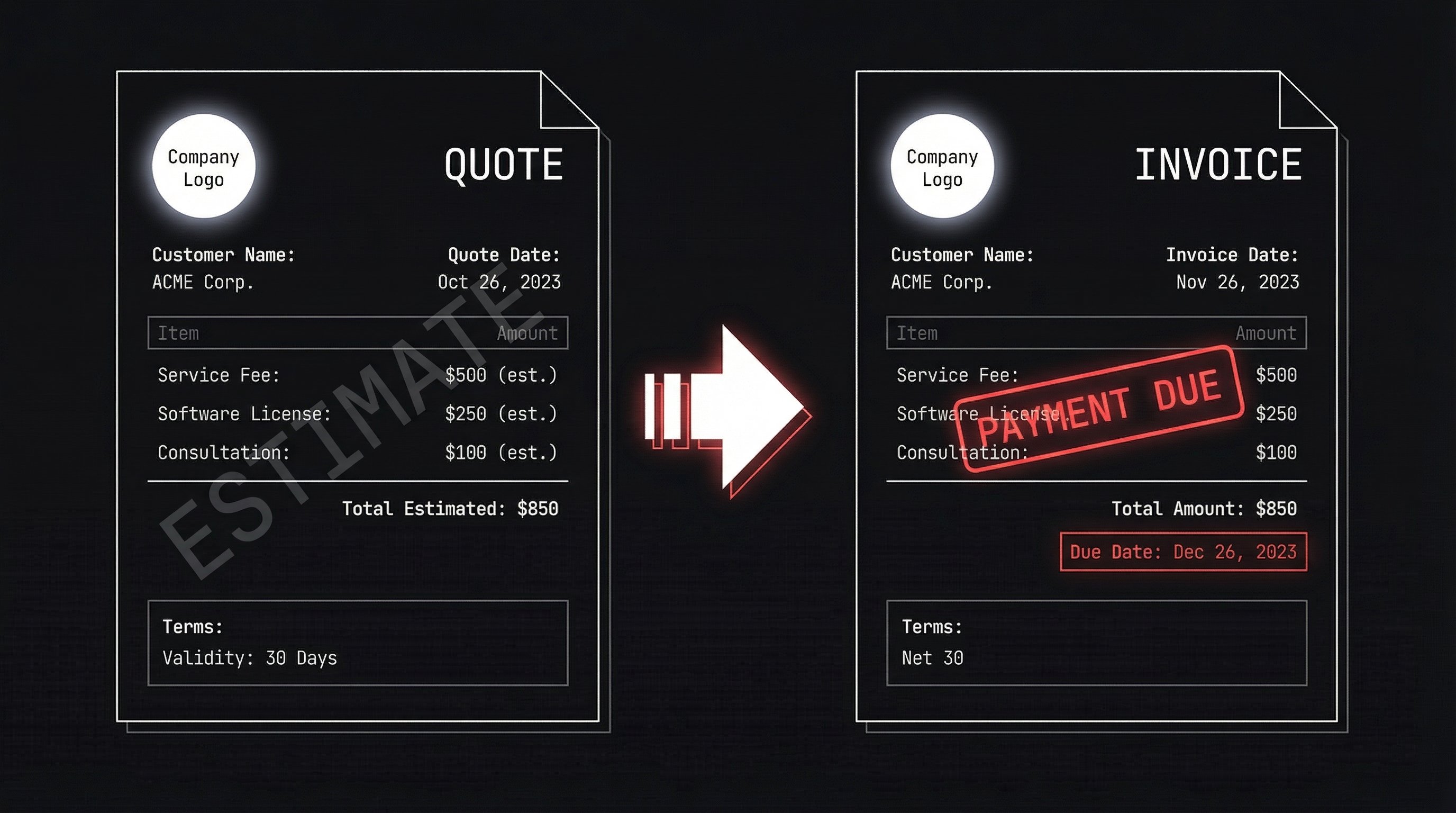

What Is a Quote?

A quote, also known as a quotation or estimate, is a preliminary document you send to potential clients before starting work. It outlines the expected costs for goods or services, giving them a clear picture of what to anticipate.

Quotes serve as a sales tool. They help secure buy-in by showing transparency upfront. Unlike final bills, quotes aren't demands for payment—they're invitations to proceed. Typically, they include:

- Your business details (name, contact info, logo)

- Client information

- Description of services or products

- Itemized estimated costs (labor, materials, etc.)

- Total estimated amount

- Validity period (e.g., 30 days)

- Terms and conditions (payment schedule, scope changes)

According to industry standards, quotes should be as accurate as possible to build trust. A 2024 FreshBooks survey found that 68% of small businesses lose clients due to unclear estimates. Make yours detailed to avoid this.

Quotes aren't always legally binding, but if the client signs or accepts them explicitly, they can form a contract. Always include a note like "This quote is valid for X days and subject to change based on final scope."

What Is an Invoice?

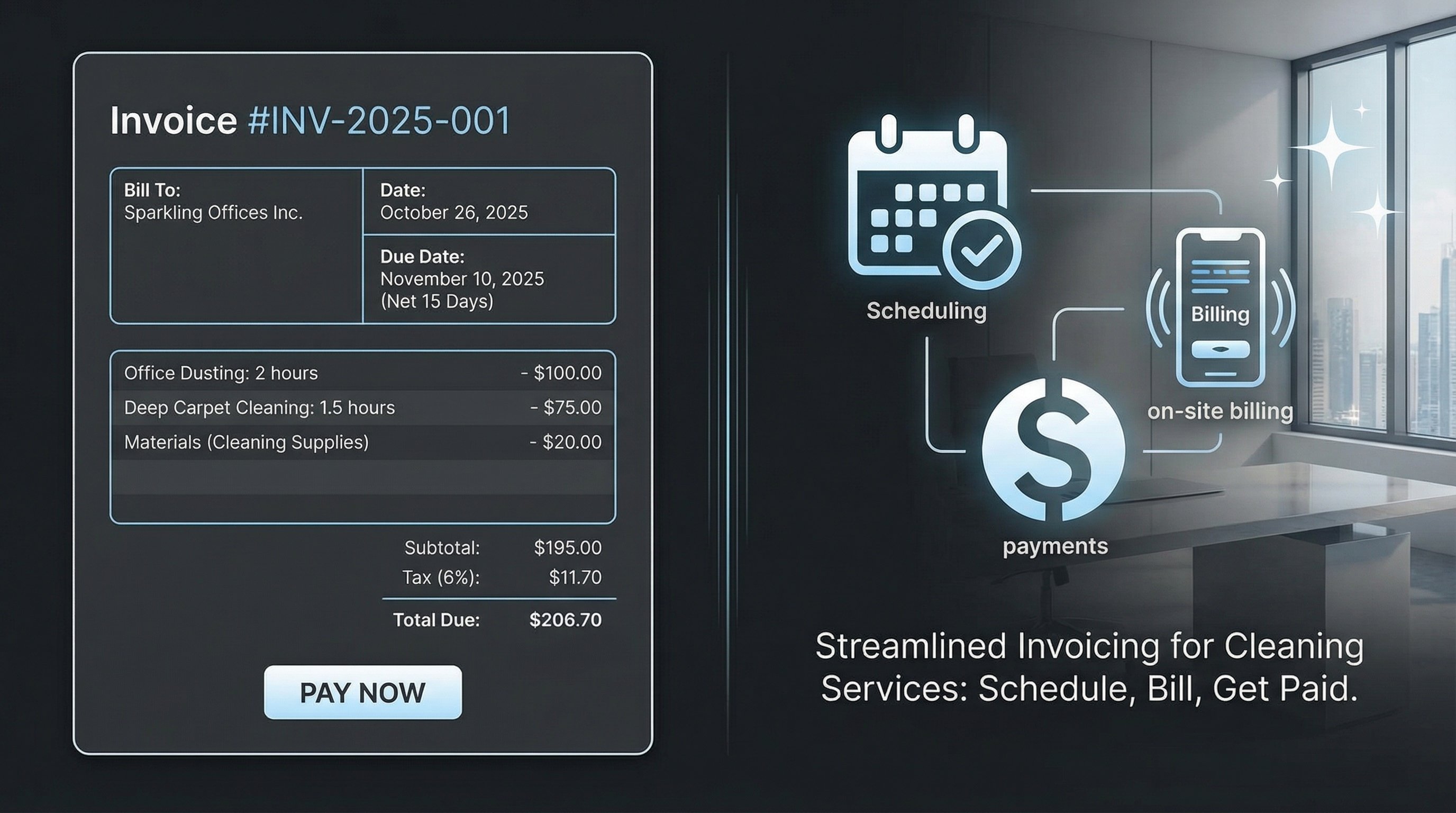

An invoice is the official bill you issue after delivering goods or completing services. It requests payment and serves as a record of the transaction. Unlike quotes, invoices are formal and legally enforceable in most jurisdictions.

The purpose of an invoice is straightforward: get paid. It details what the client owes and when. Essential elements include:

- Invoice number and date

- Your business and client details

- Itemized charges (actual costs, not estimates)

- Subtotal, taxes, discounts, and total due

- Payment terms (e.g., net 30 days)

- Due date

- Payment instructions (bank details, accepted methods)

In the U.S., invoices must comply with IRS requirements for tax purposes, including your EIN if applicable. Globally, similar rules apply—check local laws to ensure deductibility. A HighRadius report from 2025 notes that accurate invoicing reduces payment delays by up to 40% for SMBs.

Invoices can include late fees if specified in your terms, but they demand action from the client. Once paid, they become proof of transaction for accounting.

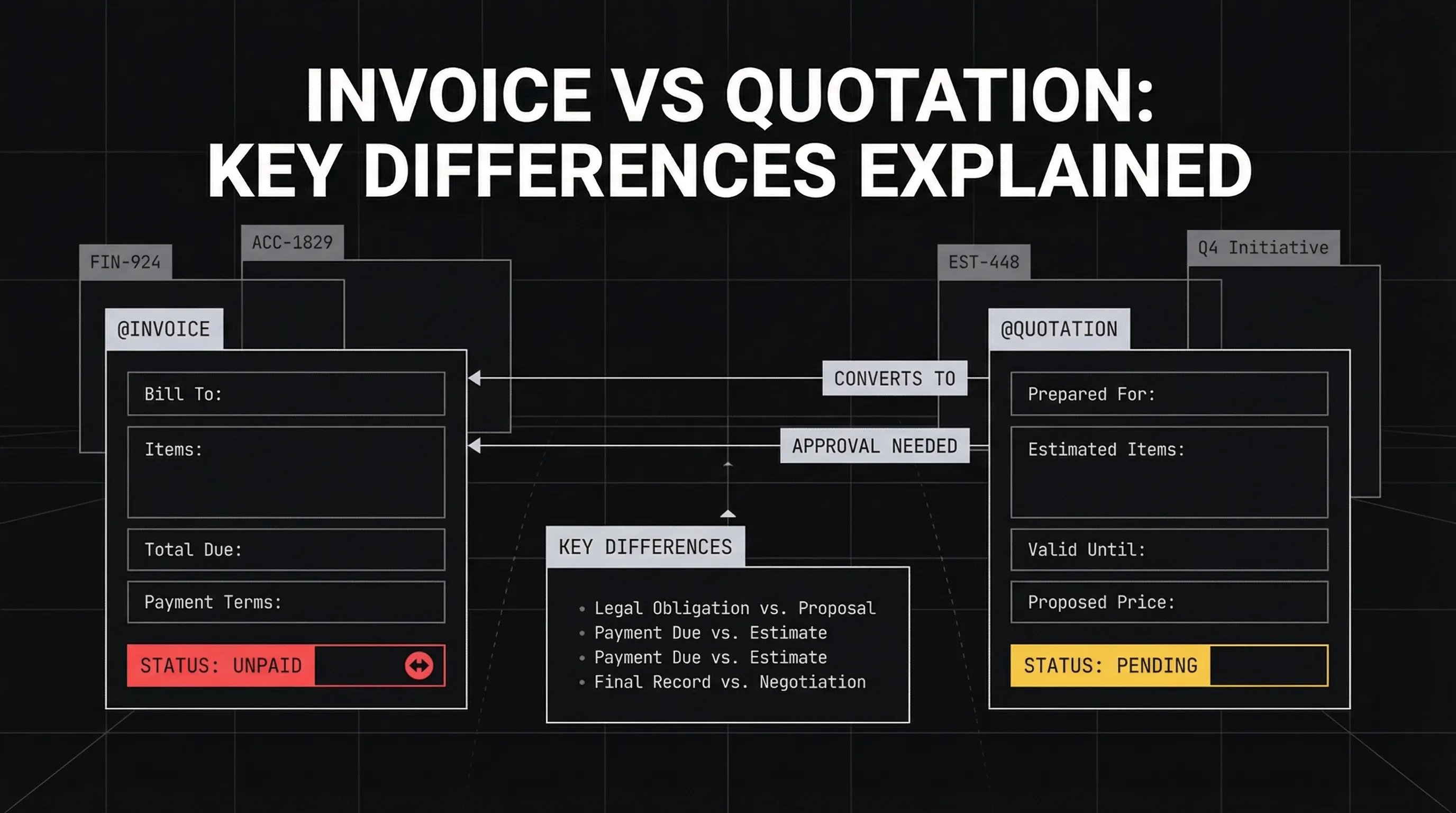

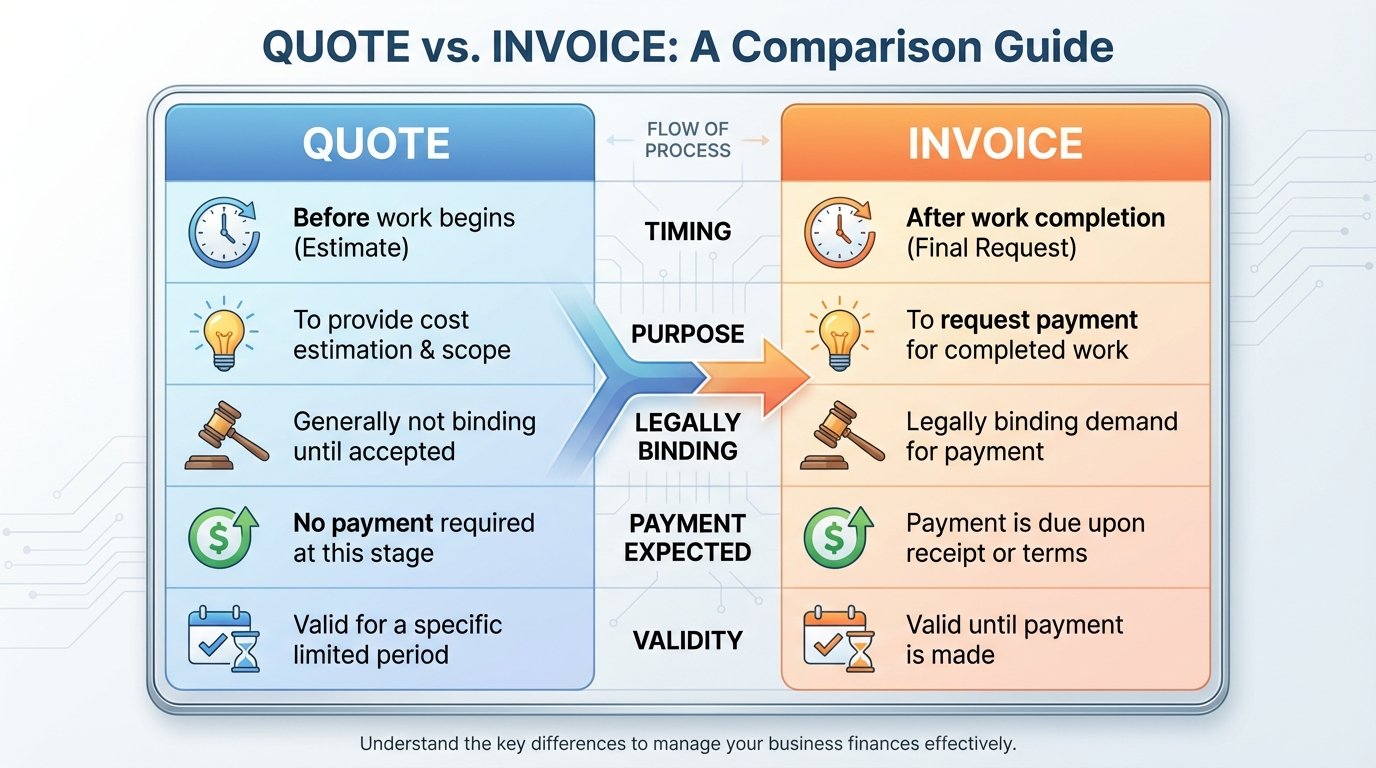

Key Differences Between Quotes and Invoices

The main distinction boils down to timing and intent, but several factors set them apart. Understanding these prevents costly errors in your billing workflow.

Here's a quick comparison:

| Aspect | Quote | Invoice |

|---|---|---|

| Timing | Before work begins | After work is completed |

| Purpose | Estimate costs; get approval | Request payment; record transaction |

| Legally Binding | Usually not (unless accepted as contract) | Yes, enforceable demand for payment |

| Payment Expected | No immediate payment | Yes, with due date |

| Content | Estimated prices, validity period | Actual costs, taxes, invoice number |

| Validity | Expires (e.g., 30-90 days) | Remains until paid |

| Customization | Flexible, negotiable | Fixed, based on agreement |

As shown, quotes are exploratory, while invoices are conclusive. Mixing them up can lead to disputes—for instance, treating a quote as a final bill might scare off clients.

When to Use a Quote vs. an Invoice

Use a quote early in the sales process, especially for custom projects where scope isn't fixed. It's ideal for:

- Large or complex jobs (e.g., website development, construction)

- Clients needing budget approval

- Negotiable pricing scenarios

Send quotes promptly after initial discussions. PineBill allows you to generate professional quotes with one click, including customizable templates that match your brand—no design skills needed.

Switch to an invoice once the client accepts the quote and you've fulfilled your end. Use invoices for:

- Standard services or products

- Recurring billing

- Finalizing one-off transactions

In service-based businesses, 75% of payments are faster when invoices follow accepted quotes, per a 2025 Tipalti study. Always reference the original quote on the invoice to maintain continuity—for example, "Invoice based on Quote #123 dated MM/DD/YYYY."

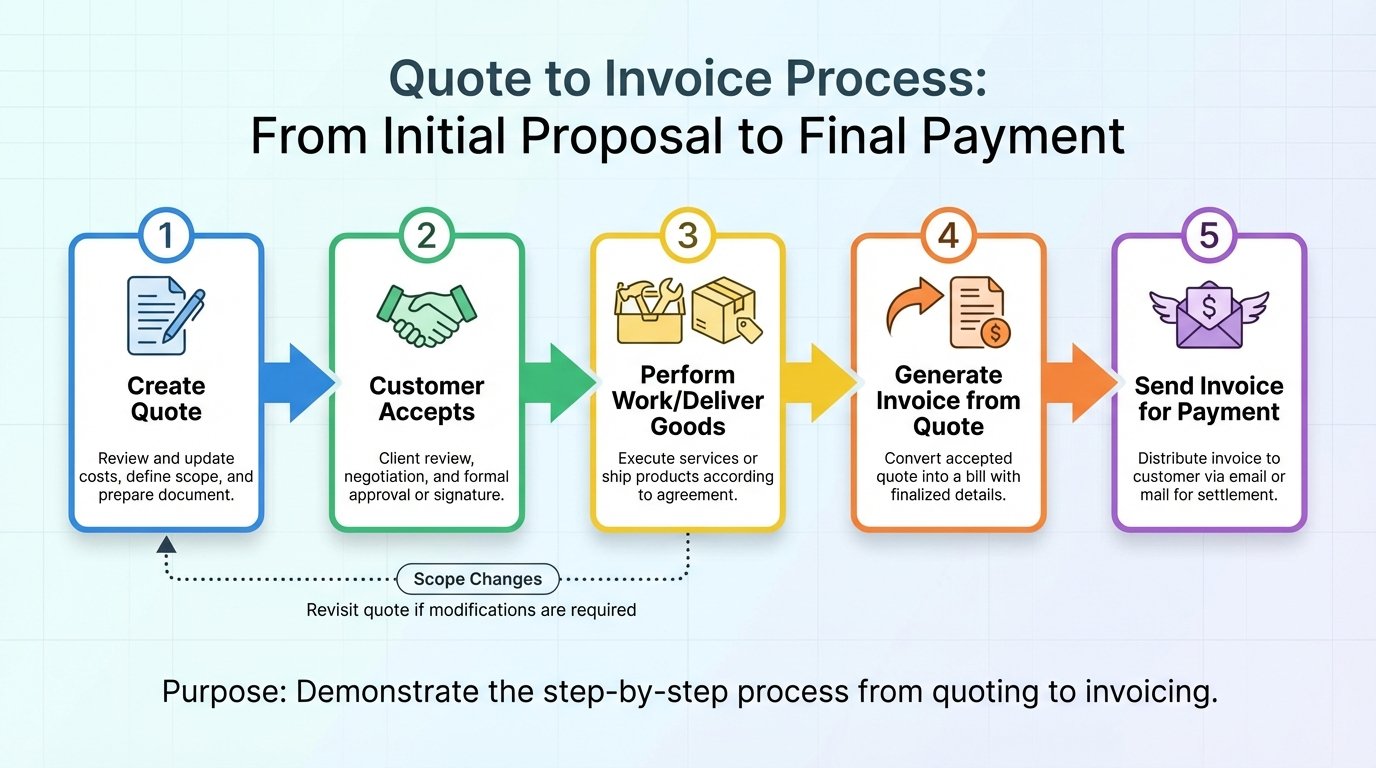

Converting Quotes to Invoices: Best Practices

The transition from quote to invoice should be seamless to avoid rework. Here's a step-by-step process:

Review and Accept the Quote

Ensure the client signs or emails acceptance. Document this to protect against disputes.

Complete the Work

Deliver goods or services as outlined. Track any changes and get approval for adjustments.

Generate the Invoice

Use software to convert the quote automatically. Update estimates to actuals, add taxes, and set the due date.

Send and Follow Up

Email the invoice with clear instructions. Automate reminders for overdue payments.

With PineBill, this conversion is built-in: Select a quote, mark it as accepted, and generate an invoice with all details pre-filled. This reduces errors and saves hours weekly for busy owners. Try it free—no credit card required.

Common Mistakes to Avoid with Quotes and Invoices

Even experienced business owners slip up here. Top pitfalls include:

- Vague Quotes: Omitting details leads to scope creep. Always specify inclusions/exclusions.

- No Validity Period: Quotes without expiration can haunt you if prices fluctuate.

- Skipping Acceptance: Verbal agreements aren't enough—get written confirmation.

- Inaccurate Invoices: Mismatching the quote erodes trust. Double-check calculations, especially taxes.

- Delayed Invoicing: Waiting too long after completion slows cash flow. Invoice within 24-48 hours.

A PandaDoc analysis shows that 42% of SMBs face payment issues due to poor documentation. Use templates and automation to stay consistent—PineBill's smart templates ensure you never miss critical details.

Key Takeaways

- Quotes estimate and negotiate before work; invoices bill and enforce after delivery.

- Tailor quotes for complex projects to secure commitments, and use invoices for all payments.

- Always include essential details like terms, dates, and totals in both to comply with regulations.

- Leverage tools like PineBill to convert quotes to invoices effortlessly, improving efficiency.

- Avoid common errors by documenting acceptances and reviewing for accuracy.

Mastering these documents strengthens your operations and client trust.

Ready to Simplify Your Billing Process?

Stop wasting time on manual quote and invoice creation. PineBill automates your entire billing workflow, from generating professional quotes to converting them to invoices with a single click. Join thousands of small businesses who've streamlined their billing and improved cash flow.

Start Free Today — No credit card required. Create unlimited quotes and invoices in minutes.

Frequently Asked Questions

Implementing clear distinctions between quotes and invoices will professionalize your billing. With PineBill's integrated tools, you can create, track, and convert these documents effortlessly—reducing administrative work by up to 80%.

Ready to get paid faster? Create your first professional quote in 60 seconds with PineBill — completely free, no credit card required. Join the thousands of businesses streamlining their billing today.