Proforma Invoice vs Invoice: Complete Guide

Understanding the difference between a proforma invoice and a standard commercial invoice is essential for businesses engaged in sales, especially international trade. While both documents serve important purposes, they have distinct functions and legal implications.

What is a Proforma Invoice? (Pro Forma Invoice Meaning)

A proforma invoice is a preliminary bill of sale sent to buyers before a shipment or delivery of goods. The term "proforma" is Latin for "as a matter of form" or "for the sake of form."

Key Characteristics of Proforma Invoices:

- Not a demand for payment - serves as a quote or estimate

- Issued before goods are shipped or services are rendered

- Not recorded as revenue in accounting systems

- Often used in international transactions for customs purposes

- Can be modified or canceled without accounting implications

- Typically labeled "PROFORMA INVOICE" to distinguish from commercial invoices

Common Uses for Proforma Invoices:

- International Trade: Required by customs authorities to assess duties and taxes before shipment

- Purchase Authorization: Helps buyers secure internal approval and arrange financing

- Advance Commitment: Shows buyer the exact costs before placing a formal order

- Import Documentation: Assists with import licenses and foreign exchange allocations

What is a Commercial Invoice?

A commercial invoice (also called a standard invoice or final invoice) is a legal document issued by sellers requesting payment for goods or services already provided or about to be delivered.

Key Characteristics of Commercial Invoices:

- Legal demand for payment - creates a payment obligation

- Issued after goods are shipped or services are completed

- Recorded as accounts receivable and revenue

- Required for tax reporting and accounting purposes

- Legally binding document

- Contains unique invoice number for tracking

Common Uses for Commercial Invoices:

- Payment Collection: Primary document for requesting and tracking payments

- Accounting Records: Essential for bookkeeping and financial statements

- Tax Documentation: Required for VAT, sales tax, and income tax reporting

- Legal Protection: Serves as proof of transaction in disputes

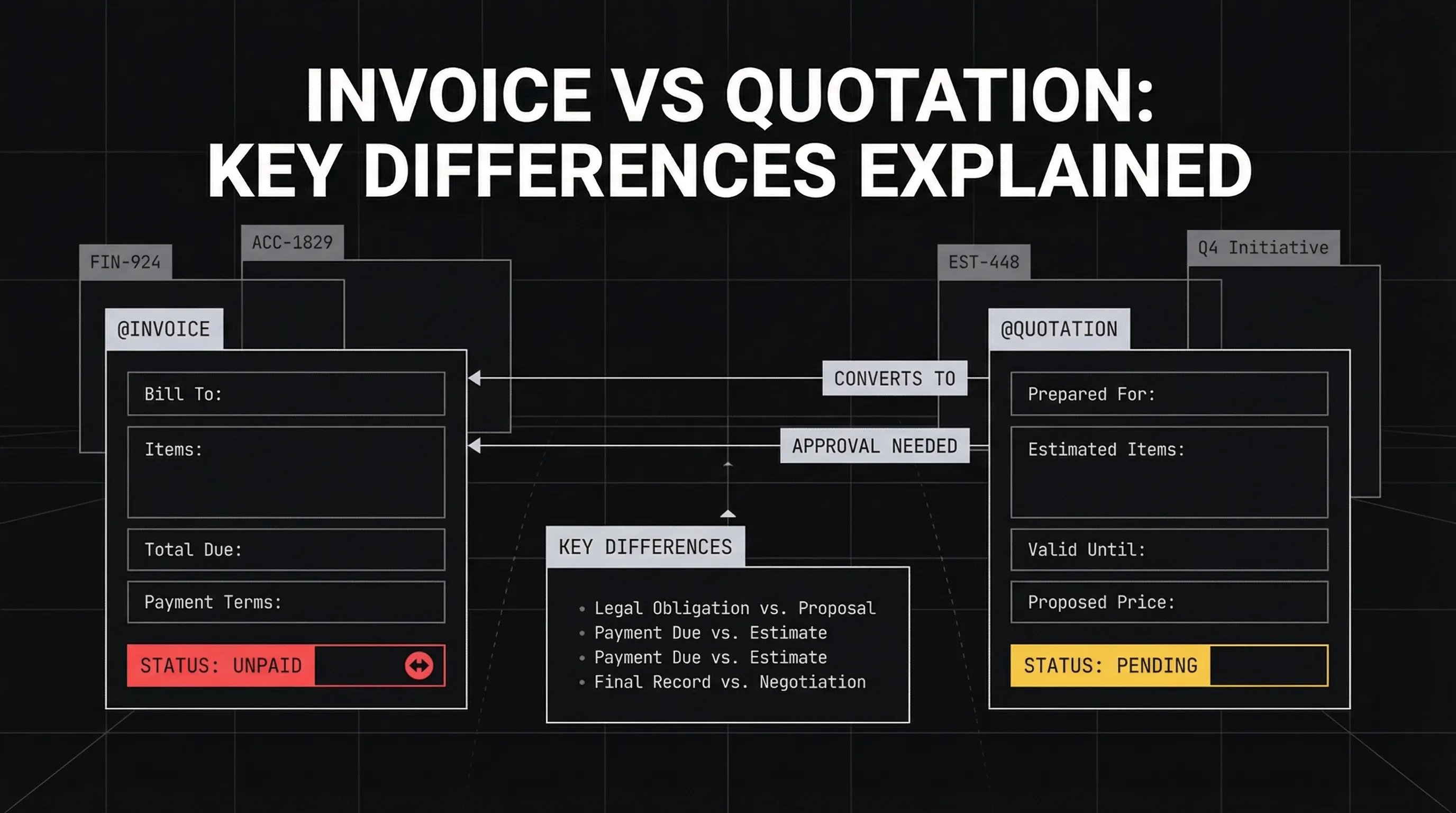

Proforma Invoice vs Commercial Invoice: Key Differences

| Feature | Proforma Invoice | Commercial Invoice |

|---|---|---|

| Purpose | Quote/estimate | Payment request |

| Timing | Before shipment/order | After shipment/delivery |

| Legal Status | Not legally binding | Legally binding |

| Accounting | Not recorded as revenue | Recorded as revenue |

| Payment | No payment obligation | Creates payment obligation |

| Modification | Can be changed easily | Requires credit notes to modify |

| Tax Impact | No tax implications | Subject to sales tax/VAT |

| Customs | Used for import clearance | Final document for customs |

When to Use a Proforma Invoice

Use a proforma invoice when:

1. Requesting Purchase Approval

Buyers often need a formal document to secure internal approval or budget allocation before committing to a purchase.

2. International Shipments

Many countries require proforma invoices for:

- Customs clearance

- Calculating import duties and taxes

- Obtaining import licenses

- Arranging letters of credit

3. Advance Payment or Deposits

When requesting a deposit or advance payment, a proforma invoice shows the commitment without creating a final invoice.

4. Providing Detailed Quotes

For complex projects or large orders, a proforma invoice provides more detail than a standard quote:

- Itemized pricing

- Shipping costs

- Payment terms

- Delivery schedules

When to Use a Commercial Invoice

Use a commercial invoice when:

1. Requesting Payment

After goods are shipped or services are rendered, a commercial invoice officially requests payment.

2. Recording Sales

Commercial invoices are essential for:

- Accounts receivable tracking

- Revenue recognition

- Financial reporting

- Tax compliance

3. Finalizing International Transactions

While proforma invoices help with customs pre-clearance, commercial invoices are required as the final documentation for:

- Permanent import/export records

- Final customs valuation

- Certificate of origin verification

4. Legal Documentation

Commercial invoices serve as legal proof of:

- Sale agreement

- Delivery obligations

- Payment terms

- Transaction details

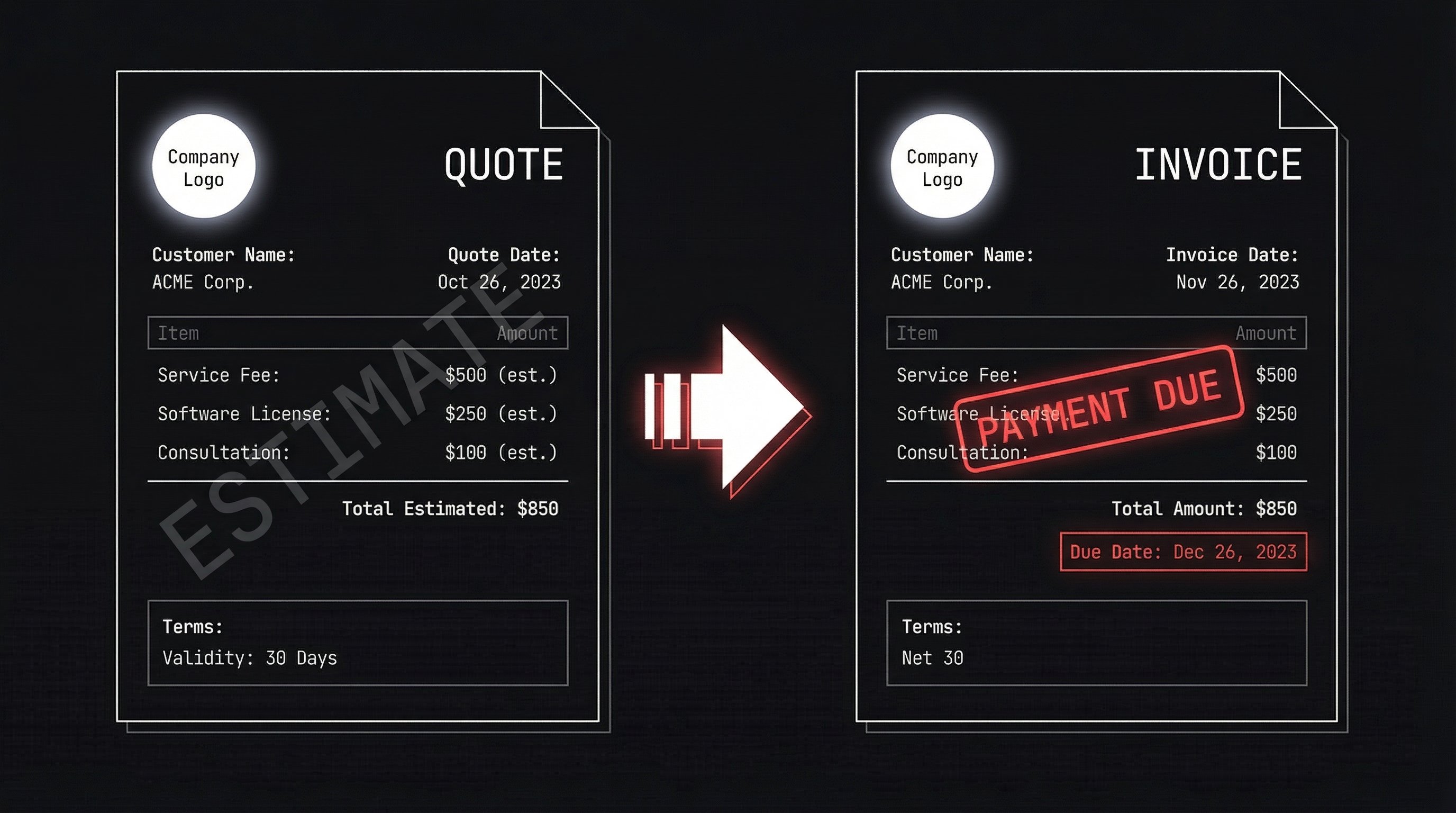

Proforma Invoice vs Invoice: Converting Between Them

Many businesses issue a proforma invoice first, then convert it to a commercial invoice once the order is confirmed:

Conversion Process:

- Issue Proforma Invoice: Send preliminary pricing and terms

- Buyer Approves: Customer confirms they want to proceed

- Create Commercial Invoice: Generate final invoice with unique number

- Reference Original: Include proforma invoice number for tracking

- Request Payment: Send commercial invoice as payment demand

Important: Never simply rename a proforma invoice to a commercial invoice. Always create a new document with a unique invoice number for proper accounting.

Common Elements in Both Documents

Despite their differences, proforma and commercial invoices typically contain similar information:

- Seller's business name and address

- Buyer's business name and address

- Description of goods or services

- Quantities and unit prices

- Total amount

- Payment terms

- Delivery terms (Incoterms)

- Currency

Key Difference: The proforma invoice should be clearly marked "PROFORMA INVOICE" while the commercial invoice shows "INVOICE" or "COMMERCIAL INVOICE."

Legal and Tax Implications

Proforma Invoices:

- No tax obligation for buyer or seller

- Not counted as revenue in financial statements

- No payment deadline enforcement

- Can be canceled without credit notes

- Not admissible as proof of sale in most legal disputes

Commercial Invoices:

- Creates tax obligations (sales tax, VAT, income tax)

- Counts as revenue when issued or paid

- Legally enforceable payment obligation

- Requires credit notes or refund invoices for corrections

- Legally binding document in disputes

Difference Between Proforma and Commercial Invoice in International Trade

International trade adds complexity to the proforma vs commercial invoice distinction:

Proforma Invoice Role:

- Customs Pre-Clearance: Submitted to customs before shipment

- Import Planning: Helps importers estimate landed costs

- Letter of Credit: Banks use proforma invoices to establish L/Cs

- Foreign Exchange: Importers arrange currency conversion in advance

Commercial Invoice Role:

- Final Customs Clearance: Required for permanent import records

- Duty Payment: Basis for calculating final import duties and taxes

- Trade Statistics: Used by governments for import/export data

- Certificate of Origin: Must match certificate of origin details

Pro Tip: In international trade, you may issue both - proforma for advance planning and commercial for final clearance and payment.

Key Takeaways:

- Proforma invoices are quotes/estimates issued before delivery - not legally binding

- Commercial invoices are payment demands issued after delivery - legally binding

- Use proforma invoices for international customs, buyer approval, and advance planning

- Use commercial invoices for payment requests, accounting records, and tax reporting

- Always clearly distinguish between the two with proper labeling and numbering

- International trade often requires both documents at different stages