Invoice vs Quotation: Key Differences Explained

A quotation and an invoice serve completely different purposes in the sales process. Mixing them up creates confusion, payment delays, and accounting headaches. Here's what you need to know.

What is a Quotation?

A quotation (also called a quote or estimate) is a document sent to potential customers before any work begins. It outlines what you'll provide and how much it will cost.

Key Characteristics:

- Sent before work starts - customer hasn't committed yet

- Not a payment request - it's a proposal, not a bill

- Can be negotiated - prices and terms are still flexible

- Has an expiration date - typically valid for 30-90 days

- No accounting entry - not recorded as revenue

- May or may not be binding - depends on local laws and wording

What to Include in a Quotation:

- Detailed description of products or services

- Itemized pricing with quantities

- Total cost including taxes (if applicable)

- Validity period (e.g., "Valid for 30 days")

- Payment terms if accepted

- Delivery timeline or project schedule

- Terms and conditions

What is an Invoice?

An invoice is a legal document requesting payment for goods delivered or services completed. It's a formal payment demand.

Key Characteristics:

- Sent after work is done - or when payment is due

- Legal payment request - creates a payment obligation

- Cannot be easily changed - requires credit notes for modifications

- Has a due date - specifies when payment must be made

- Recorded in accounting - counts as accounts receivable and revenue

- Legally binding - enforceable document

What to Include in an Invoice:

- Unique invoice number for tracking

- Invoice date and payment due date

- Seller's business details (name, address, tax ID)

- Buyer's billing information

- Description of delivered goods/services

- Quantities, unit prices, and total amount

- Applicable taxes (VAT, sales tax)

- Payment terms and accepted methods

- Late payment penalties (if applicable)

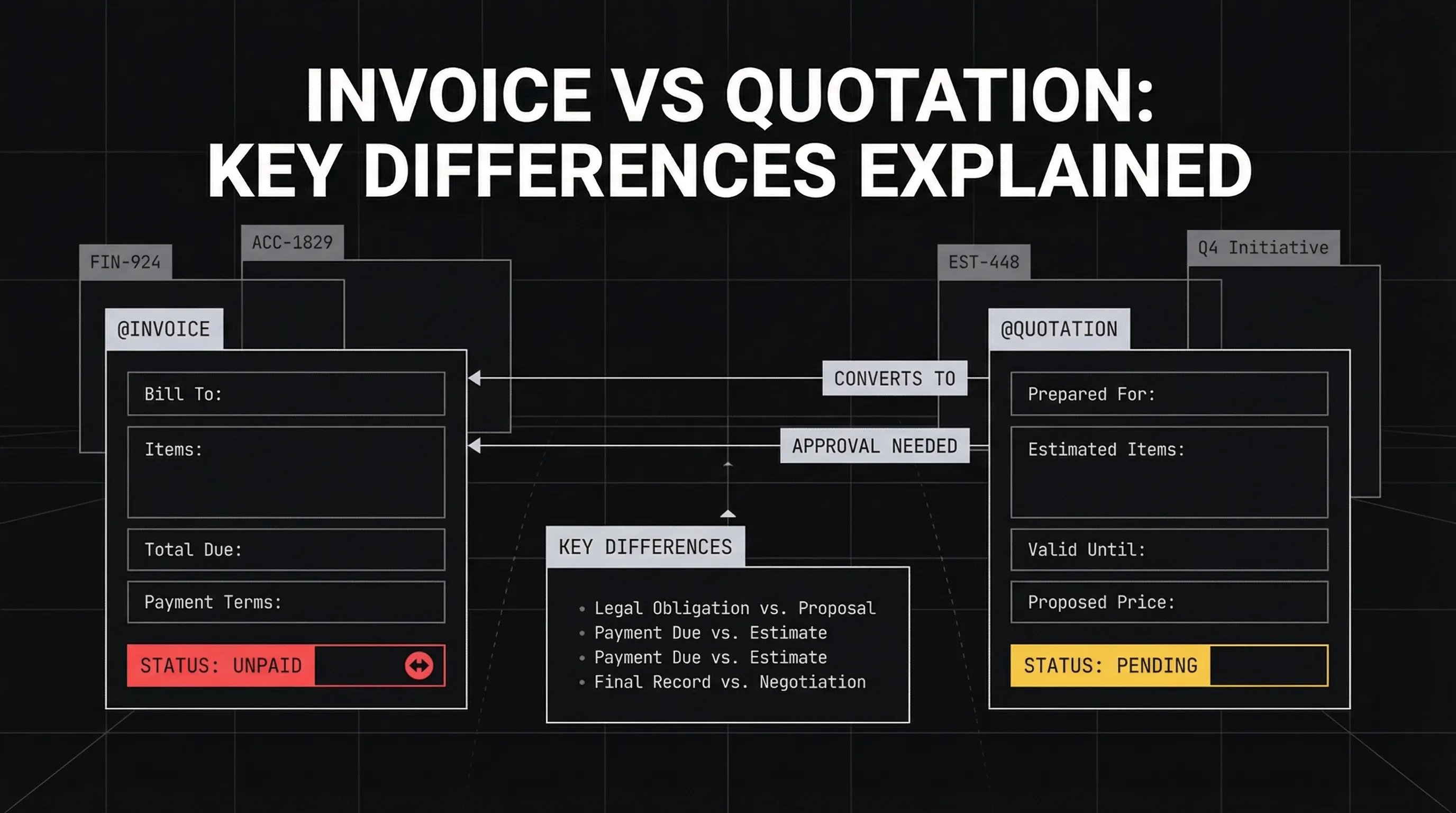

Invoice vs Quotation: Key Differences

| Feature | Quotation | Invoice |

|---|---|---|

| Timing | Before work begins | After work is completed |

| Purpose | Propose pricing and terms | Request payment |

| Legal Status | Not legally binding* | Legally binding |

| Payment | No payment due | Payment required |

| Accounting | Not recorded | Recorded as revenue/receivable |

| Modification | Can be revised easily | Requires formal credit notes |

| Expiration | Has validity period | No expiration (has due date) |

| Customer Action | Accept, reject, or negotiate | Pay by due date |

| Document Number | Quote number (optional) | Invoice number (required) |

| Tax Implications | No tax event | Creates tax obligation |

*Some quotations can be legally binding contracts depending on jurisdiction and wording

When to Use a Quotation

Use quotations in these situations:

1. New Customer Inquiries

When a prospect asks "how much will this cost?", send a quotation. It helps them:

- Compare your pricing with competitors

- Get internal budget approval

- Understand exactly what they'll receive

2. Custom or Complex Projects

For projects where pricing isn't standardized:

- Construction and renovation work

- Custom manufacturing

- Consulting services

- Large-scale orders with volume discounts

3. B2B Sales Processes

Business customers often require formal quotations to:

- Complete purchase order processes

- Obtain approval from multiple stakeholders

- Match against budgets and contracts

4. Service Agreements

Before starting ongoing service relationships:

- Maintenance contracts

- Subscription services

- Professional retainers

When to Use an Invoice

Use invoices when payment is actually due:

1. After Delivering Products

Once you've shipped goods or handed them over to the customer, send an invoice requesting payment.

2. After Completing Services

When the work is finished (or at agreed milestones for larger projects), invoice for the completed work.

3. For Recurring Billing

Send invoices on the regular schedule:

- Monthly subscriptions

- Retainer services

- Lease or rental payments

4. For Immediate Purchases

Retail or point-of-sale transactions where payment happens immediately still need invoices for:

- Accounting records

- Tax documentation

- Customer receipts

How Quotations and Invoices Work Together

The typical sales workflow:

Customer Inquiry

Customer asks about your products or services.

Send Quotation

You provide a detailed quote with pricing and terms.

Negotiation (Optional)

Customer may request changes. You send a revised quotation.

Customer Accepts

Customer agrees to the terms (verbally, in writing, or with a purchase order).

Deliver Goods/Services

You complete the work or ship the products.

Send Invoice

You issue an invoice requesting payment, typically referencing the original quotation number.

Payment Received

Customer pays according to the invoice terms.

Important: A quotation should never replace an invoice. Even if the customer accepts your quotation, you still need to send a proper invoice for payment and accounting purposes.

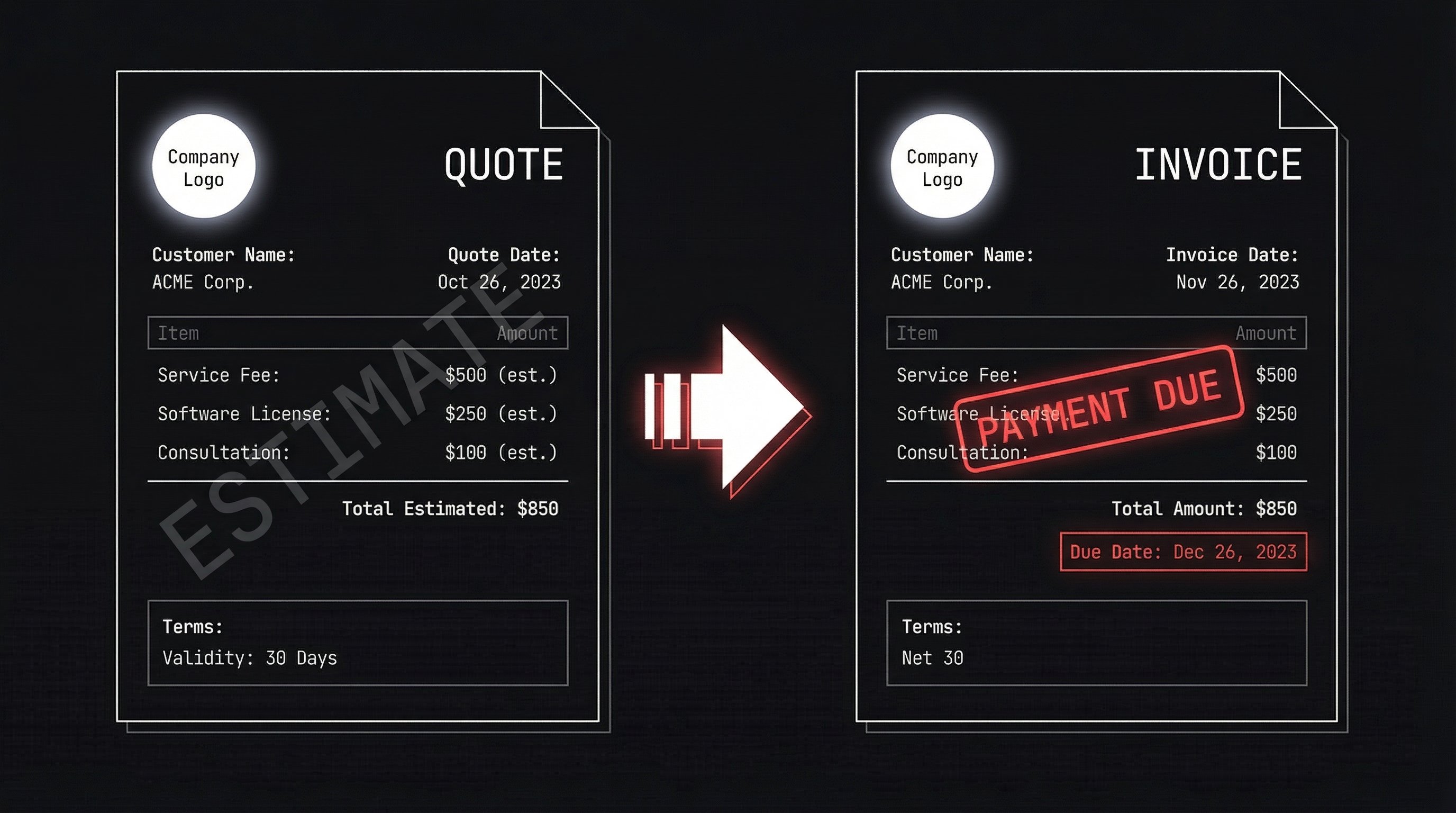

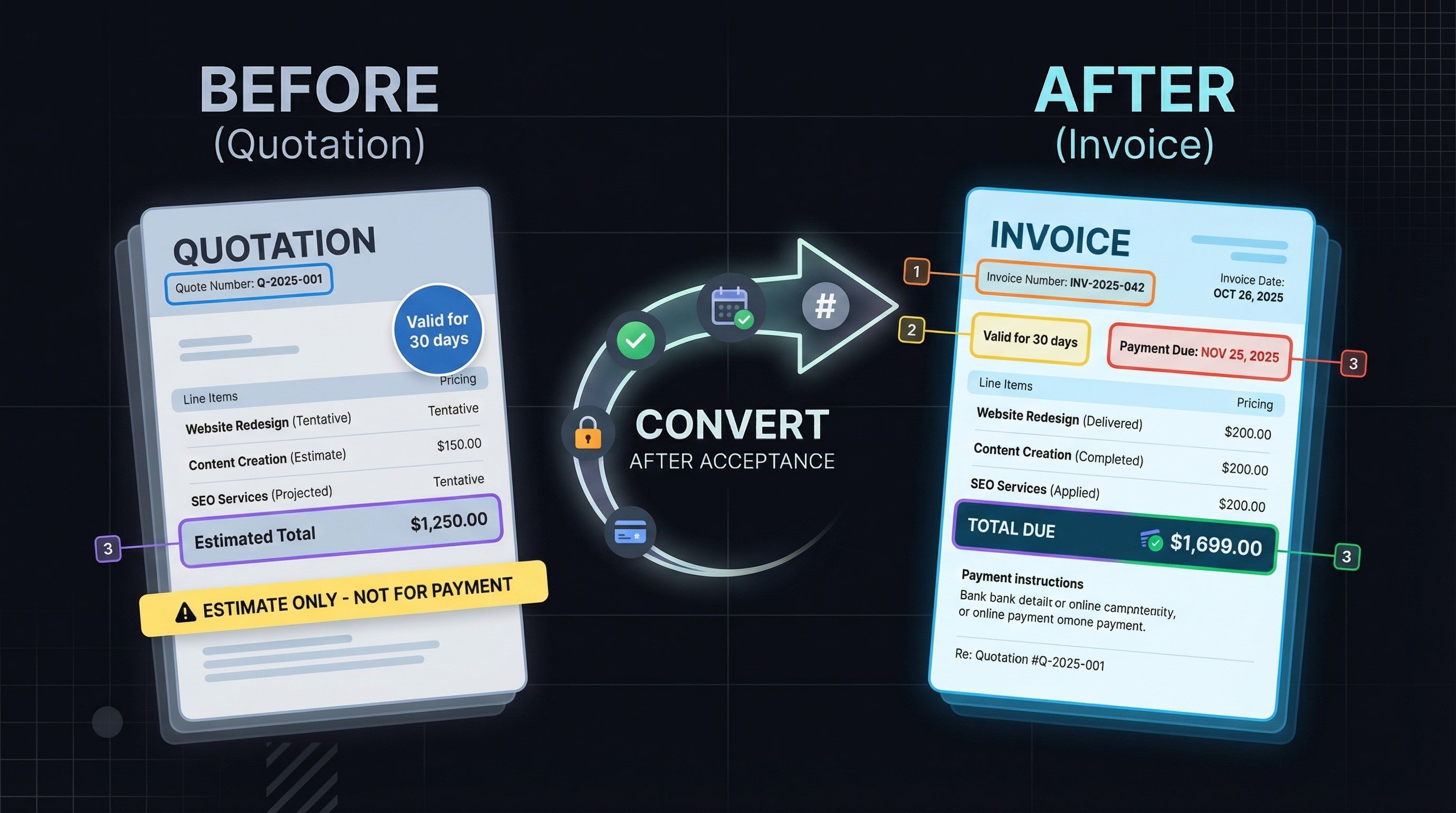

Converting a Quotation to an Invoice

When a customer accepts your quotation, don't just rename it. Create a proper invoice that:

Include These Elements:

- Unique invoice number - different from quote number

- Invoice date - date of issue

- Payment due date - based on your payment terms

- Reference to quotation - "As per quotation #Q-2025-001"

- Actual quantities delivered - may differ from quote

- Payment instructions - bank details, payment methods

- Legal requirements - tax numbers, registration details

Remove These from the Quote:

- "Quotation" header (replace with "Invoice")

- Validity period language

- Tentative or estimated pricing language

- Negotiation terms

Common Mistakes to Avoid

1. Using "Quote" When You Mean "Invoice"

Sending a document labeled "quotation" when requesting payment confuses customers and their accounting departments. They can't pay a quote.

2. Not Following Up After Sending Quotes

Quotations without follow-up have low conversion rates. Set reminders to check in before the quote expires.

3. Sending Invoices Before Delivery

Unless you have agreed-upon advance payment terms, sending invoices prematurely looks unprofessional and may damage trust.

4. Missing the Quote-to-Invoice Reference

Always reference the original quotation number on your invoice. This helps customers match the invoice to their approved budget or purchase order.

5. Not Setting Quotation Expiration Dates

Without an expiration date, you're stuck honoring old pricing even if your costs have increased.

Legal Considerations

Quotation Legal Status:

In many jurisdictions, a quotation can become a binding contract if:

- It contains specific, unambiguous terms

- The customer accepts it in writing

- Both parties intended to create legal relations

Tip: Include clear language like "This quotation is an estimate only and does not constitute a binding contract until confirmed by purchase order" if you want to avoid binding commitments.

Invoice Legal Status:

Invoices are always legally binding documents. They:

- Create a legal obligation to pay

- Can be used as evidence in court

- Must comply with tax regulations

- Form the basis for debt collection

Key Takeaways

- Quotations are sent before work - they're proposals, not payment requests

- Invoices are sent after work - they're legal demands for payment

- Never use a quotation to request payment - always send a proper invoice

- Reference your quotation number on the final invoice for clear tracking

- Both documents serve important but completely different roles in your sales process

- Keep quotations flexible and negotiable; make invoices clear and final