Best Practices for Cleaning Service Invoicing in 2025

The cleaning services industry is booming, projected to grow the software market from $1.79 billion in 2024 to $1.96 billion in 2025. Yet, many owners struggle with invoicing, leading to cash flow issues—up to 90% face problems like missed invoices or delayed payments. In 2025, effective cleaning service invoicing means embracing automation and compliance to get paid faster.

This guide covers best practices tailored for cleaning businesses, from essential invoice elements to cutting-edge tools. Whether you handle residential or commercial jobs, these strategies will optimize your billing process.

Ready to streamline your cleaning business invoicing? Try PineBill for free and create professional invoices in seconds—no credit card required.

Why Invoicing Matters for Cleaning Services

Cleaning businesses often deal with recurring contracts, variable job scopes, and material costs. Poor invoicing can result in lost revenue—studies show service calls without invoices cost cleaning firms thousands monthly. In 2025, with rising operational costs and labor shortages, accurate billing is crucial for profitability.

Key challenges include:

- Tracking time and supplies for one-off deep cleans versus routine maintenance.

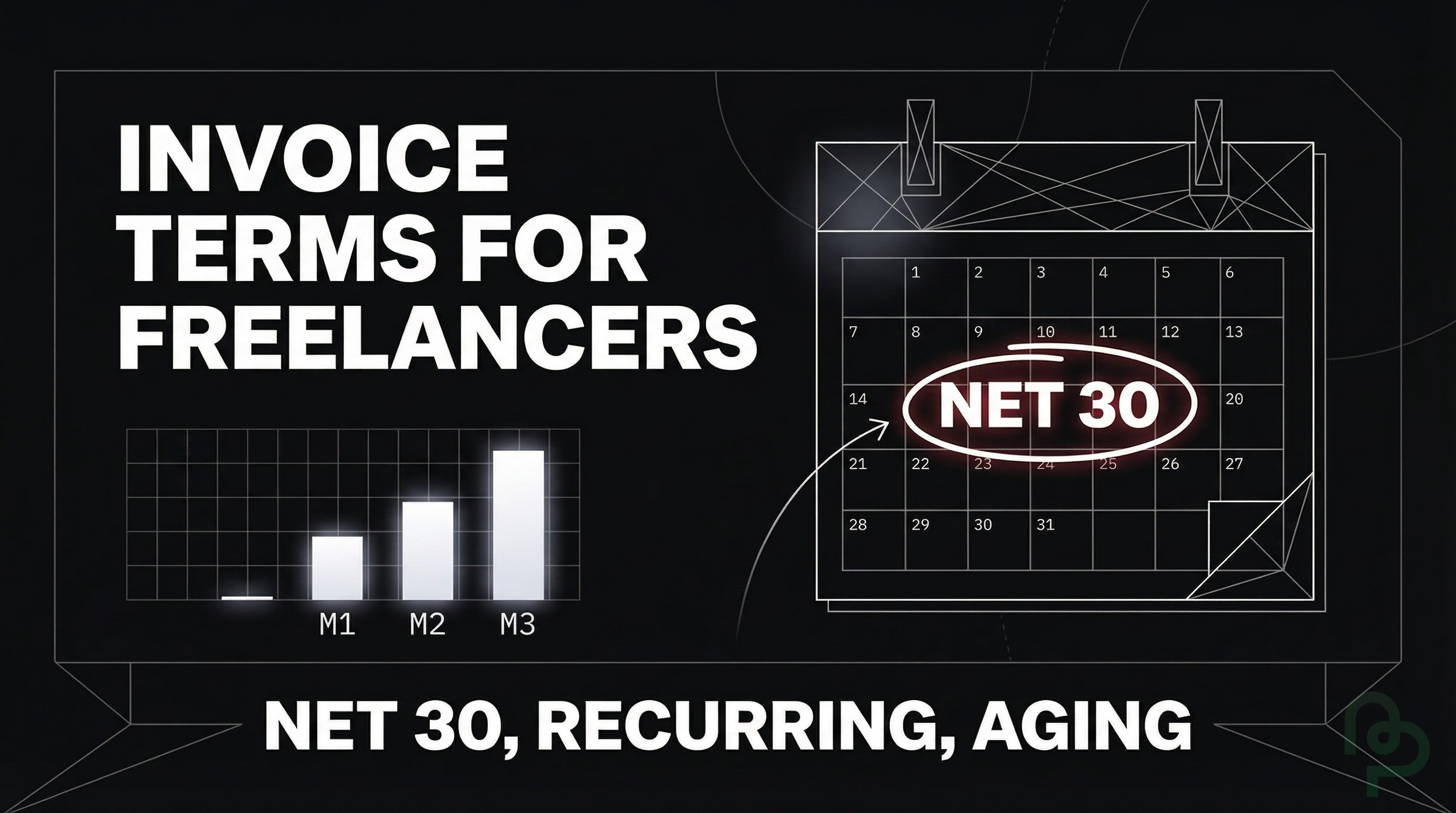

- Managing multiple clients with different payment terms.

- Ensuring compliance with tax laws amid evolving regulations.

Adopting best practices reduces these issues by 75% through automation, according to industry reports.

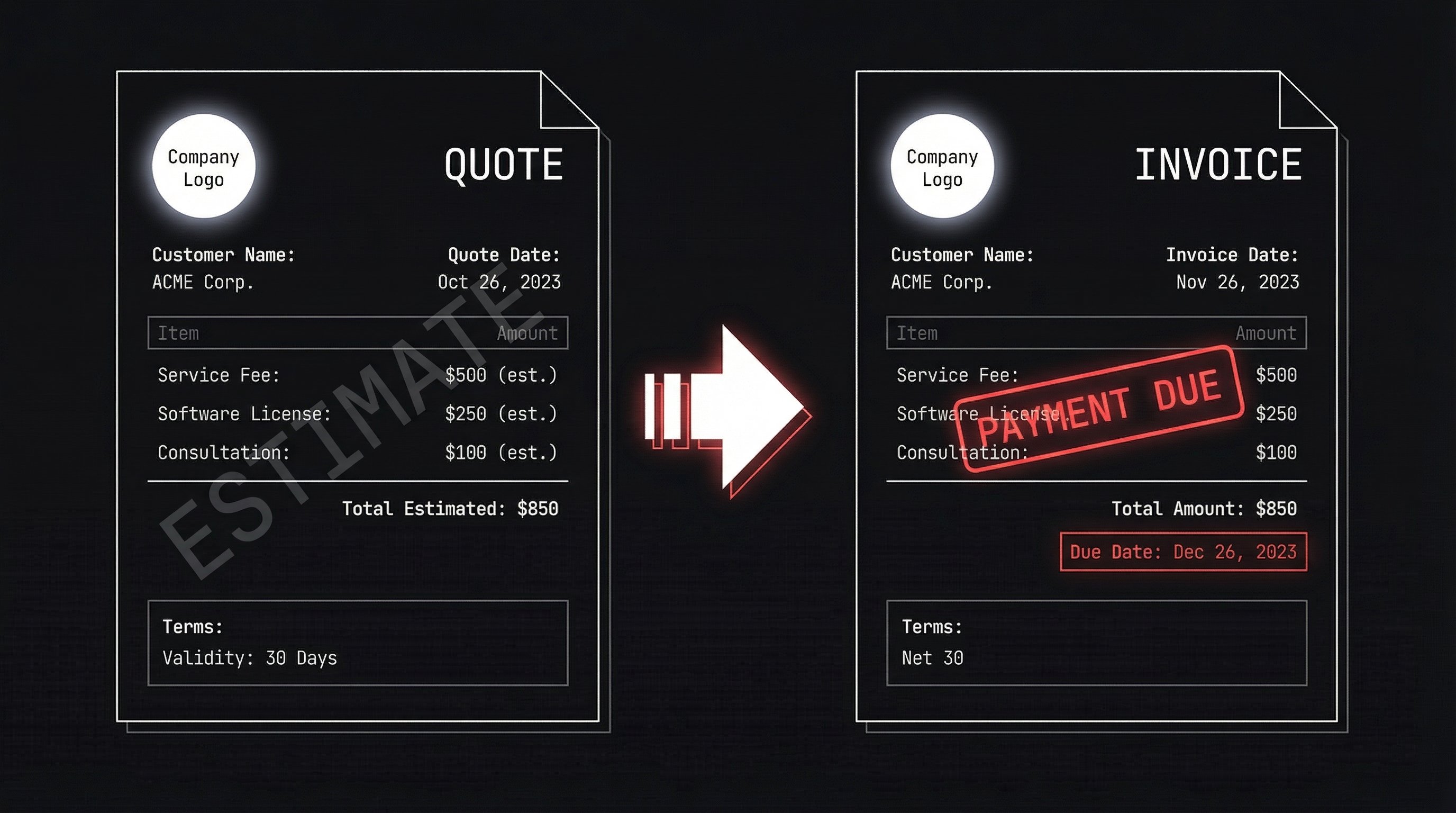

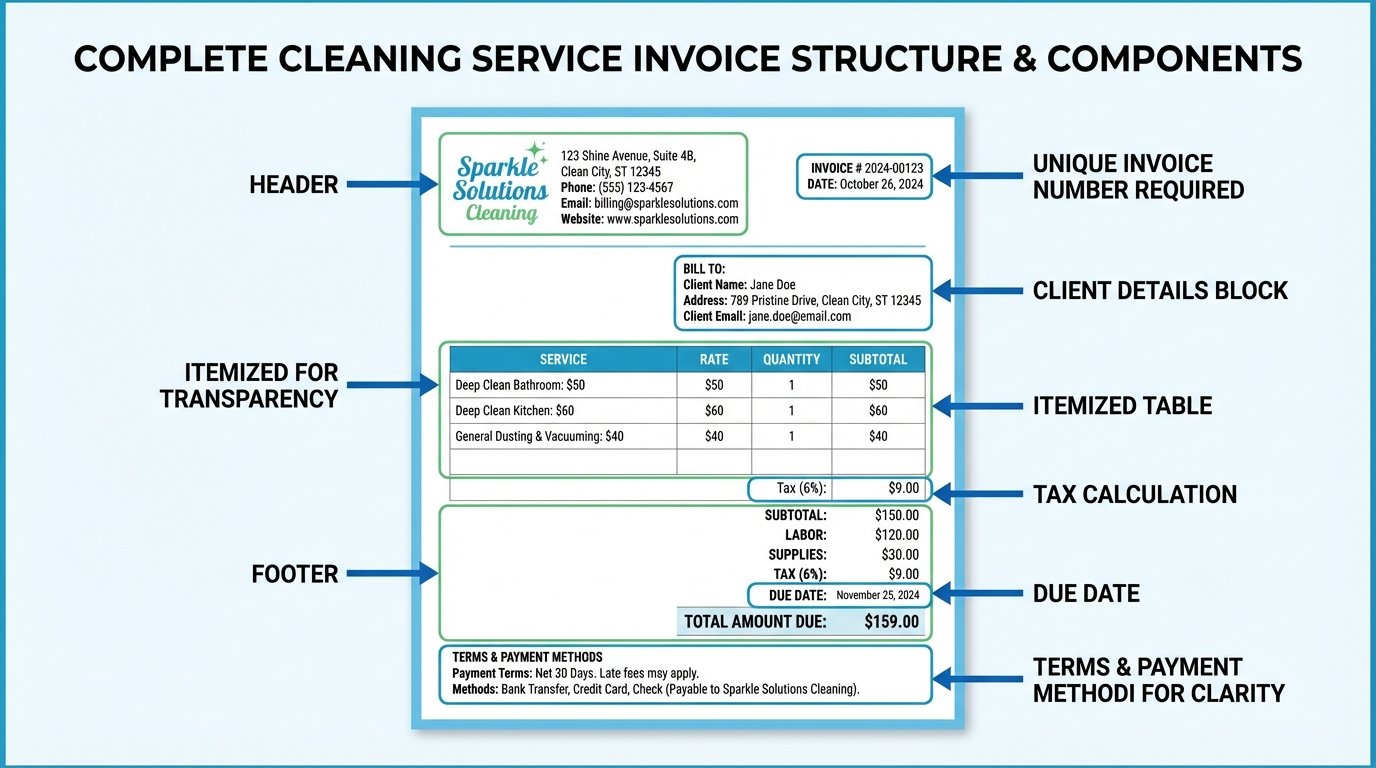

Essential Elements of a Cleaning Service Invoice

A professional invoice builds trust and speeds up payments. Include these core components:

- Your Business Details: Company name, logo, address, phone, email, and tax ID.

- Client Information: Name, contact details, and billing address.

- Invoice Number and Date: Unique sequential number (e.g., INV-2025-001) and issue date.

- Service Description: Itemized list—e.g., "Weekly office cleaning: 4 hours @ $25/hr" or "Deep clean kitchen: $150 flat fee." Break down labor, materials (detergents, equipment), and any add-ons like eco-friendly supplies.

- Rates and Totals: Hourly rates, flat fees, subtotal, taxes (sales tax varies by state, average 6-7%), and total due.

- Payment Terms: Due date (e.g., Net 15), accepted methods (ACH, credit card), and late fees (1-1.5% monthly, check state caps).

- Notes Section: Reminders for recurring services or next appointment.

Use templates to standardize this. For recurring clients, pre-fill details to save time.

💡 Pro Tip: PineBill provides customizable cleaning service invoice templates with all these elements built-in. Start creating professional invoices now and get paid faster.

Legal Requirements for Invoicing in 2025

In the US, invoices aren't always legally required but are essential for tax compliance and disputes. Key 2025 updates:

- Sales Tax: Collect and remit based on service location. Most states tax cleaning services (e.g., California at 7.25-10.25%). Use nexus rules for multi-state operations.

- Retention Rules: Keep records for 4 years per Federal Acquisition Regulation (FAR) for government contracts.

- E-Invoicing Mandates: Some states push digital formats for transparency; prepare for potential federal expansions to curb tax fraud.

- Late Fees: Caps vary—e.g., 1.5% max in many states. Always disclose in contracts.

- Accessibility: Include clear terms to avoid disputes; ADA compliance for digital invoices.

Consult a tax professional for your state. Tools like PineBill automate tax calculations to ensure accuracy and compliance, saving you hours of manual work each month.

Best Practices for Cleaning Service Invoicing in 2025

1. Send Invoices Promptly

Timely billing is key—send within 24-48 hours of job completion. For recurring services, automate weekly or monthly sends. This reduces disputes and improves cash flow by 30%, per industry data.

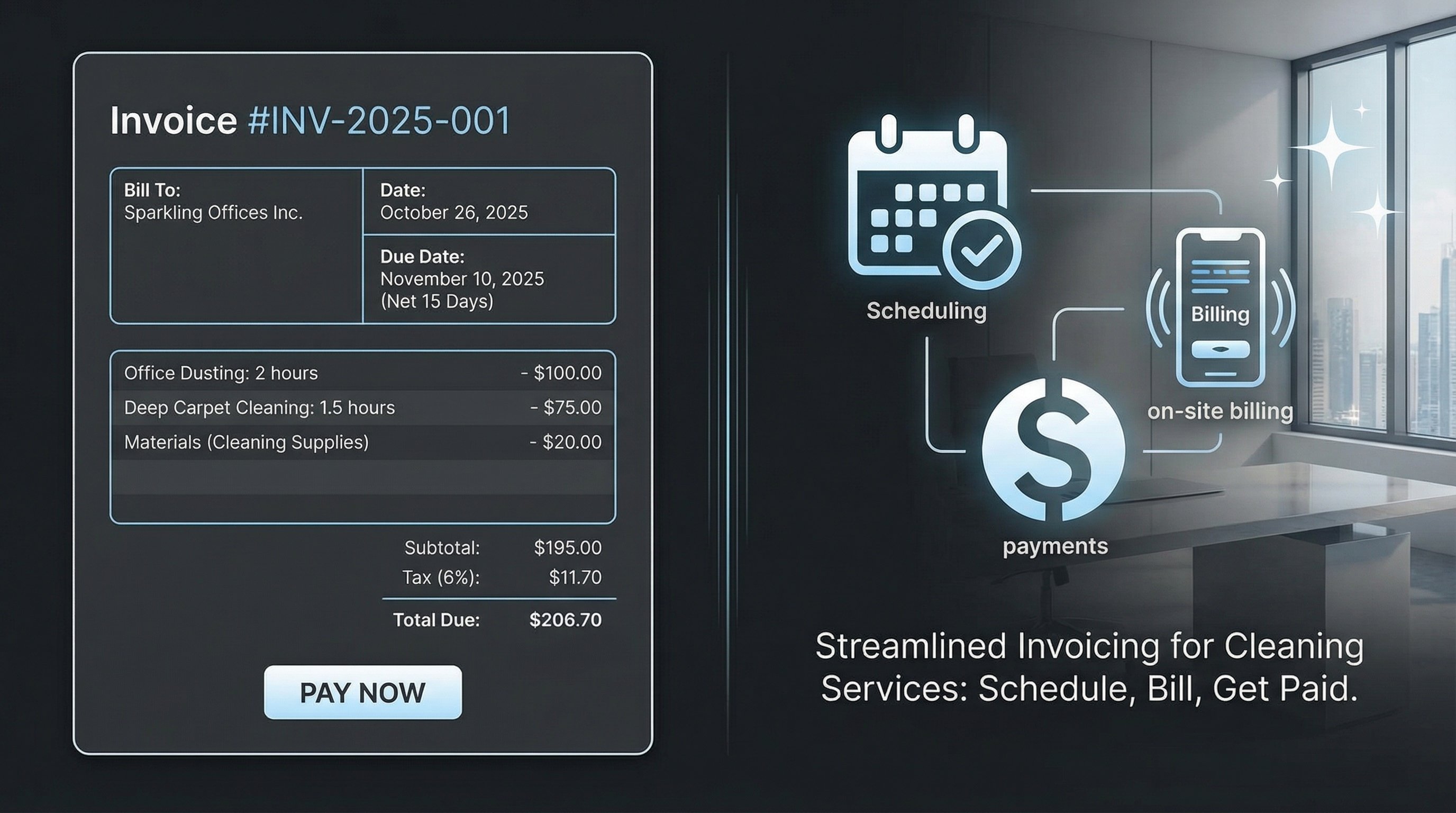

2. Go Digital and Automate

Paper invoices are outdated. Use cloud-based software for:

- Mobile apps to generate invoices on-site.

- Auto-reminders for overdue payments.

- Integration with scheduling tools.

In 2025, AI-driven automation predicts payment delays and suggests follow-ups.

Stop chasing payments manually. PineBill's automated reminder system ensures you get paid on time, every time. Join hundreds of cleaning businesses already saving 10+ hours per week.

3. Customize for Service Types

- Residential: Focus on simplicity—flat fees for homes.

- Commercial: Detail square footage, frequency, and compliance certifications (e.g., green cleaning).

- One-Off Jobs: Include before/after notes or photos for verification.

4. Set Clear Payment Policies

Offer incentives like 2% early payment discounts. Integrate multiple payment options—80% of clients prefer digital methods.

5. Track and Analyze

Monitor metrics like average payment time (aim for under 15 days) and invoice rejection rates. Use analytics to refine pricing.

| Best Practice | Benefit | Tool Example |

|---|---|---|

| Itemized Line Items | Transparency reduces disputes | PineBill templates |

| Automated Reminders | 75% faster collections | Jobber integration |

| Mobile Invoicing | On-site billing | ZenMaid app |

| Tax Automation | Compliance ease | QuickBooks sync |

How to Create a Cleaning Service Invoice: Step-by-Step

Gather Job Details

Log hours, services performed, materials used, and client feedback. Use a mobile app to capture this in real-time.

Select a Template

Choose a customizable template in your invoicing software. Input business and client info automatically from your CRM.

Itemize Services

Break down charges: e.g., Labor: 3 hours @ $30/hr = $90; Supplies: $15; Tax: $7.95; Total: $112.95.

Add Terms and Send

Include due date and terms. Send via email or client portal. Track delivery and openings for follow-up.

Follow Up

If unpaid after 7 days, send a polite reminder. Escalate to late fees if needed.

Top Invoicing Tool for Cleaning Businesses in 2025

PineBill cuts invoicing time by 50% and boosts on-time payments. With features specifically designed for cleaning businesses:

- ✅ Mobile invoicing - Create and send invoices from any job site

- ✅ Smart tax calculations - Stay compliant across all states

- ✅ Multiple payment options - ACH, credit cards, and more

- ✅ Customizable templates - Match your brand identity

Start your free trial today and transform your cleaning business billing in minutes, not months.

Key Takeaways

- Prioritize detailed, digital invoices to build client trust.

- Automate for efficiency—expect 75% faster processing in 2025.

- Stay compliant with 2025 tax and e-invoicing rules.

- Analyze metrics to optimize cash flow.

- Integrate invoicing with operations for seamless workflows.

- Use tools like PineBill to handle recurring billing effortlessly.

Implementing these practices will transform your cleaning service invoicing from a chore to a revenue driver.

Ready to Get Paid Faster?

Don't let complicated invoicing hold your cleaning business back. Join PineBill today and experience:

- Free trail plan available - No credit card required

- Set up in under 5 minutes - Start invoicing immediately

- Get paid 3x faster - Automated reminders and multiple payment options

- Save 10+ hours per week - Focus on cleaning, not paperwork