How to Calculate Time and a Half: Overtime Pay Guide

Struggling with overtime calculations? Many small business owners underpay or overpay employees due to time and a half confusion, risking fines up to $1,000 per violation under FLSA. Get it right with this guide.

What Is Time and a Half?

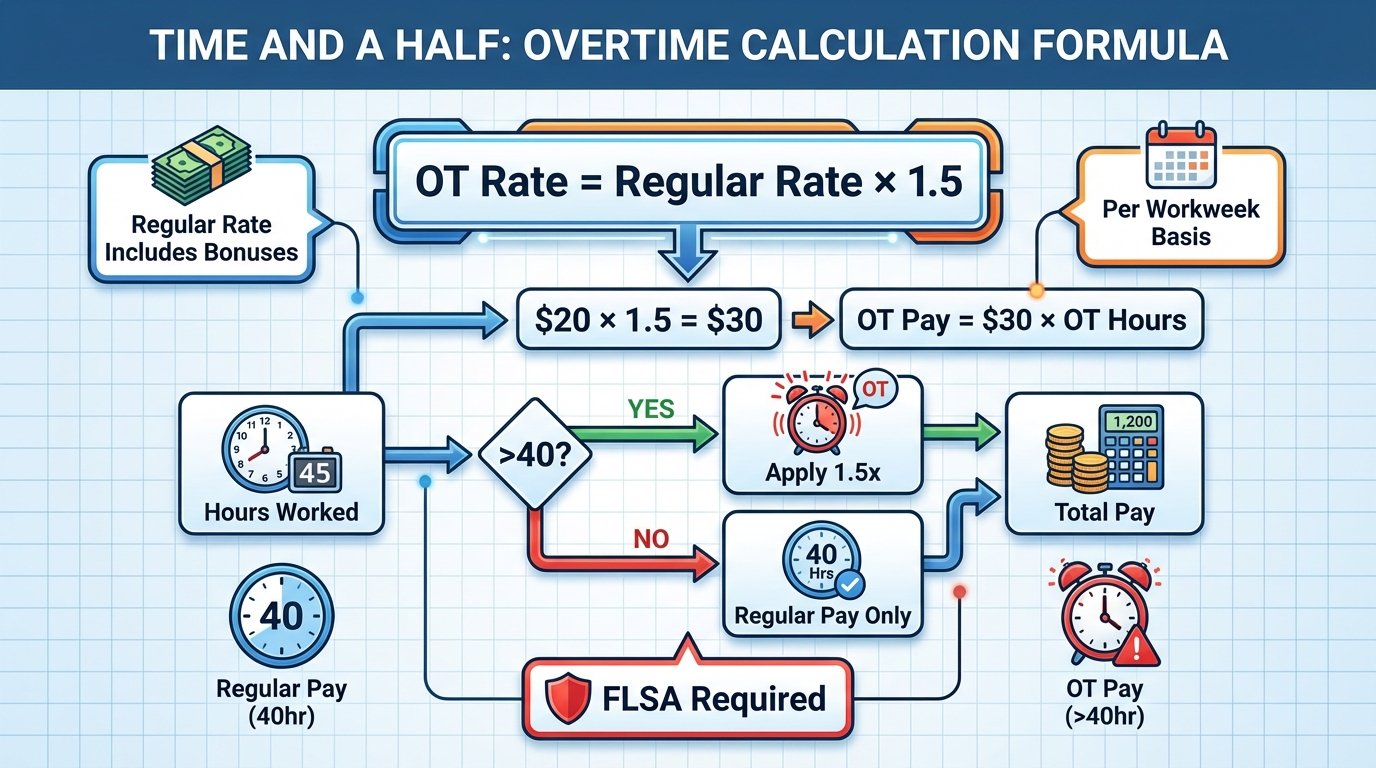

Time and a half means paying non-exempt employees 1.5 times their regular hourly rate for hours worked over 40 in a workweek. This stems from the Fair Labor Standards Act (FLSA), covering most U.S. hourly workers.

Federal law mandates this for overtime, but some states like California require daily overtime after 8 hours. According to the U.S. Department of Labor, non-compliance affects millions of workers annually.

Who Qualifies for Time and a Half?

Only non-exempt employees qualify. Exempt workers (executive, administrative, professional) earning above $35,568 annually ($684/week as of 2025, post-rule vacatur) don't get overtime.

Hourly employees are typically non-exempt. Salaried non-exempt get overtime based on their regular rate equivalent.

Small businesses: Classify correctly to avoid DOL audits. Misclassification is the top overtime violation.

Federal and State Overtime Laws

FLSA requires time and a half after 40 hours/week. Key 2025 notes:

- Salary threshold reverted to 2019 levels after 2024 rule blocked.

- States like CA, NY require daily OT (after 8-10 hours/day).

- No federal daily OT, but 7 states mandate it.

| Requirement | Federal (FLSA) | Example States (Stricter) |

|---|---|---|

| OT Trigger | >40 hrs/week | CA: >8 hrs/day or >40/week |

| Rate | 1.5x regular | Same, or 2x on 7th day (CA) |

| Exempt Salary | $35,568/year | Higher in some states |

Always check state laws via DOL website.

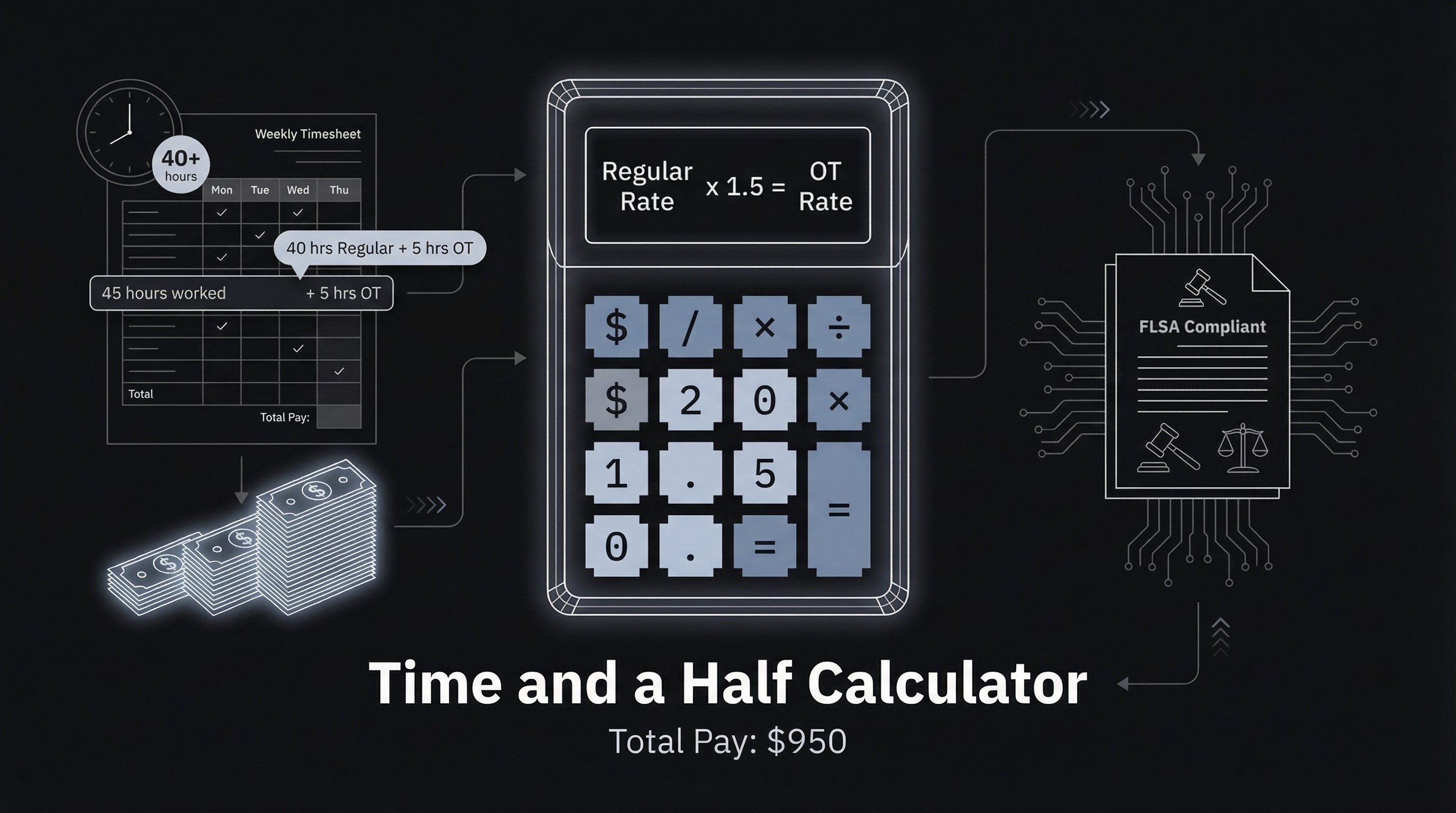

How to Calculate Time and a Half: Step-by-Step

Follow these steps for accurate payroll.

Determine Regular Hourly Rate

Include base wage plus non-discretionary bonuses/shift differentials divided by total hours.

Example: $20/hr base + $200 weekly bonus / 40 hrs = $25 regular rate.

Add to Regular Pay

Total pay = (regular rate x 40) + OT pay.

Real-World Calculation Examples

| Scenario | Regular Rate | Reg Hrs | OT Hrs | OT Rate | Total Pay |

|---|---|---|---|---|---|

| Basic Weekly | $15 | 40 | 5 | $22.50 | $697.50 |

| With Bonus | $20 (+$100 bonus/40hrs = $22.50 reg) | 40 | 10 | $33.75 | $1,012.50 |

| Salaried Non-Exempt ($800/wk /40 = $20/hr) | $20 | 35 | 10 | $30 | $950 |

BLS data shows average 3.6 OT hours/week across industries.

Common Mistakes to Avoid

- Wrong regular rate: Exclude bonuses? Fines follow.

- Averaging hours: Calculate per workweek, not pay period.

- Off-clock work: Training, travel counts.

- Exempt misclassification: Review duties test.

- State ignorance: CA daily OT trips up many.

DOL recovered $238M in back wages last year.

Key Takeaways

- Time and a half = 1.5x regular rate after 40 hrs/week (FLSA).

- Include all pay in regular rate.

- Check state laws for daily OT.

- Use tools like PineBill for compliance.

- Audit classifications annually.