How to Calculate Gross Profit: Formula and Examples

Most businesses maintain a gross profit margin between 20% and 40% to sustain healthy operations (Investopedia, 2025). Falling below this range suggests your production costs are consuming revenue before you've paid for overhead items like rent. This guide provides the exact formula to calculate your gross profit and identifies how to optimize your margins for higher growth.

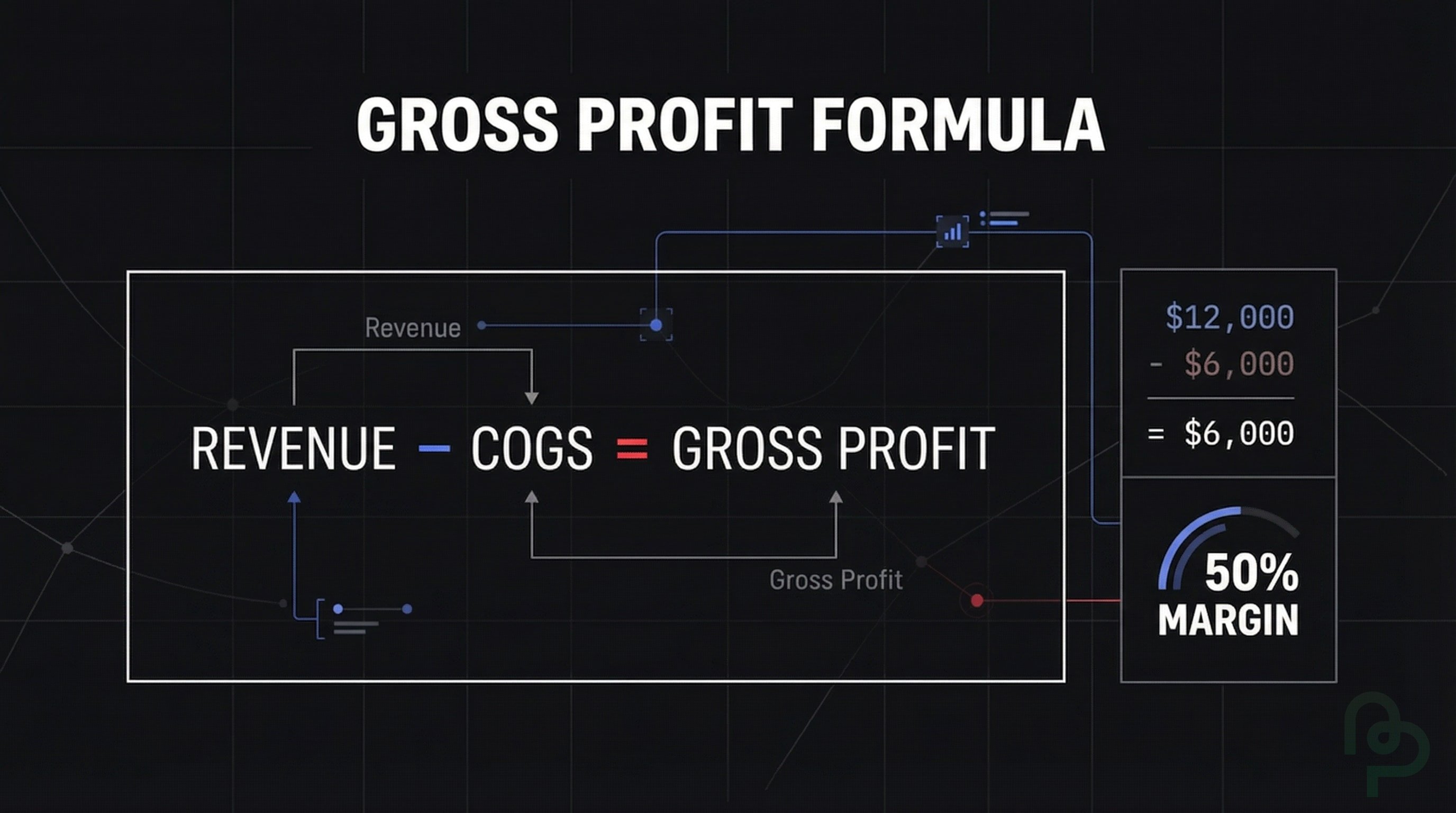

The Gross Profit Formula

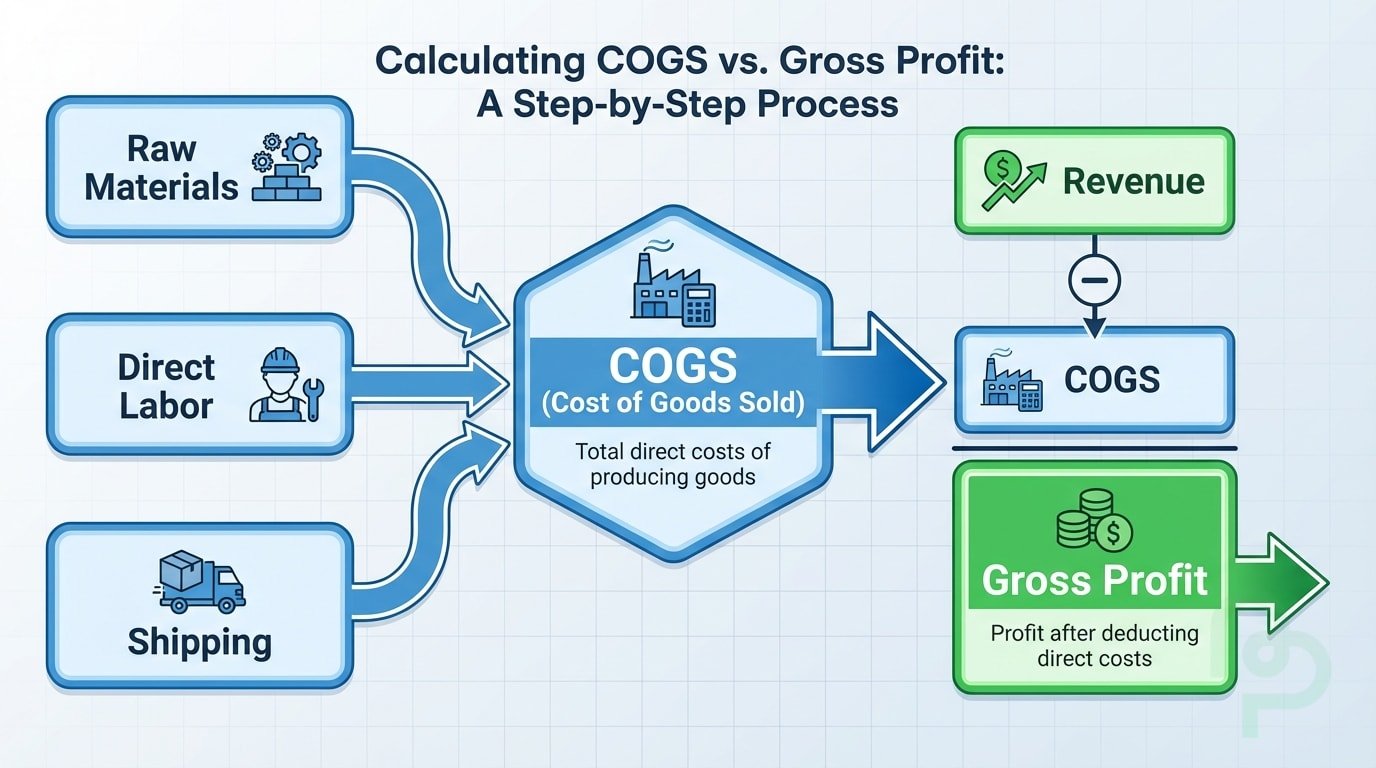

Gross profit represents the money you keep after accounting for the direct costs of creating your products. You'll subtract the Cost of Goods Sold (COGS) from your total revenue to find this figure. It doesn't include "below the line" expenses like insurance or administrative salaries.

Revenue - Cost of Goods Sold (COGS) = Gross Profit

Suppose you run a manufacturing firm that generated $15,000 in sales last month. If your materials and factory labor cost $8,000, your gross profit is $7,000. This number tells you how much cash is available to cover your fixed operating expenses and tax obligations.

Understanding Cost of Goods Sold (COGS)

COGS includes only variable costs that fluctuate with your production volume. If you don't produce a unit, you don't incur these specific expenses. Common examples include raw materials, direct manufacturing labor, and shipping fees for customer orders.

You won't include rent, marketing, or legal fees in your COGS calculation. These are fixed costs that remain steady regardless of how many units you sell. Automated business management tools like PineBill help you categorize these expenses so your profit-and-loss statements remain accurate throughout the fiscal year.

Gross Profit vs. Net Income

Gross profit only measures the efficiency of your production or service delivery. Net income, often called the "bottom line," is what remains after you deduct every single expense your business incurs. A company with a healthy gross profit can still lose money if its overhead costs are too high.

| Feature | Gross Profit | Net Income |

|---|---|---|

| Calculation | Revenue - COGS | Gross Profit - Operating Expenses - Taxes |

| Focus | Production efficiency | Overall business profitability |

| Benchmarks | 50%+ indicates strong health (MYOB, 2024) | Varies widely by industry |

| Includes Tax? | No | Yes |

Source: Paychex, 2024

How to Improve Your Profitability

Improving your gross profit generally requires adjusting either your pricing or your supply chain. If you increase your product price from $2,500 to $2,800 without increasing production costs, every dollar of that increase goes directly into your gross profit. Alternatively, you can negotiate better rates with suppliers to lower your COGS.

Software platforms like PineBill sync your spending data, making it easier to spot when material costs rise unexpectedly. You'll want to review your margins quarterly to ensure a specific product isn't suddenly becoming more expensive to produce. Consistent monitoring prevents small cost increases from eroding your annual earnings.

Key Takeaways

- Use the direct formula—subtract COGS from net sales to determine your gross profit.

- Target healthy benchmarks—aim for a gross profit margin above 50% for optimal financial health (MYOB, 2024).

- Isolate variable costs—don't include fixed expenses like rent or insurance in your COGS.

- Monitor margins regularly—adjust pricing or sourcing if your production efficiency drops below 20% (Investopedia, 2025).

- Review industry averages—service industries often have higher margins than retail due to lower inventory costs.