How Many Working Hours in a Year? 2025 Guide

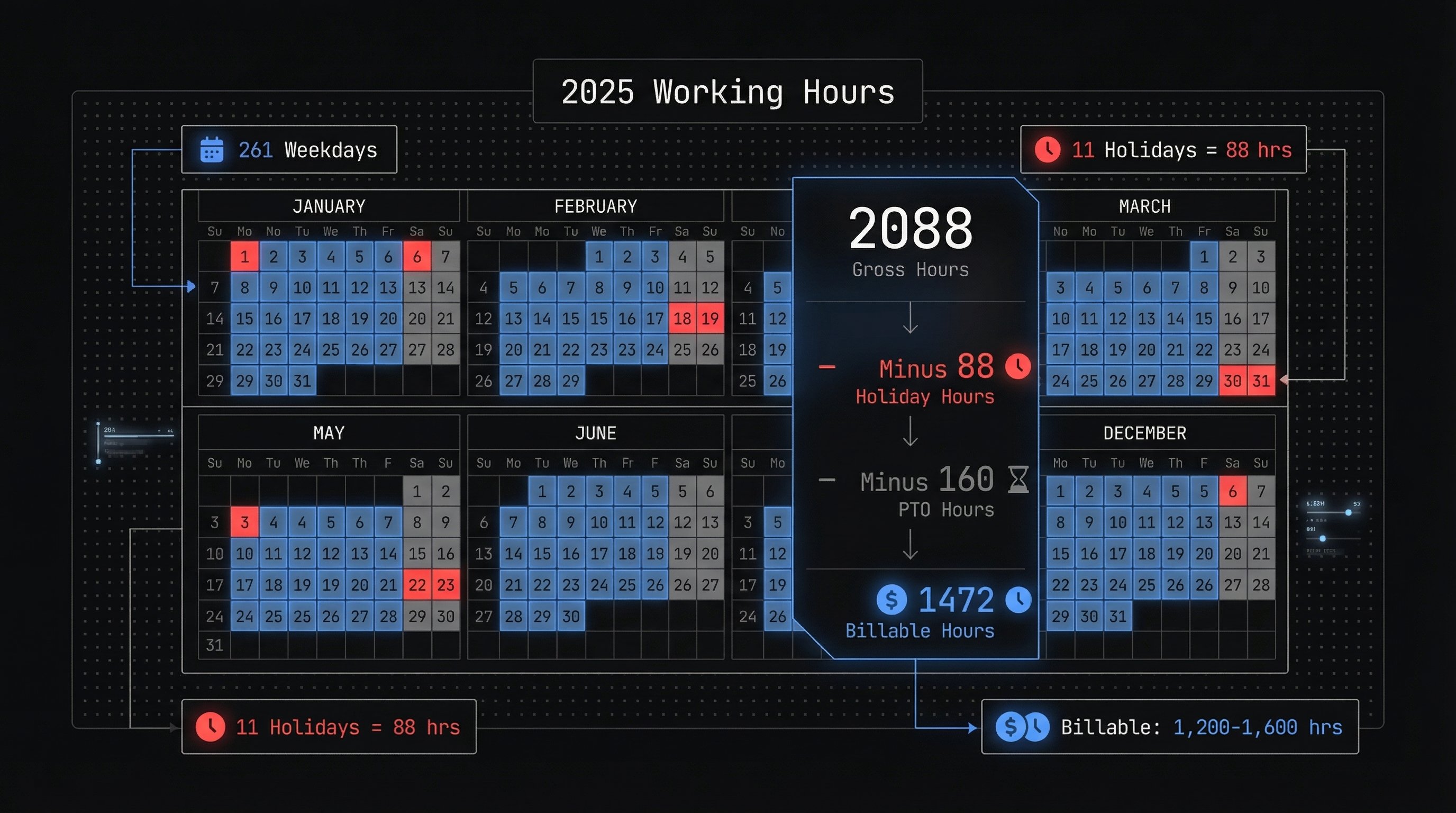

Running a business or freelancing means maximizing every billable minute. But how many working hours in a year do you actually have? The standard calculation—2,080 hours (40 hours/week × 52 weeks)—ignores holidays, vacations, and non-billable time.

In 2025, U.S. businesses face 261 weekdays but only 250 after federal holidays. After accounting for time off, realistic working hours drop to around 2,000 hours for full-time employees. For freelancers, billable hours range from 1,200 to 1,600 annually due to admin work and downtime.

This guide breaks down the numbers, calculations, and strategies to leverage your time effectively. Whether you're setting freelance rates, managing payroll, or ensuring labor compliance, accurate hour tracking with tools like PineBill is essential for profitability.

Gross Working Hours: The Starting Point

Start with the basics: a standard 40-hour workweek across 52 weeks equals 2,080 hours per year. This is the average work hours per year used as the baseline for most calculations.

Standard formula: 52 weeks × 5 days/week × 8 hours/day = 2,080 hours

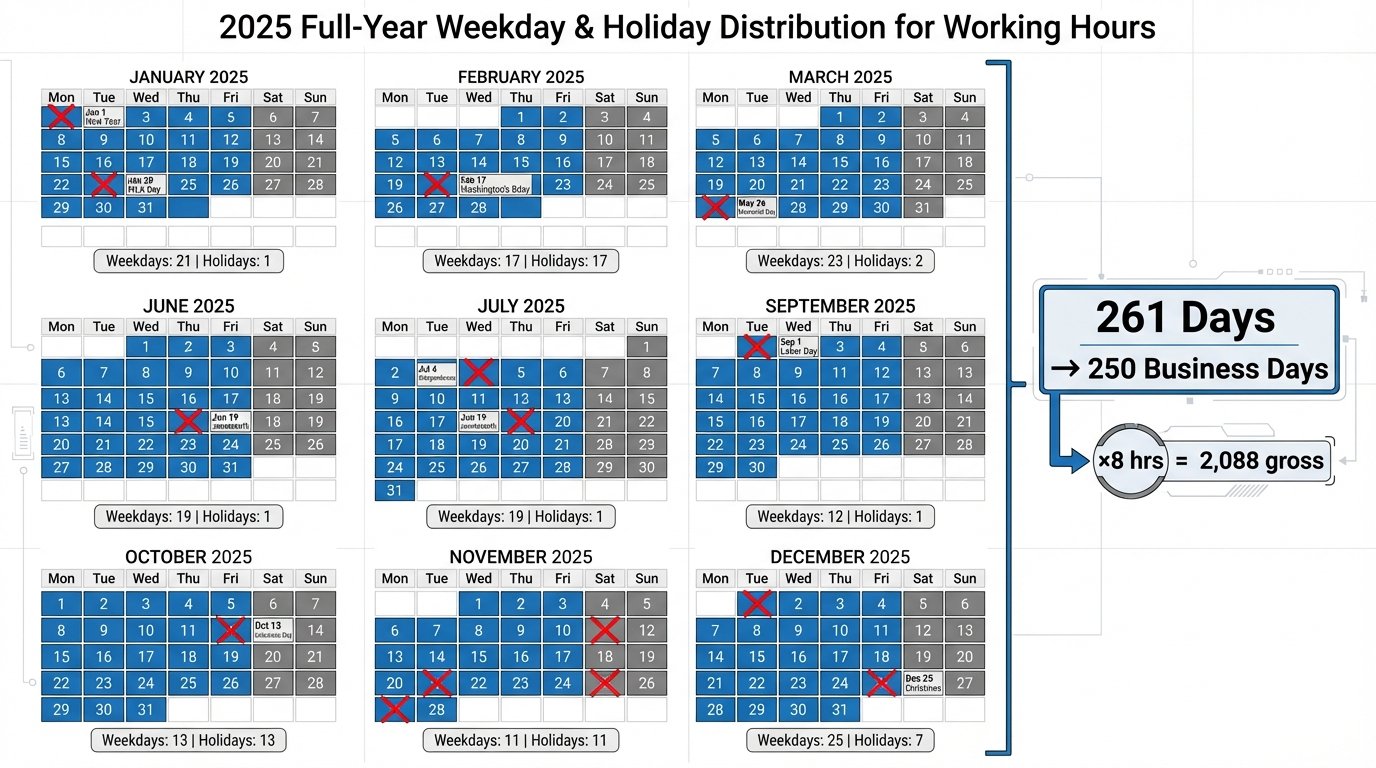

For 2025 specifically:

- Total weekdays (Monday-Friday): 261 days

- At 8 hours/day: 2,088 gross hours

This represents gross hours before deducting any time off—pure potential work capacity. Company policies, regional differences, and industry standards will significantly impact your actual working hours.

Working hours by employment type (2025):

| Employment Type | Hours/Week | Weeks/Year | Gross Annual Hours | Typical Time Off | Net Annual Hours |

|---|---|---|---|---|---|

| Full-time | 40 | 52 | 2,088 | 26 days | 1,880 |

| Part-time (30hrs) | 30 | 52 | 1,560 | 15 days | 1,440 |

| Part-time (20hrs) | 20 | 52 | 1,040 | 10 days | 960 |

| Freelancer/Contractor | 40 | 50 | 2,000 | Self-managed | 1,200-1,600 (billable) |

| Shift worker (rotating) | 37.5 | 52 | 1,950 | 20 days | 1,790 |

Subtract Holidays: 2025 U.S. Federal Holidays

The U.S. observes 11 federal holidays in 2025, all falling on weekdays:

| Date | Holiday | Day |

|---|---|---|

| Jan 1 | New Year's Day | Wed |

| Jan 20 | MLK Day | Mon |

| Feb 17 | Presidents' Day | Mon |

| May 26 | Memorial Day | Mon |

| Jun 19 | Juneteenth | Thu |

| Jul 4 | Independence Day | Fri |

| Sep 1 | Labor Day | Mon |

| Oct 13 | Columbus Day | Mon |

| Nov 11 | Veterans Day | Tue |

| Nov 27 | Thanksgiving | Thu |

| Dec 25 | Christmas | Thu |

Impact: 11 days × 8 hours = 88 hours subtracted.

Post-holidays: 261 - 11 = 250 business days or 2,000 hours.

Factor in Vacation and PTO

Average U.S. full-time employees get 10-15 vacation days annually (BLS data), plus sick time.

Common PTO scenarios and their impact:

| Scenario | Vacation Days | Sick Days | Total Time Off (Hours) | Net Working Hours |

|---|---|---|---|---|

| Minimal PTO | 10 | 5 | 120 | 1,880 |

| Standard PTO | 12 | 5 | 136 | 1,864 |

| Generous PTO | 15 | 5 | 160 | 1,840 |

| Extended PTO | 20 | 5 | 200 | 1,800 |

Calculation: 2,088 gross hours - 88 holiday hours - PTO hours = Net working hours

Real-world example: With 11 federal holiday days and 5 sick days, actual working hours = 2,000 hours (2,088 - 88 holiday hours).

OECD data shows U.S. workers average 1,796 hours/year including part-timers and actual worked time.

Billable Hours for Freelancers and SMBs

Freelancers don't bill 100% of time. Subtract:

- Admin/marketing: 20-30%

- Vacation/sick: 4-6 weeks

- Unpaid downtime

Realistic billable hours: 1,200-1,600/year (25-50% utilization).

Freelancer billable hours breakdown:

| Utilization Rate | Non-Billable % | Starting Hours | Vacation (weeks) | Billable Hours | Annual Income @ $75/hr |

|---|---|---|---|---|---|

| Conservative | 30% | 2,000 | 6 | 1,200 | $90,000 |

| Moderate | 25% | 2,000 | 5 | 1,400 | $105,000 |

| Aggressive | 20% | 2,000 | 4 | 1,472 | $110,400 |

| Optimal | 20% | 2,000 | 3 | 1,600 | $120,000 |

Example calculation:

- Start: 2,000 hours (post-holidays)

- Minus 4 weeks vacation: 160 hours → 1,840

- Minus 20% non-billable: 368 hours → 1,472 billable hours

Use this to set rates: Desired income ÷ billable hours = hourly rate.

Freelance rate calculator (based on billable hours):

| Desired Annual Income | 1,200 Billable Hrs | 1,400 Billable Hrs | 1,600 Billable Hrs | Recommended Rate* |

|---|---|---|---|---|

| $60,000 | $50/hr | $43/hr | $38/hr | $50/hr |

| $80,000 | $67/hr | $57/hr | $50/hr | $67/hr |

| $100,000 | $83/hr | $71/hr | $63/hr | $83/hr |

| $120,000 | $100/hr | $86/hr | $75/hr | $100/hr |

| $150,000 | $125/hr | $107/hr | $94/hr | $125/hr |

*Recommended rate based on conservative 1,200 billable hours + 25-30% buffer for taxes/overhead.

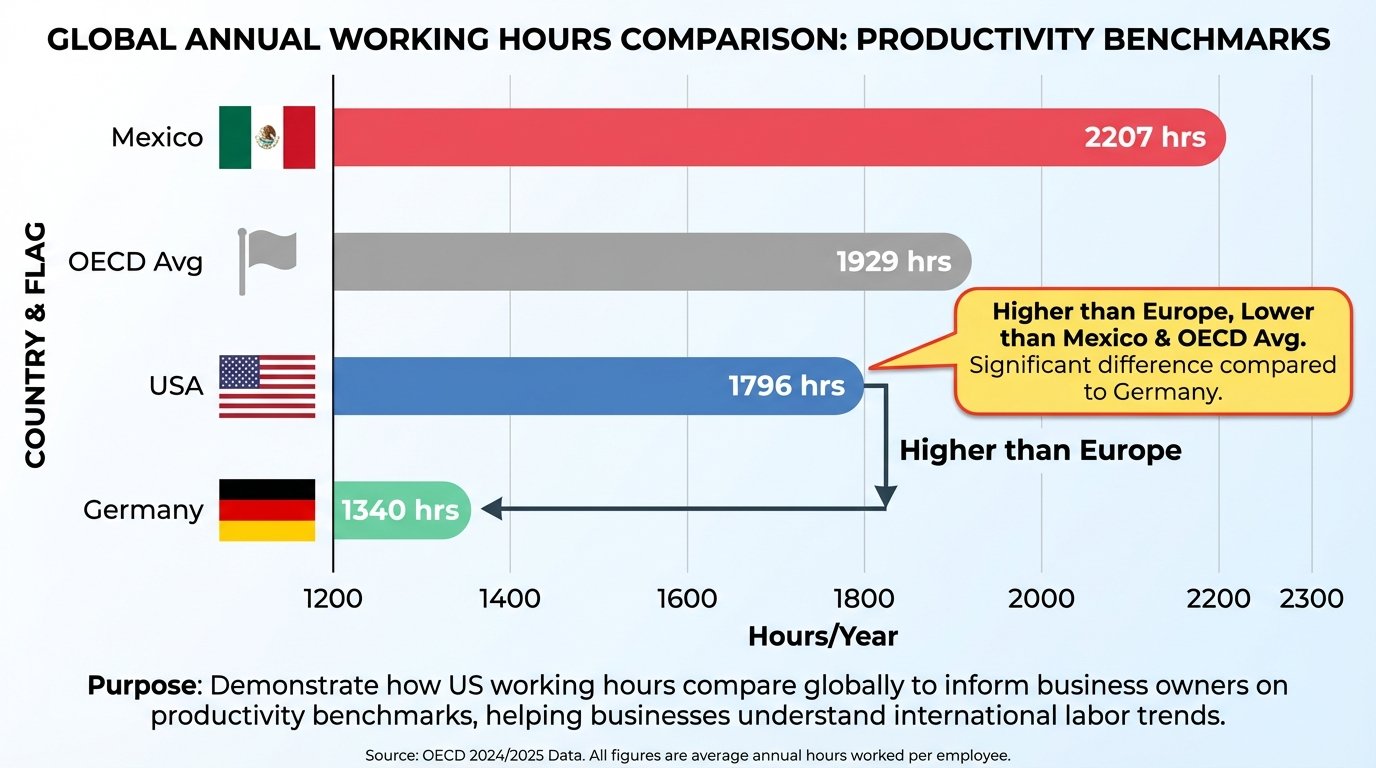

Global Comparison: Hours Worked by Country

U.S. workers log more hours than most developed nations (OECD 2024 data):

| Country | Annual Hours (Avg per Worker) |

|---|---|

| Mexico | 2,207 |

| Costa Rica | 2,100+ |

| USA | 1,796 |

| OECD Avg | 1,929 |

| Germany | 1,340 |

| Netherlands | 1,430 |

Source: OECD, Clockify 2025 stats.

How to Calculate Your Exact Working Hours

Customize for your situation:

Gather Inputs

List your workweek hours, holidays observed, PTO days, and non-billable percentage.

Compute Gross

Weekdays in 2025 × daily hours (e.g., 261 × 8 = 2,088).

Subtract Fixed Time Off

Holidays + PTO days × hours/day.

Apply Utilization Rate

Net hours × billable % (e.g., 80%).

Step-by-step calculation example:

| Step | Description | Calculation | Result |

|---|---|---|---|

| 1 | Total weekdays in 2025 | 261 days × 8 hours/day | 2,088 hours |

| 2 | Subtract federal holidays | 2,088 - (11 days × 8 hrs) | 2,000 hours |

| 3 | Subtract vacation days | 2,000 - (10 days × 8 hrs) | 1,920 hours |

| 4 | Subtract sick days | 1,920 - (5 days × 8 hrs) | 1,880 hours |

| 5 | Apply non-billable % (20% for freelancers) | 1,880 × 0.80 | 1,504 billable hours |

This calculation shows a realistic billable hour expectation for a freelancer with standard PTO and 20% non-billable time.

Factors Affecting Your Working Hours

Your actual working hours can vary significantly based on:

- Employment contracts and shift requirements - Part-time, full-time, or contract positions have different hour structures

- Flexible work arrangements - Remote work and flexible schedules impact total hours worked

- Industry type and task complexity - Some industries require more hours during peak seasons

- Automation and process improvements - Efficient workflows can reduce required hours for the same output

- Company policies - Organizational PTO, sick leave, and holiday observances vary widely

- Regional differences - State holidays and local regulations affect working days

Why Calculate Annual Hours?

Understanding your annual working hours provides critical benefits:

- Simplifies income calculation - Essential for hourly workers to project annual earnings and set competitive freelance rates

- Supports work-life balance planning - Helps allocate time between work, personal life, and professional development

- Ensures compliance with labor regulations - Keeps your business aligned with overtime laws and employment standards

- Assists with payroll management - Accurate tracking prevents payroll errors and budgeting issues

- Optimizes resource allocation - Businesses can better forecast staffing needs and project timelines

Key Takeaways

- Gross 2025: 2,088 hours (261 weekdays × 8)

- Post-holidays: 2,000 hours (250 days)

- Full-time net: 1,840-1,880 after average PTO and sick leave

- Freelancer billable: Aim for 1,200-1,600

- Track religiously: Use PineBill to turn hours into revenue

- U.S. ranks high globally: 1,796 avg vs. OECD 1,929

Frequently Asked Questions

Master your hours to master your business. Start tracking with PineBill today.