Best Tech Stack for Solo Entrepreneurs in 2026: A Guide

Businesses with proper legal structures from day one are 23% more likely to survive their first three years (Medium, 2025). This structural integrity provides the foundation for scaling without administrative collapse. This guide outlines the essential 2026 solopreneur software stack required to optimize digital operations and maximize revenue retention.

The High Cost of Software Fragmentation

Managing a business as a team of one often leads to "tool creep," where monthly subscriptions accumulate without a corresponding increase in output. A minimalist solopreneur stack typically costs between $100 and $150 per month (Workahomie, 2025). When these tools don't communicate, the business owner plateaus due to manual data entry.

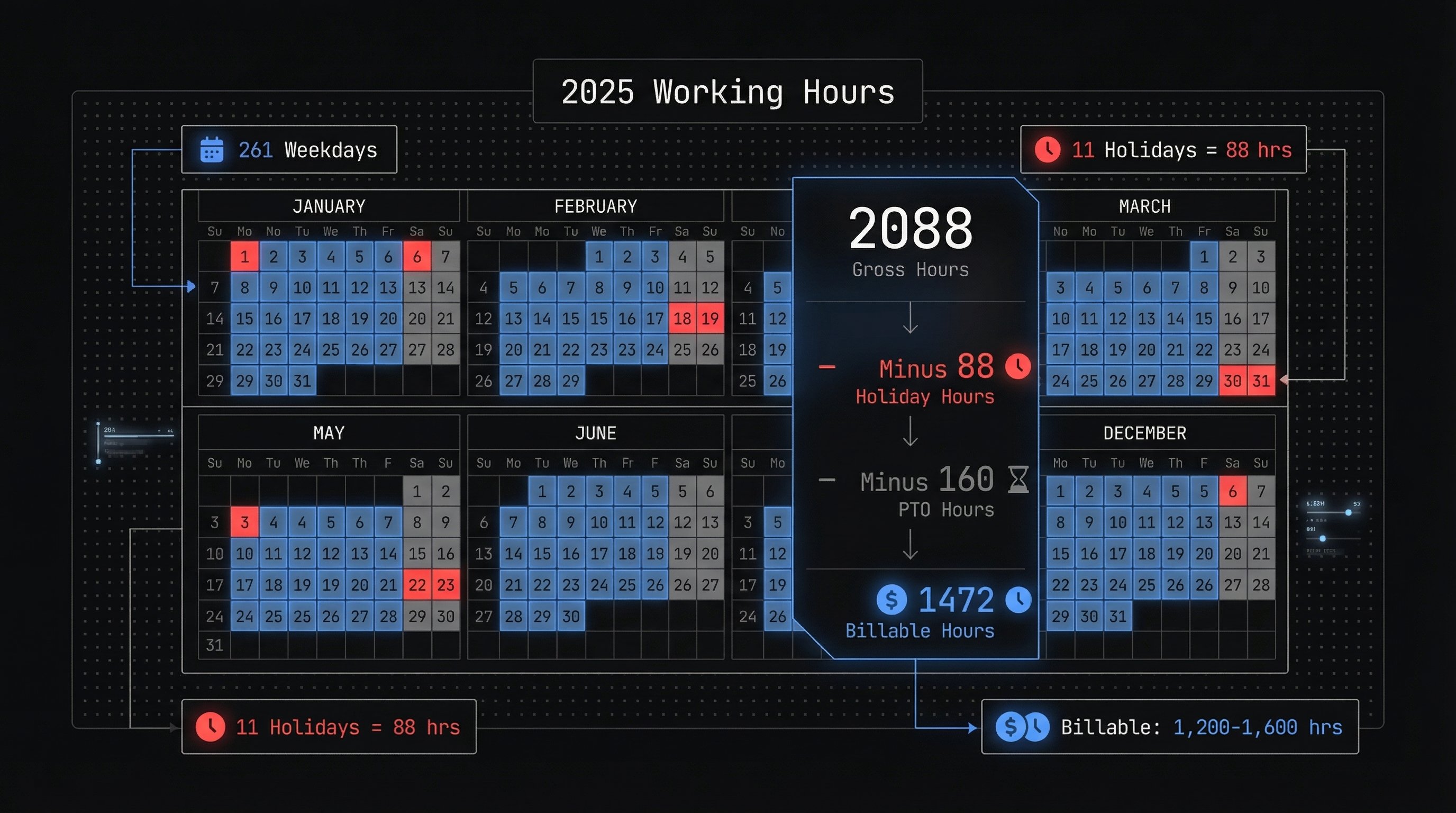

Manual administrative tasks represent a direct drain on billable hours. If you charge $150 per hour and spend five hours weekly on manual data syncing, you'll lose $3,000 in monthly earning potential. This loss often stems from copying lead data from forms into spreadsheets or manually generating invoices for recurring retainers.

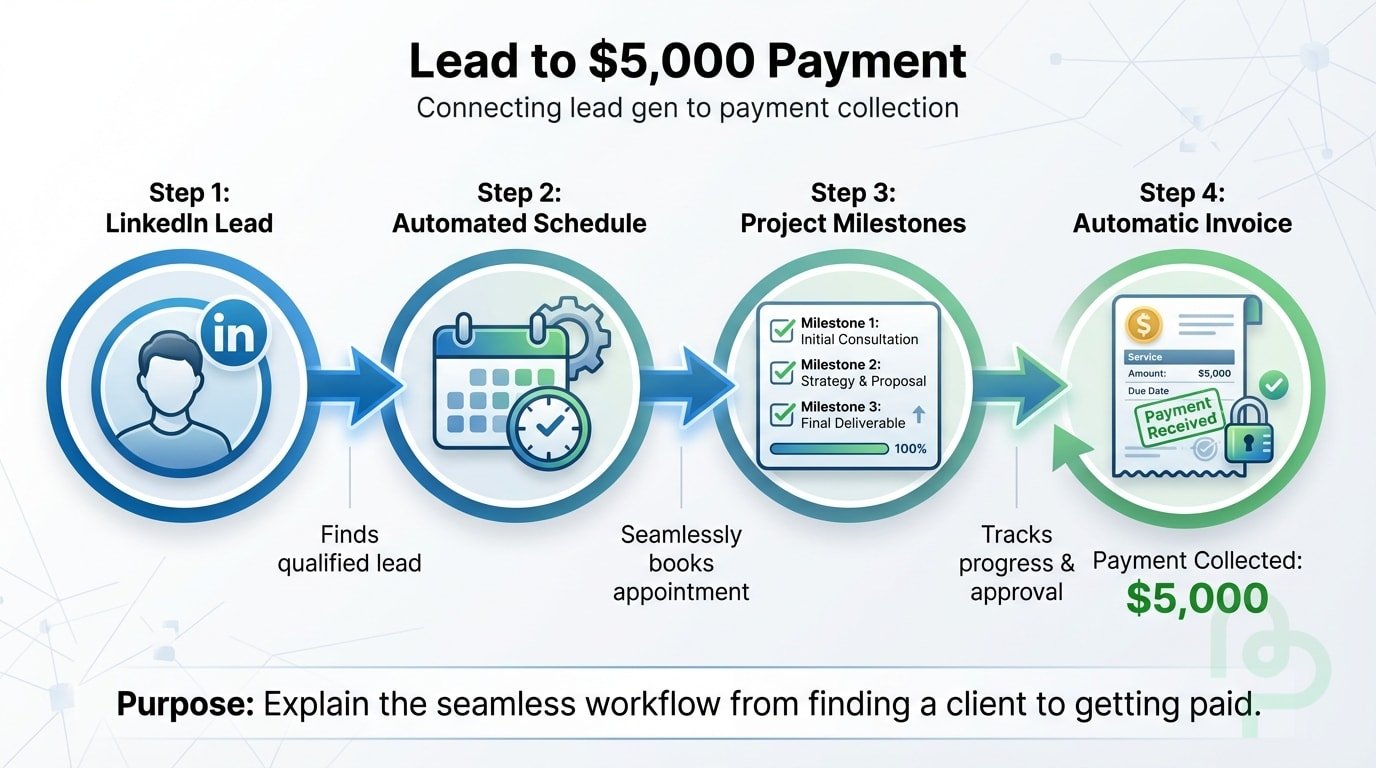

Context switching further compounds financial leakage. Every time a founder moves between a project management tool and an accounting dashboard, focus diminishes. Integrating your stack reduces this friction, ensuring that a $5,000 project doesn't cost an additional $500 in lost efficiency through administrative overhead.

Strategic Infrastructure for Solo Operations

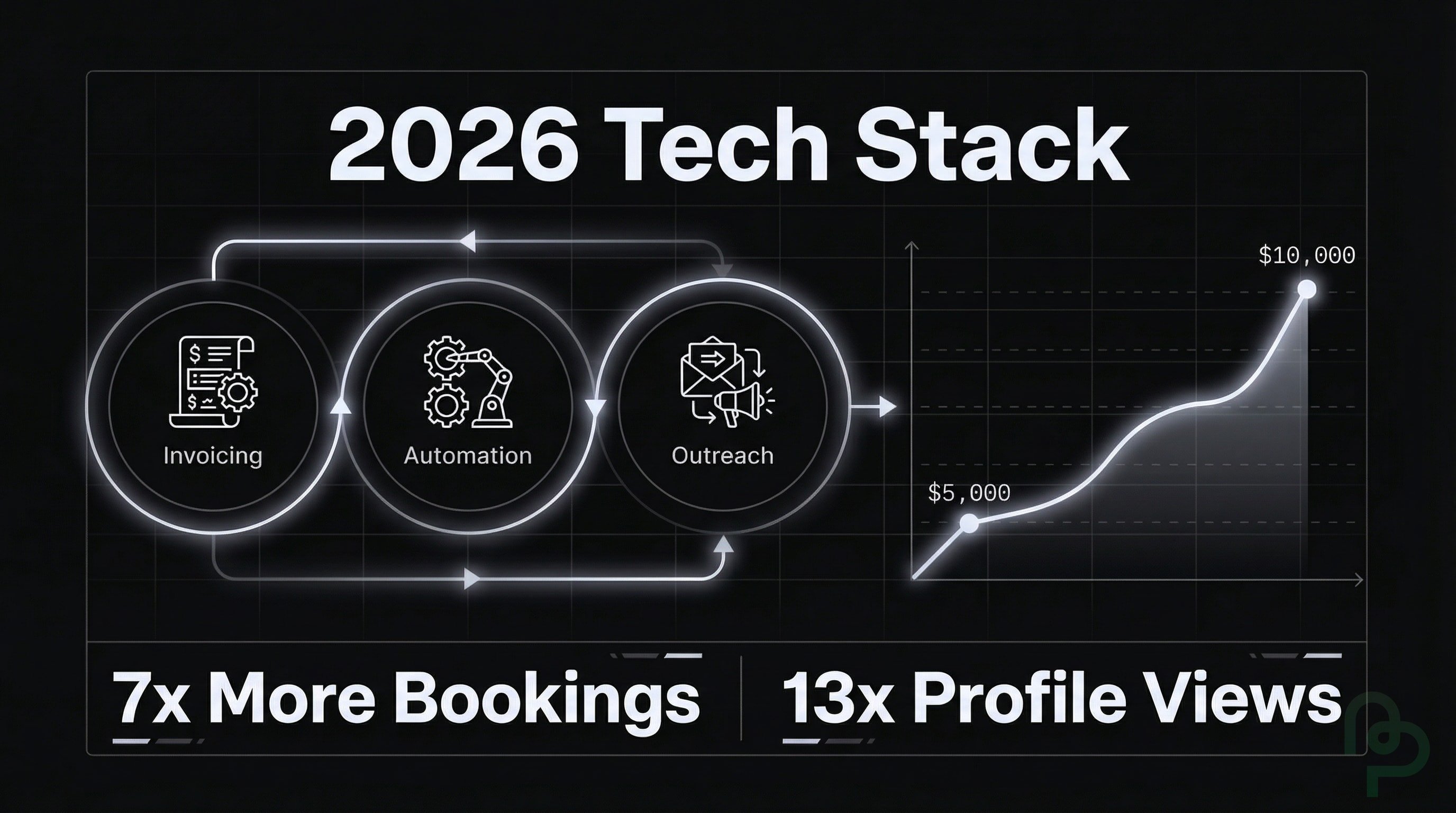

A robust stack in 2026 centers on consolidated workspaces and automated outreach. High-performing solopreneurs prioritize tools like LinkedIn Premium, as these users receive 13x more profile views on average (Calendly, 2025). More views lead to more inquiries, which must then be funneled into a structured scheduling system.

Scheduling automation is no longer optional for those managing client-facing businesses. Data indicates that integrating scheduling links into your digital storefront results in 7x more bookings compared to standard contact forms (Calendly, 2025). Tools like TidyCal or Calendly eliminate the time-consuming back-and-forth communication that often kills $10,000 milestones before they start.

Project management platforms like Notion or ClickUp serve as the "second brain." They store internal SOPs, client deliverables, and CRM data in a unified interface. By tethering these to an automated invoicing system, solopreneurs ensure that project completion immediately triggers a request for payment, protecting the cash flow necessary for survival.

How to Build Your Integrated Automation Loop

Building a high-output system requires connecting disparate freelancer tech tools into a single, cohesive engine.

Establish a Unified Project Workspace

Set up a workspace in Notion or Airtable to track $5,000+ client projects. Every new project entry should include the client's billing details and specific payment milestones. This prevents documentation from scattering across email threads and PDF downloads.

Automate Lead Collection and Processing

Use Typeform to collect client briefs. High-conversion forms use conditional logic to ask specific questions based on project size. For a $7,500 consulting engagement, the form should automatically trigger a Slack notification or an email alert to ensure an immediate response.

Synchronize Payment and Invoicing

Connect your project management milestones to a billing platform. Tools like PineBill sync bank feeds automatically, allowing you to track when a payment arrives without manual verification. Automating this step ensures that a $1,200 monthly retainer is billed and collected on the same date every month without fail.

Implement Recurring Client Check-ins

Use automated scheduling for discovery calls and monthly reviews. This keeps the client relationship warm without requiring manual calendar management. Setting up buffer times between these meetings prevents burnout and allows for deep work sessions.

Comparison of Solo Tech Stacks in 2026

Selecting the right tier for your business depends on your revenue volume and the complexity of your deliverables.

| Function | Minimalist Tier ($100/mo) | Pro Solo Tier ($350/mo) | Automation Impact |

|---|---|---|---|

| Project Management | Notion (Free/Plus) | ClickUp (Business) | High - PM tools save 3+ hours/week |

| Financials | Stripe + PineBill | PineBill | Critical - Prevents tax-season errors |

| Marketing | MailerLite | ActiveCampaign | Med - Increases lead nurturing |

| Lead Gen | Trello Boards | LinkedIn Premium | High - 13x more profile visibility |

Failure to manage cash flow remains a primary threat to small businesses. Approximately 82% of small businesses fail specifically due to cash flow mismanagement (Flowlu, 2025). Using an automated financial stack ensures you have real-time visibility into your ledger, preventing you from overextending on new software or hardware before the revenue is actually in the bank.

Key Takeaways

- Structure First—Entity formation increases survival rates by 23% by providing a clear legal and financial boundary.

- Optimize Outreach—LinkedIn Premium users see 13x more views, making it a primary engine for high-ticket lead generation.

- Automate Billing—Using tools like PineBill for automated invoicing protects you from the 82% failure rate associated with poor cash flow.

- Consolidate Tools—Aim to keep your monthly software spend between $100 and $150 to maintain healthy profit margins.

- Sync for Speed—Automated scheduling links lead to 7x more bookings, drastically reducing the sales cycle for new projects.